Throughout the last three months, 14 analysts have evaluated Wells Fargo (NYSE:WFC), offering a diverse set of opinions from bullish to bearish.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 6 | 6 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 3 | 0 | 0 |

| 2M Ago | 0 | 4 | 3 | 0 | 0 |

| 3M Ago | 1 | 2 | 0 | 0 | 0 |

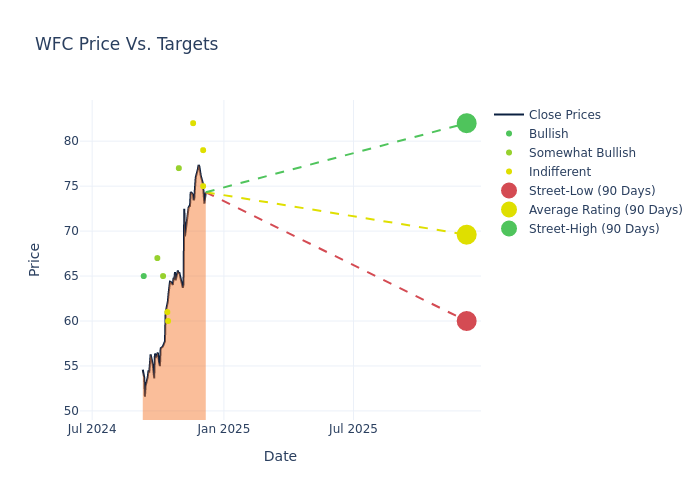

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $69.93, with a high estimate of $82.00 and a low estimate of $60.00. Marking an increase of 8.12%, the current average surpasses the previous average price target of $64.68.

Decoding Analyst Ratings: A Detailed Look

A clear picture of Wells Fargo's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Richard Ramsden | Goldman Sachs | Raises | Buy | $82.00 | $72.00 |

| Scott Siefers | Piper Sandler | Raises | Neutral | $75.00 | $62.00 |

| David Konrad | Keefe, Bruyette & Woods | Raises | Market Perform | $79.00 | $61.00 |

| Keith Horowitz | Citigroup | Raises | Neutral | $82.00 | $67.00 |

| John Pancari | Evercore ISI Group | Raises | Outperform | $77.00 | $71.00 |

| David Rochester | Compass Point | Raises | Neutral | $60.00 | $57.00 |

| Glenn Thum | Phillip Securities | Raises | Accumulate | $65.00 | $60.83 |

| Scott Siefers | Piper Sandler | Raises | Neutral | $62.00 | $60.00 |

| Gerard Cassidy | RBC Capital | Maintains | Sector Perform | $61.00 | $61.00 |

| John Pancari | Evercore ISI Group | Raises | Outperform | $71.00 | $68.00 |

| Steven Chubak | Wolfe Research | Announces | Outperform | $65.00 | - |

| John Pancari | Evercore ISI Group | Raises | Outperform | $68.00 | $65.00 |

| Betsy Graseck | Morgan Stanley | Lowers | Overweight | $67.00 | $68.00 |

| Richard Ramsden | Goldman Sachs | Lowers | Buy | $65.00 | $68.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Wells Fargo. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of Wells Fargo compared to the broader market.

- Price Targets: Analysts provide insights into price targets, offering estimates for the future value of Wells Fargo's stock. This comparison reveals trends in analysts' expectations over time.

Capture valuable insights into Wells Fargo's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on Wells Fargo analyst ratings.

All You Need to Know About Wells Fargo

Wells Fargo is one of the largest banks in the United States, with approximately $1.9 trillion in balance sheet assets. The company has four primary segments: consumer banking, commercial banking, corporate and investment banking, and wealth and investment management. It is almost entirely focused on the U.S.

Breaking Down Wells Fargo's Financial Performance

Market Capitalization: Boasting an elevated market capitalization, the company surpasses industry averages. This signals substantial size and strong market recognition.

Negative Revenue Trend: Examining Wells Fargo's financials over 3 months reveals challenges. As of 30 September, 2024, the company experienced a decline of approximately -2.35% in revenue growth, reflecting a decrease in top-line earnings. When compared to others in the Financials sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Wells Fargo's net margin falls below industry averages, indicating challenges in achieving strong profitability. With a net margin of 23.82%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Wells Fargo's ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of 2.99%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): Wells Fargo's ROA is below industry standards, pointing towards difficulties in efficiently utilizing assets. With an ROA of 0.25%, the company may encounter challenges in delivering satisfactory returns from its assets.

Debt Management: Wells Fargo's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 1.19.

What Are Analyst Ratings?

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.