Estate planning is a critical aspect of comprehensive financial planning, especially when it comes to ensuring your heirs receive the maximum benefit from your legacy. Among the various components of estate planning, the designation of beneficiaries for individual retirement accounts (IRAs) is a particularly nuanced decision with far-reaching tax implications.

The distinction between Roth IRAs and traditional IRAs (or company retirement plans) is crucial to understand when planning for the future of your heirs. Each type of account is subject to different tax rules upon distribution:

- Roth IRAs. These accounts offer tax-free distributions to beneficiaries, which can be particularly advantageous for heirs who are in higher tax brackets.

- Traditional IRAs and retirement plans. Distributions from these pre-tax accounts are taxed according to the beneficiaries' individual tax rates, which means that the actual amount received after taxes can vary significantly among your heirs.

A one-size-fits-all approach in designating equal percentages to each beneficiary may not be the most effective strategy. Instead, a more tailored approach that considers the unique tax brackets of each beneficiary can lead to a more equitable distribution of your estate.

Impact on after-tax inheritance

Consider a scenario where Clara is 80 years old and looking to maximize the amount that goes to her heirs, subsequently reducing the amount claimed by Uncle Sam at tax time. Ray is a prominent attorney in the highest tax bracket of 37%. Steven earns less money and falls in the 12% federal tax bracket.

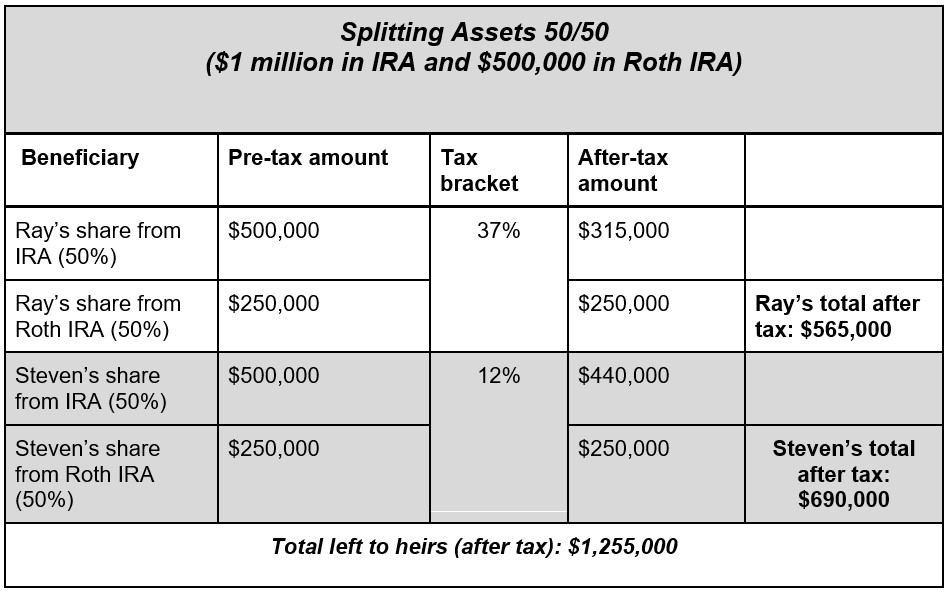

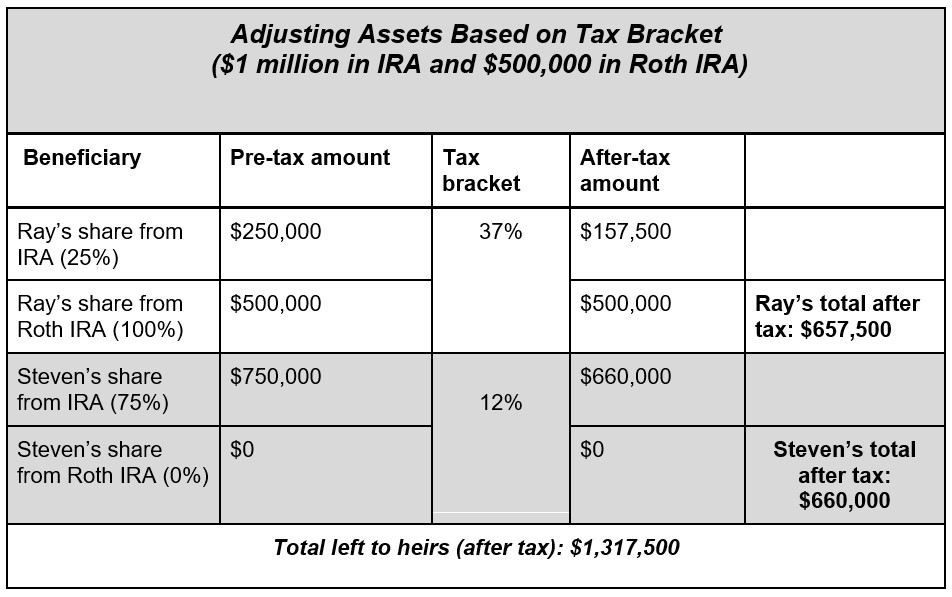

Clara has $1 million in a traditional IRA (pre-tax account) and $500,000 in a Roth IRA. Initially, she had split both accounts 50/50 between her two sons. However, leaving more of the tax-free Roth to Ray may make sense because he is the higher-earning beneficiary. More of the traditional IRA could be left to Steven, as he is in a lower tax bracket, and the taxable distributions from the IRA are less impactful. Consider the following:

By adjusting the amount going to each beneficiary, Clara's distribution was more equitable to each child. She also was able to have less of her inheritance lost to taxes. In fact, she was able to give her heirs a total of $62,500 more ($1,317,500 - 1,255,000) than by splitting each account 50/50.

This also works when considering how much to leave a beneficiary from taxable brokerage accounts. Because of how capital gains are taxed, you may be able to leave your heirs more money by adjusting the amount each beneficiary receives based on their tax bracket.

Tax-efficient estate planning

In essence, strategically designating IRA beneficiaries transcends mere asset distribution; it is a testament to the power of informed financial planning and the profound impact of tax considerations on inheritance. This example illuminates a path for families that can significantly enhance the value of their legacy for their heirs.

By eschewing the traditional equal-split approach in favor of a model that aligns with each beneficiary's unique tax situation, individuals can ensure that their heirs are positioned to receive the maximum possible benefit from their inheritance. This method not only honors the benefactor's intent to provide for their loved ones but does so in a manner that is both tax-efficient and equitable, allowing for a legacy that is felt more deeply and preserved more completely.

The case of Clara and her sons serves as a compelling illustration of how adjusting beneficiary designations to account for different income levels and associated tax brackets can result in a more favorable after-tax outcome. Such strategic adjustments, while requiring careful consideration and possibly the guidance of a certified financial planner, can significantly reduce the tax burden on the estate. This allows a greater portion of one's life savings to reach the intended recipients — fully embodying the true spirit of a given legacy.

Investment advisory services offered through Osaic Advisory Services, LLC (Osaic Advisory), a registered investment advisor. Osaic Advisory is separately owned and other entities and/or marketing names, products or services referenced here are independent of Osaic Advisory.