The DRAM and NAND flash industries could hit a huge revenue milestone this year. Storage Newsletter reports that DRAM and NAND flash revenue is expected to increase by a whopping 75% and 77% this year, respectively. The main attraction is high-revenue-generating products that are increasing in demand, such as High-Bandwidth Memory (HBM).

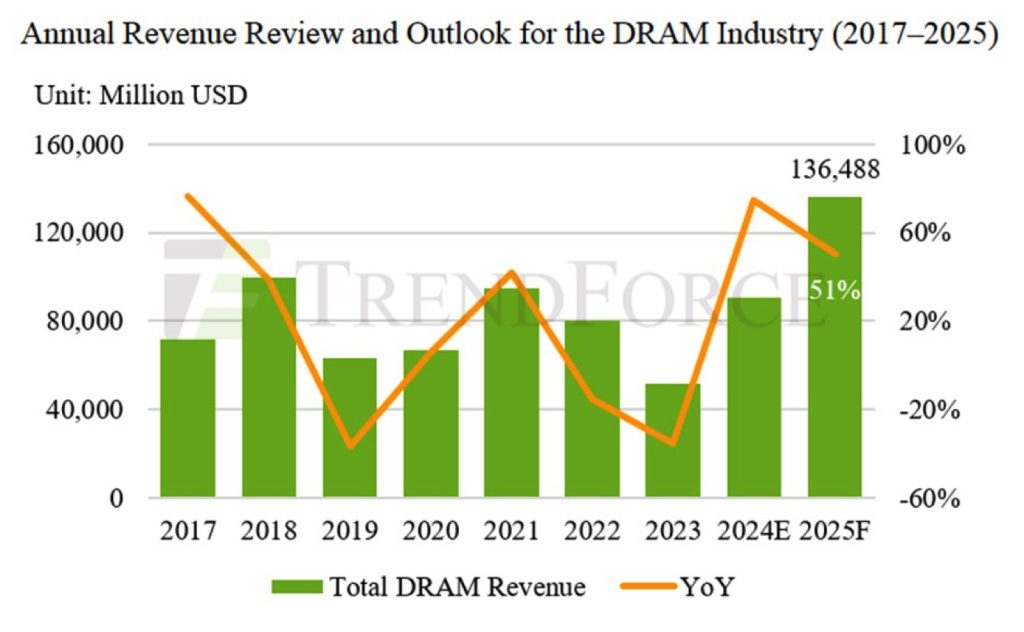

DRAM revenue is expected to hit $90.7 billion in 2024, a 75% increase compared to 2023. This trend will continue into 2025, when DRAM revenue is projected to increase by 51% to $136.5 billion. This massive boom in revenue is being generated by several factors. One is average DRAM prices, which increased by 53% in 2024 and could rise another 35% in 2025.

HBM memory demand is another huge factor in increasing DRAM revenue. HBM is one of the most expensive-to-produce forms of system memory and is currently in huge demand. HBM is purportedly expected to contribute just 5% of DRAM bit shipments but could generate 20% of the total DRAM revenue in 2024.

Other forms of high-speed memory, such as DDR5 and LPDDR5/LPDDR5X, are also helping boost DRAM profits. DDR5 adoption is still ramping up in the server market and will hit 40% of total DRAM server market share by 2024, increasing to 65% in 2025. LPDDR5 and LPDDR5X are expected to purportedly contribute 50% and 60% of the mobile DRAM bit shipments in 2024 and 2025, respectively. (Intel Lunar Lake chips will no doubt contribute to this.)

NAND flash revenue is forecast to increase 77% year-over-year, totaling $67.4 billion for 2024. In 2025, NAND flash revenue will reach $87 billion, a 29% year-over-year increase over 2024. 2025's revenue increase will be purportedly driven by the adoption of QLC flash in enterprise SSDs and UFS storage in smartphones, along with a recovery in server demand and restrained capital expenditure reportedly caused by manufacturers limiting supply.

QLC will reportedly contribute 20% of NAND flash bit shipments in 2024, and adoption will increase even more in 2025. The main attraction behind this is the adoption of QLC in the smartphone industry, with Apple reportedly implementing QLC storage into its iPhones by 2026.