(Please enjoy this updated version of my weekly commentary published April 19th, 2022 from the POWR Growth newsletter).

As usual, we will start by reviewing the past week…

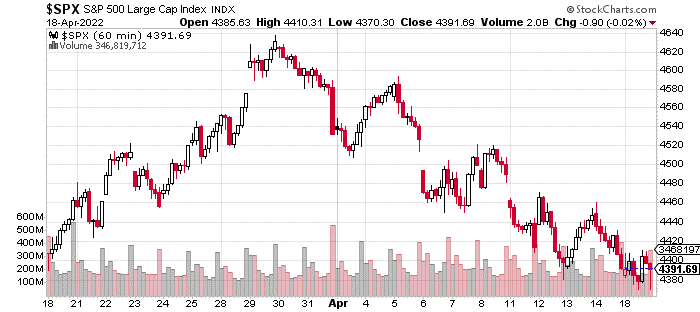

Here is an hourly, 3-week chart of the S&P 500:

Since last week, we’ve continued to selloff albeit with less intensity.

Overall, the S&P 500 is down about 0.5%. The Russell 2000 was up 0.2%, while the Nasdaq was down 2.2%.

Despite this weakness, I’m seeing some reasons for optimism.

I think the major one is that the market has digested a significant amount of bad news and is still standing. We’ve priced in rates that should get above 3% sometime next year and permanently higher energy prices due to the conflict in Russia and Ukraine.

In addition to inflation, these will remain challenges, but I think that the market has priced in the worst extremes in terms of a ‘rate of change’.

I think there is upside potential if the economy can prove to be stronger than expected which could probably trigger oversold bounces in many names.

This is what I wrote last week in regards to the ‘bullish case’:

Here’s the bullish case in a nutshell: The economy is resilient enough to handle these bumps in the road without being thrown off. Inflation is peaking.

Besides, the markets have already priced in a significant set of rate hikes over the next year in addition to absorbing selling due to fears about Russia and Ukraine.

The result is a slowing economy, in concert, with a slowing of inflationary pressures, that reduces the urgency of the Fed to take action. Basically, the economy does the heavy lifting for the Fed.

And as we’ve noted multiple times, the market has felt heavy and negative in terms of sentiement and newsflow but if we step back and take a look at a longer-term chart, it looks like a healhty digestion of a move lower.

Further, the market has traded sideways since its initial move lower in January, creating a nice level of support in the 410 to 430 range.

As we discussed in the trade alert, 3 positive developments are Russia seemingly downgrading its ambitions in Ukraine, inflation that does show a peaking in terms of certain components, and earnings that have been good but not great.

And I think these factors are part of my reasoning for a more constructive stance on the market.

Interesting Areas

Some parts of the market are so strong that they are breaking out to new highs like energy and agriculture. Other parts of the market are down between 30 and 50% from recent highs. I think that it’s good to have exposure to both extremes.

In terms of themes, I think one overwhelming one is that I want to bet against recession fears as I think it’s overblown, and many stocks are pricing in a significant slowdown. In these situations, a strong earnings report can turn the momentum.

Another area that has seen some underperformance is luxury spending and travel. Looking back at previous inflationary periods, luxury spending actually increased.

I see this trend continuing this cycle as asset inflation does create some winners who are likely to splurge on high-priced items.

A similar situation with travel as hotel and airlines is talking about a new record in terms of booking and demand which is leading to more pricing power.

Yes, costs will rise but I believe some operators are in better position to capitalize on this type of high-demand, high-pressure environment.

What To Do Next?

The POWR Growth portfolio was launched in April last year and has significantly outperformed the S&P 500 since then.

What is the secret to success?

The portfolio gets most of its fresh picks from the Top 10 Growth Stocks strategy which has stellar +48.22% annual returns.

If you would like to see the current portfolio of growth stocks, and be alerted to our next timely trades, then consider starting a 30 day trial by clicking the link below.

About POWR Growth newsletter & 30 Day Trial

SPY shares fell $1.99 (-0.45%) in after-hours trading Tuesday. Year-to-date, SPY has declined -6.01%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Jaimini Desai

Jaimini Desai has been a financial writer and reporter for nearly a decade. His goal is to help readers identify risks and opportunities in the markets. He is the Chief Growth Strategist for StockNews.com and the editor of the POWR Growth and POWR Stocks Under $10 newsletters. Learn more about Jaimini’s background, along with links to his most recent articles.

Why the Stock Market May Have Digested Most of the Bad News StockNews.com