What Is Persistent Inflation?

Inflation that continues to be high over a prolonged period of time is known as persistent inflation. The term typically gets the attention of investors and analysts when there’s a sudden pick-up in inflation above a steady monthly rate and the rate exceeds key interest rates, turning the real rate of interest negative. It also becomes of interest to consumers when a protracted period of high inflation reduces their purchasing power.

The Federal Reserve, which has a dual mandate to keep inflation low and to achieve full employment, keeps an eye on consumer prices for any sign of persistent inflation. For its decision-making on monetary policy and economic analyses, the U.S. central bank uses the Personal Consumption Expenditures Price Index as its main barometer of inflation.

What Is the Personal Consumption Expenditures Price Index?

The Personal Consumption Expenditures Price Index is similar to the Consumer Price Index, another important inflation measure, in that it monitors changes in prices for consumer goods, but is constructed differently. In health care, for example, the CPI tracks how much money consumers are spending on medicine, while the PCEPI tracks employers’ contributions to cover workers’ medical expenses.

What Causes Persistent Inflation?

Fed officials are ever watchful of changes in consumer prices from month to month, and there are different reasons as to why persistent inflation occurs.

Supply-chain issues can contribute to high inflation. As demand for a particular good increases, and there are time lags in securing materials for production, manufacturing, and shipping, its price will go up—usually in an amount that is much higher than average. Unexpected events such as limited output of crude oil could, for example, push energy prices higher.

Persistent Inflation Example: The Great Inflation

The Great Inflation of the 1970s and early 80s is a prime example of persistent inflation, and in this case, the phenomenon lasted for years instead of months. The inflation rate, as measured by the CPI, stayed above 5 percent and peaked at 14 percent in 1980. An expansion in the money supply and high energy prices were cited as among the main reasons why inflation was so persistent at the time.

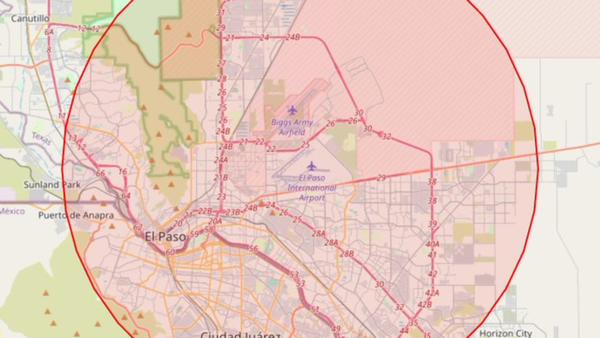

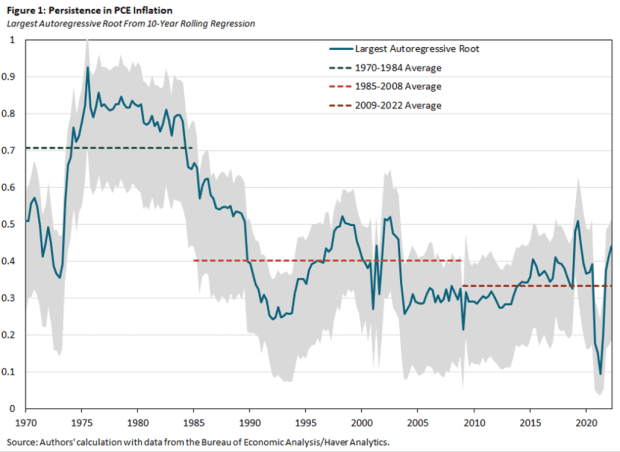

The graph below shows the duration of persistent inflation during the Great Inflation. In response to this crisis, the Fed sharply increased interest rates. That helped to lower inflation, but at the cost of slowing economic growth so sharply that the economy fell into a recession.

The historical graph below helps illustrate the challenges that Fed policymakers face in determining when inflation moves from transitory to persistent on a monthly basis (and determining its duration).

How Does Transitory Inflation Lead to Persistent Inflation?

Inflation that is above the average rate but isn’t consistently higher than normal is considered transitory inflation. But if the inflation rate is consistently high, then it is considered persistent.

For example, if the inflation rate moved from 8 percent one month to 4 percent the next, then bounced between 4 and 8 for several months afterward, there might be some disagreement between analysts as to whether this constitutes transitory or persistent inflation.

What Happens When There Is Persistent Inflation?

With their purchasing power down, people may turn to their employers for pay increases to help with the rising cost of living. As a consequence, businesses might increase wages, but typically, the cost of increasing wages is passed on to consumers in the form of higher prices for goods and services.

When inflation persists, the Federal Reserve looks at its most important monetary policy-setting tool, the Federal funds rate, and compares that to the inflation rate. The Fed funds rate has historically been higher than the inflation rate. If the inflation rate exceeds the Fed funds rate, then the Fed usually acts to raise interest rates to a level that exceeds the inflation rate.

One of the greatest risks, though, is the lag effect of monetary policy in response to high inflation rates of prior months. A sharp increase in interest rates in a short period of time can take months to work its way into the economy, and that could curb growth. Some investors and analysts would argue that by the time higher interest rates take an effect on curbing prices, the inflation rate could have declined on its own without monetary policy action.