SentinelOne (NYSE:S) is set to give its latest quarterly earnings report on Wednesday, 2024-12-04. Here's what investors need to know before the announcement.

Analysts estimate that SentinelOne will report an earnings per share (EPS) of $0.01.

Investors in SentinelOne are eagerly awaiting the company's announcement, hoping for news of surpassing estimates and positive guidance for the next quarter.

It's worth noting for new investors that stock prices can be heavily influenced by future projections rather than just past performance.

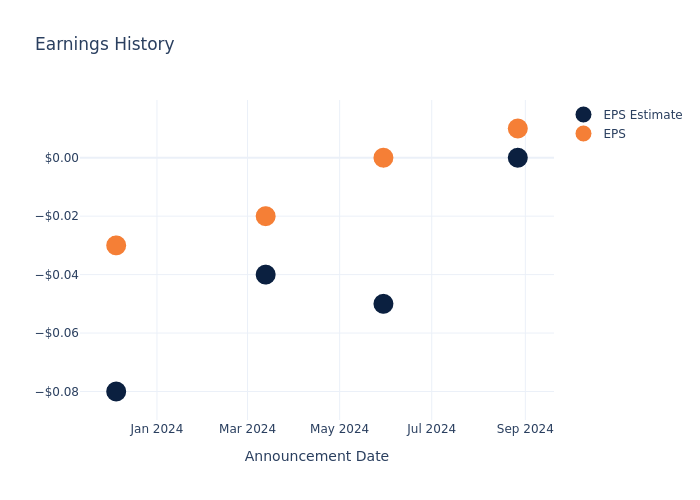

Earnings History Snapshot

The company's EPS beat by $0.01 in the last quarter, leading to a 1.29% drop in the share price on the following day.

Here's a look at SentinelOne's past performance and the resulting price change:

| Quarter | Q2 2025 | Q1 2025 | Q4 2024 | Q3 2024 |

|---|---|---|---|---|

| EPS Estimate | 0 | -0.05 | -0.04 | -0.08 |

| EPS Actual | 0.01 | 0 | -0.02 | -0.03 |

| Price Change % | -1.0% | -13.0% | -17.0% | 17.0% |

SentinelOne Share Price Analysis

Shares of SentinelOne were trading at $27.43 as of December 02. Over the last 52-week period, shares are up 17.62%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analyst Views on SentinelOne

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on SentinelOne.

Analysts have provided SentinelOne with 12 ratings, resulting in a consensus rating of Outperform. The average one-year price target stands at $30.0, suggesting a potential 9.37% upside.

Comparing Ratings with Competitors

The analysis below examines the analyst ratings and average 1-year price targets of UiPath, Dolby Laboratories and CommVault Systems, three significant industry players, providing valuable insights into their relative performance expectations and market positioning.

- The consensus outlook from analysts is an Neutral trajectory for UiPath, with an average 1-year price target of $15.55, indicating a potential 43.31% downside.

- Analysts currently favor an Outperform trajectory for Dolby Laboratories, with an average 1-year price target of $100.0, suggesting a potential 264.56% upside.

- The consensus among analysts is an Buy trajectory for CommVault Systems, with an average 1-year price target of $185.67, indicating a potential 576.89% upside.

Peer Analysis Summary

Within the peer analysis summary, vital metrics for UiPath, Dolby Laboratories and CommVault Systems are presented, shedding light on their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| SentinelOne | Outperform | 33.14% | $148.24M | -4.26% |

| UiPath | Neutral | 10.07% | $252.93M | -4.46% |

| Dolby Laboratories | Outperform | 4.90% | $270.81M | 2.39% |

| CommVault Systems | Buy | 16.06% | $190.42M | 5.56% |

Key Takeaway:

SentinelOne ranks at the bottom for Revenue Growth and Gross Profit, while it ranks in the middle for Return on Equity.

Delving into SentinelOne's Background

SentinelOne is a cloud-based cybersecurity company specializing in endpoint protection. SentinelOne's primary offering is its Singularity platform that offers a single pane of glass for an enterprise to detect and respond to security threats attacking its IT infrastructure. The California-based firm was founded in 2013 and went public in 2021.

Key Indicators: SentinelOne's Financial Health

Market Capitalization Perspectives: The company's market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Positive Revenue Trend: Examining SentinelOne's financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 33.14% as of 31 July, 2024, showcasing a substantial increase in top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Information Technology sector.

Net Margin: SentinelOne's net margin lags behind industry averages, suggesting challenges in maintaining strong profitability. With a net margin of -34.78%, the company may face hurdles in effective cost management.

Return on Equity (ROE): SentinelOne's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of -4.26%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): SentinelOne's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of -2.97%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.01.

To track all earnings releases for SentinelOne visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.