Oracle (NYSE:ORCL) will release its quarterly earnings report on Monday, 2024-12-09. Here's a brief overview for investors ahead of the announcement.

Analysts anticipate Oracle to report an earnings per share (EPS) of $1.48.

The market awaits Oracle's announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

It's important for new investors to understand that guidance can be a significant driver of stock prices.

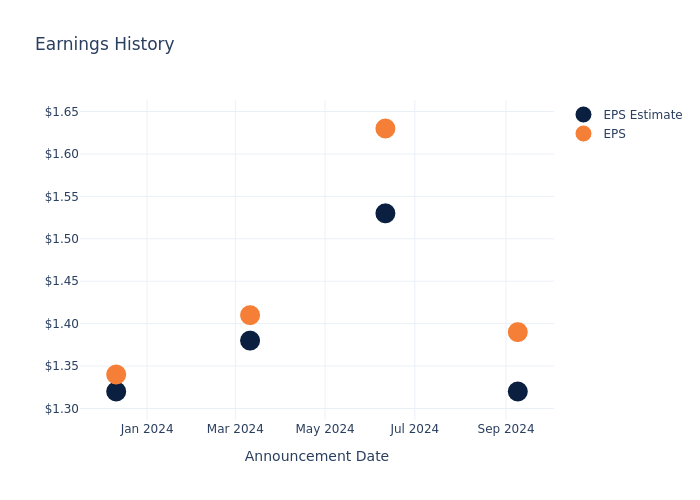

Past Earnings Performance

Last quarter the company beat EPS by $0.07, which was followed by a 11.44% increase in the share price the next day.

Here's a look at Oracle's past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | 1.32 | 1.53 | 1.38 | 1.32 |

| EPS Actual | 1.39 | 1.63 | 1.41 | 1.34 |

| Price Change % | 11.0% | 13.0% | 12.0% | -12.0% |

Performance of Oracle Shares

Shares of Oracle were trading at $186.24 as of December 05. Over the last 52-week period, shares are up 61.76%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analyst Insights on Oracle

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on Oracle.

The consensus rating for Oracle is Outperform, derived from 33 analyst ratings. An average one-year price target of $180.64 implies a potential 3.01% downside.

Peer Ratings Overview

In this comparison, we explore the analyst ratings and average 1-year price targets of ServiceNow, Palo Alto Networks and CrowdStrike Holdings, three prominent industry players, offering insights into their relative performance expectations and market positioning.

- The consensus outlook from analysts is an Outperform trajectory for ServiceNow, with an average 1-year price target of $1032.85, indicating a potential 454.58% upside.

- Analysts currently favor an Outperform trajectory for Palo Alto Networks, with an average 1-year price target of $421.73, suggesting a potential 126.44% upside.

- CrowdStrike Holdings received a Outperform consensus from analysts, with an average 1-year price target of $363.91, implying a potential 95.4% upside.

Peers Comparative Analysis Summary

The peer analysis summary outlines pivotal metrics for ServiceNow, Palo Alto Networks and CrowdStrike Holdings, demonstrating their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Oracle | Outperform | 6.86% | $9.40B | 30.01% |

| ServiceNow | Outperform | 22.25% | $2.21B | 4.81% |

| Palo Alto Networks | Outperform | 13.88% | $1.58B | 6.33% |

| CrowdStrike Holdings | Outperform | 28.52% | $755.09M | -0.57% |

Key Takeaway:

Oracle ranks at the top for Gross Profit and Return on Equity among its peers. It is in the middle for Revenue Growth.

Delving into Oracle's Background

Oracle provides database technology and enterprise resource planning, or ERP, software to enterprises around the world. Founded in 1977, Oracle pioneered the first commercial SQL-based relational database management system. Today, Oracle has more than 400,000 customers in 175 countries.

Oracle: Delving into Financials

Market Capitalization Analysis: The company's market capitalization surpasses industry averages, showcasing a dominant size relative to peers and suggesting a strong market position.

Revenue Growth: Over the 3 months period, Oracle showcased positive performance, achieving a revenue growth rate of 6.86% as of 31 August, 2024. This reflects a substantial increase in the company's top-line earnings. When compared to others in the Information Technology sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Oracle's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 22.01%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Oracle's ROE excels beyond industry benchmarks, reaching 30.01%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): Oracle's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 2.05%, the company showcases efficient use of assets and strong financial health.

Debt Management: Oracle's debt-to-equity ratio stands notably higher than the industry average, reaching 7.81. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

To track all earnings releases for Oracle visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.