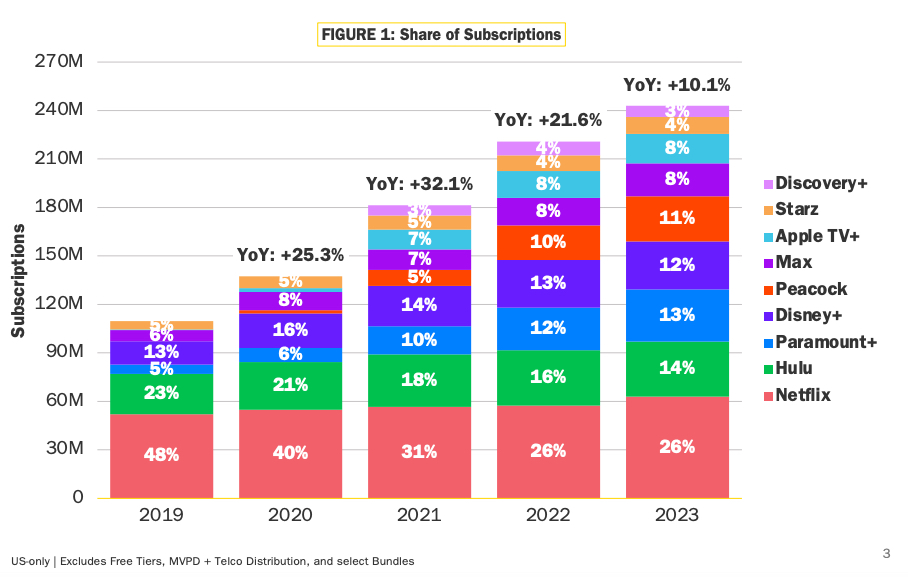

The premium U.S. subscription streaming business is still growing customers at a double-digit clip domestically, but the expansion rate has dramatically decelerated as of late, new research from Antenna shows.

Collectively, the top nine American SVOD services added 17 million fewer U.S. subscribers in 2023 compared to 2022, expanding their ranks at just 10.1% vs. 21.6% the previous year.

Averaged together from 2020 - 2022, based on data from Antenna's latest quarterly "State of Subscriptions" report, the domestic subscription video-on-demand business had been growing customers at a pace of 26.3% before last year.

The top nine U.S. SVOD services finished 2023 with 242.9 million subscribers in the world's largest streaming market, Antenna said.

What the F*** Is Happening?

Describing the subscription streaming market has having entered a "new phase of sobriety," Antenna says it "sources data from a variety of data collection partners which contribute millions of permission-based, consumer opt-in, raw transaction records."

Presenting the research company's findings in a Wednesday afternoon webinar, Antenna Co-founder and CEO Jonathan Carson searched for silver linings, noting other online subscription sectors his firm tracks have actually entered recession since the "boom boom" era of the COVID-19 pandemic.

Still, Antenna's metrics bely a bleak near-term future for the video streaming business, at least in terms of customer growth here in the U.S. market.

For one, the 2023 customer growth picture might have looked a lot worse if not for Netflix's 5.73 million subscriber additions in the U.S. and Canada, an expansion driven by the streaming company's crackdown on account sharing. Netflix lost around 280,000 subscribers in this domestic region in 2022. Notably, Netflix didn't lose domestic market share for the first time since the Streaming Wars started in 2019.

