AeroVironment (NASDAQ:AVAV) is preparing to release its quarterly earnings on Wednesday, 2024-12-04. Here's a brief overview of what investors should keep in mind before the announcement.

Analysts expect AeroVironment to report an earnings per share (EPS) of $0.68.

The announcement from AeroVironment is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

It's worth noting for new investors that guidance can be a key determinant of stock price movements.

Earnings Track Record

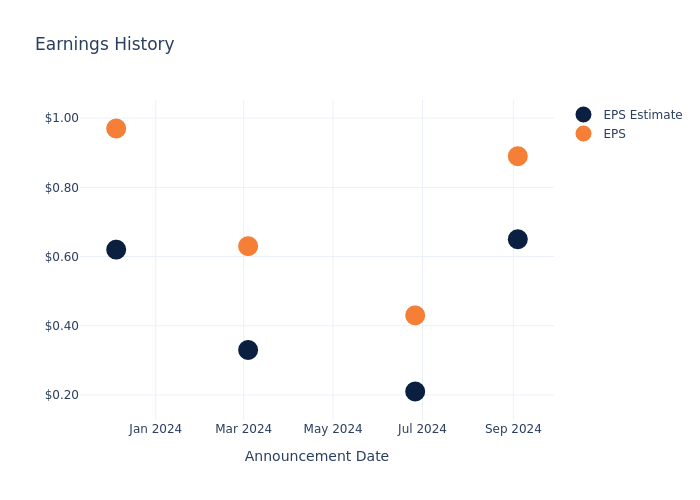

In the previous earnings release, the company beat EPS by $0.24, leading to a 5.31% drop in the share price the following trading session.

Performance of AeroVironment Shares

Shares of AeroVironment were trading at $203.19 as of December 02. Over the last 52-week period, shares are up 58.54%. Given that these returns are generally positive, long-term shareholders should be satisfied going into this earnings release.

Analyst Insights on AeroVironment

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on AeroVironment.

Analysts have provided AeroVironment with 4 ratings, resulting in a consensus rating of Buy. The average one-year price target stands at $232.5, suggesting a potential 14.42% upside.

Understanding Analyst Ratings Among Peers

The following analysis focuses on the analyst ratings and average 1-year price targets of and Hexcel, three prominent industry players, providing insights into their relative performance expectations and market positioning.

- As per analysts' assessments, Hexcel is favoring an Neutral trajectory, with an average 1-year price target of $67.89, suggesting a potential 66.59% downside.

Overview of Peer Analysis

Within the peer analysis summary, vital metrics for and Hexcel are presented, shedding light on their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| AeroVironment | Buy | 24.38% | $81.47M | 2.54% |

| Hexcel | Neutral | 8.82% | $106.50M | 2.52% |

Key Takeaway:

AeroVironment ranks higher in Revenue Growth compared to its peers. In terms of Gross Profit, AeroVironment is at a similar level as its peers. However, AeroVironment has a higher Return on Equity than its peers. Overall, AeroVironment is positioned favorably among its peers based on these metrics.

Unveiling the Story Behind AeroVironment

AeroVironment Inc operates under a single business segment in which it supplies unmanned aircraft systems, tactical missile systems, high-altitude pseudo-satellites, and other related services to government agencies within the United States Department of Defense as well as the United States allied international governments. The systems can help with security, surveillance, or sensing, and provide eyes in the sky without needing an actual person, or driver in the sky.

AeroVironment's Financial Performance

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Revenue Growth: AeroVironment's remarkable performance in 3 months is evident. As of 31 July, 2024, the company achieved an impressive revenue growth rate of 24.38%. This signifies a substantial increase in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Industrials sector.

Net Margin: AeroVironment's net margin excels beyond industry benchmarks, reaching 11.17%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): The company's ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of 2.54%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): AeroVironment's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 2.1% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: With a below-average debt-to-equity ratio of 0.06, AeroVironment adopts a prudent financial strategy, indicating a balanced approach to debt management.

To track all earnings releases for AeroVironment visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.