Chewy (NYSE:CHWY) will release its quarterly earnings report on Wednesday, 2024-12-04. Here's a brief overview for investors ahead of the announcement.

Analysts anticipate Chewy to report an earnings per share (EPS) of $0.08.

Investors in Chewy are eagerly awaiting the company's announcement, hoping for news of surpassing estimates and positive guidance for the next quarter.

It's worth noting for new investors that stock prices can be heavily influenced by future projections rather than just past performance.

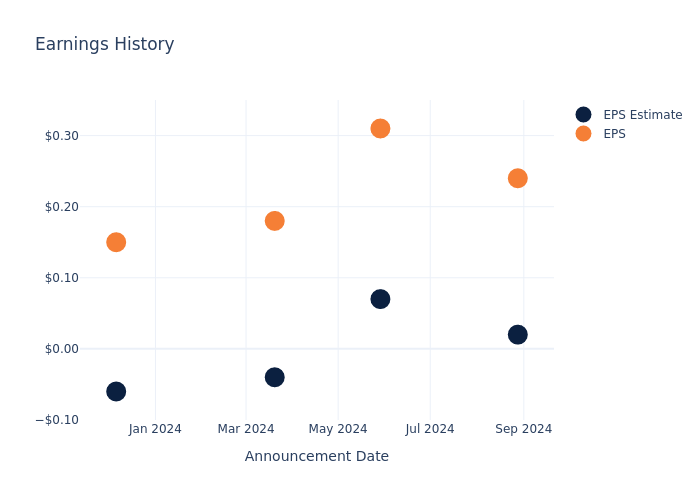

Earnings Track Record

In the previous earnings release, the company beat EPS by $0.22, leading to a 0.07% drop in the share price the following trading session.

Here's a look at Chewy's past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.02 | 0.07 | -0.04 | -0.06 |

| EPS Actual | 0.24 | 0.31 | 0.18 | 0.15 |

| Price Change % | -0.0% | 0.0% | -10.0% | -1.0% |

Tracking Chewy's Stock Performance

Shares of Chewy were trading at $33.63 as of December 02. Over the last 52-week period, shares are up 73.8%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analyst Observations about Chewy

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on Chewy.

Analysts have given Chewy a total of 9 ratings, with the consensus rating being Outperform. The average one-year price target is $37.44, indicating a potential 11.33% upside.

Analyzing Analyst Ratings Among Peers

The following analysis focuses on the analyst ratings and average 1-year price targets of Dick's Sporting Goods, Ulta Beauty and Five Below, three prominent industry players, providing insights into their relative performance expectations and market positioning.

- The consensus among analysts is an Neutral trajectory for Dick's Sporting Goods, with an average 1-year price target of $248.23, indicating a potential 638.12% upside.

- Analysts currently favor an Neutral trajectory for Ulta Beauty, with an average 1-year price target of $411.0, suggesting a potential 1122.12% upside.

- Analysts currently favor an Neutral trajectory for Five Below, with an average 1-year price target of $95.55, suggesting a potential 184.12% upside.

Insights: Peer Analysis

In the peer analysis summary, key metrics for Dick's Sporting Goods, Ulta Beauty and Five Below are highlighted, providing an understanding of their respective standings within the industry and offering insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Chewy | Outperform | 2.63% | $843.84M | 52.96% |

| Dick's Sporting Goods | Neutral | 0.49% | $1.09B | 7.61% |

| Ulta Beauty | Neutral | 0.88% | $978.18M | 10.87% |

| Five Below | Neutral | 9.37% | $271.79M | 2.07% |

Key Takeaway:

Chewy ranks highest in Gross Profit and Return on Equity among its peers. It is in the middle for Revenue Growth.

Discovering Chewy: A Closer Look

Chewy is the largest e-commerce pet care retailer in the US, generating $11.2 billion in 2023 sales across pet food, treats, hard goods, and pharmacy categories. The firm was founded in 2011, acquired by PetSmart in 2017, and tapped public markets as a stand-alone company in 2019 after spending a couple of years developing under the aegis of the pet superstore chain. The firm generates sales from pet food, treats, over-the-counter medications, medical prescription fulfillment, and hard goods, like crates, leashes, and bowls.

Breaking Down Chewy's Financial Performance

Market Capitalization: Surpassing industry standards, the company's market capitalization asserts its dominance in terms of size, suggesting a robust market position.

Revenue Growth: Chewy's remarkable performance in 3 months is evident. As of 31 July, 2024, the company achieved an impressive revenue growth rate of 2.63%. This signifies a substantial increase in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Consumer Discretionary sector.

Net Margin: Chewy's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 10.46% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 52.96%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 9.49%, the company showcases effective utilization of assets.

Debt Management: Chewy's debt-to-equity ratio is below the industry average. With a ratio of 1.06, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

To track all earnings releases for Chewy visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

.png?w=600)