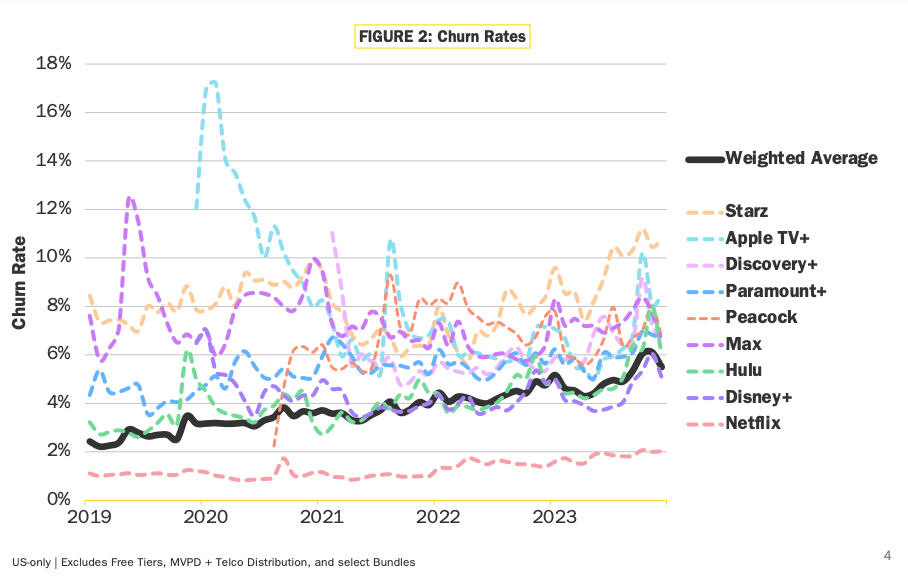

Overall, churn is getting worse, not better.

Weighted average churn jumped 0.8pts year over year to 5.5%, Antenna reports. Peacock had the largest yearly improvement, while Netflix maintained its industry-low churn rate of below 2%.

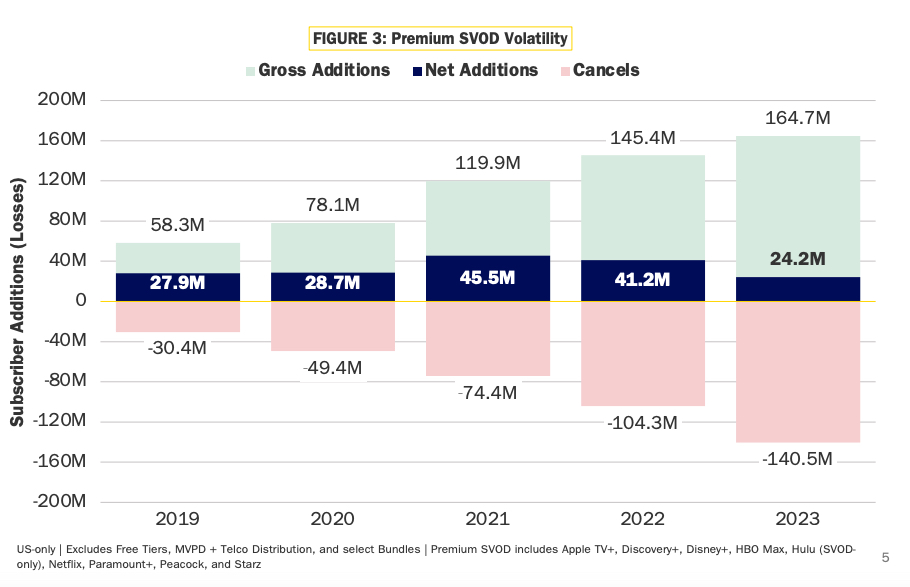

The big streamers are "working harder for smaller gains," adding more customer signups than they ever have, but also bleeding customers at an unprecedented rate.

For the major streamers, getting "sober" in regard to their largely abandoned strategy of deficit spending for rapid expansion of scale has, in many cases, resulted in vast improvements in key financial metrics, including average revenue per customer.

Through price hikes and its account-sharing crackdown, for example, Netflix is projected by at least one analyst to more than double its revenue in 2024, expanding by as much as 15%.

Warner Bros. Discovery, meanwhile, has seen customer growth for Max slow to a crawl recently, but its direct-to-consumer losses in the fourth quarter ($55 million) were but a fraction of the $217 million bled in the same period of 2022.