10 analysts have shared their evaluations of Southwest Airlines (NYSE:LUV) during the recent three months, expressing a mix of bullish and bearish perspectives.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 0 | 7 | 1 | 2 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 2 |

| 2M Ago | 0 | 0 | 4 | 0 | 0 |

| 3M Ago | 0 | 0 | 2 | 1 | 0 |

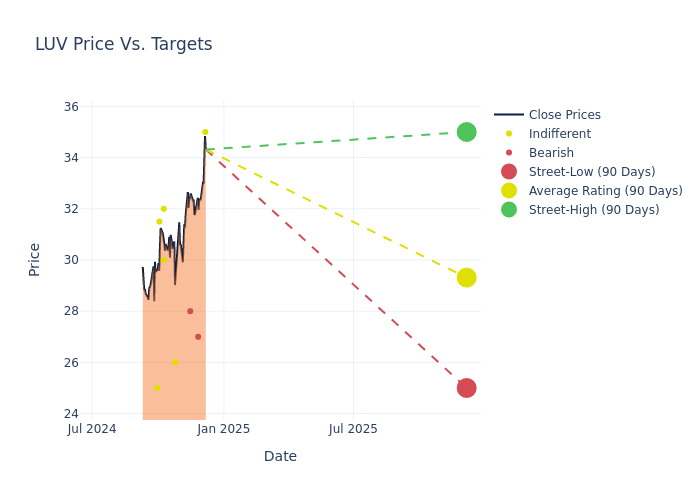

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $29.05, along with a high estimate of $35.00 and a low estimate of $24.00. This upward trend is evident, with the current average reflecting a 19.01% increase from the previous average price target of $24.41.

Deciphering Analyst Ratings: An In-Depth Analysis

A comprehensive examination of how financial experts perceive Southwest Airlines is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Brandon Oglenski | Barclays | Raises | Equal-Weight | $35.00 | $32.00 |

| Thomas Wadewitz | UBS | Announces | Sell | $27.00 | - |

| Catherine O'Brien | Goldman Sachs | Announces | Sell | $28.00 | - |

| Jamie Baker | JP Morgan | Raises | Neutral | $26.00 | $20.00 |

| Brandon Oglenski | Barclays | Raises | Equal-Weight | $32.00 | $27.00 |

| Christopher Stathoulopoulos | Susquehanna | Raises | Neutral | $30.00 | $25.00 |

| Sheila Kahyaoglu | Jefferies | Raises | Hold | $32.00 | $24.00 |

| Stephen Trent | Citigroup | Raises | Neutral | $31.50 | $28.25 |

| Sheila Kahyaoglu | Jefferies | Raises | Underperform | $24.00 | $20.00 |

| Helane Becker | TD Cowen | Raises | Hold | $25.00 | $19.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Southwest Airlines. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Providing a comprehensive analysis, analysts offer qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Southwest Airlines compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of Southwest Airlines's stock. This comparison reveals trends in analysts' expectations over time.

For valuable insights into Southwest Airlines's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on Southwest Airlines analyst ratings.

About Southwest Airlines

Southwest Airlines is the largest domestic air carrier in the United States by passengers boarded. Southwest operates nearly 800 aircraft in an all-Boeing 737 fleet. Despite offering some longer routes and a few perks for business travelers, the airline predominantly specializes in short-haul, leisure flights operated in a single, open-seating cabin configuration in a point-to-point network. In 2025, Southwest will modify its cabins to offer some seats with extra legroom and will update its ticketing process to offer assigned seats.

Southwest Airlines: A Financial Overview

Market Capitalization: Positioned above industry average, the company's market capitalization underscores its superiority in size, indicative of a strong market presence.

Revenue Growth: Southwest Airlines's revenue growth over a period of 3 months has been noteworthy. As of 30 September, 2024, the company achieved a revenue growth rate of approximately 5.29%. This indicates a substantial increase in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Industrials sector.

Net Margin: The company's net margin is below industry benchmarks, signaling potential difficulties in achieving strong profitability. With a net margin of 0.98%, the company may need to address challenges in effective cost control.

Return on Equity (ROE): Southwest Airlines's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of 0.64%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): Southwest Airlines's ROA lags behind industry averages, suggesting challenges in maximizing returns from its assets. With an ROA of 0.19%, the company may face hurdles in achieving optimal financial performance.

Debt Management: Southwest Airlines's debt-to-equity ratio is below the industry average at 0.87, reflecting a lower dependency on debt financing and a more conservative financial approach.

The Core of Analyst Ratings: What Every Investor Should Know

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.