What Is a Housing Recession?

A housing recession occurs when there’s a slowdown in activity in the housing market over a particular period, usually a few months (e.g., three to six months, and maybe longer).

According to the National Association of Home Builders, a group that represents tradesmen and home builders associations across the U.S., a housing recession can be characterized by a range of factors, including declines in single-family permits, single-family starts, pending sales for new and existing homes, and rising sales cancellations rates. These typically reflect monthly data and are year-on-year changes.

What Are the Causes of a Housing Recession?

Rising interest rates tend to be the main reason for a downturn in the housing market. In particular, significant increases in borrowing costs usually translate to higher monthly mortgage payments, which could discourage consumers from taking out loans to finance the purchases of new and existing homes.

Property developers, in turn, might hold off on building new homes or undertake renovations of existing homes. Building permits and housing starts decline, and homebuyers choose to lose their deposits rather than continue with their purchases. Still, even as conditions in the housing market deteriorate during a housing recession, prices for homes may remain relatively high.

Typical of boom and bust cycles, a housing recession can follow a housing bubble—a period of significant rises in prices in the housing market. Prices usually cool down when interest rates start to rise, and, in turn, activity in the housing market slows.

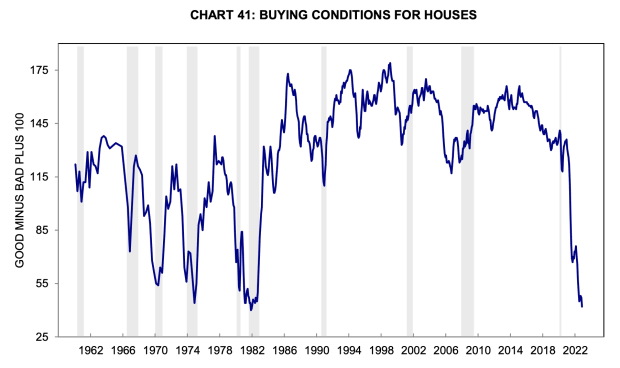

The table below shows a monthly index on buying conditions for houses from January 1960 to November 2022. The measure, based on surveys of consumers that form the University of Michigan’s Consumer Sentiment Index, indicates that sentiment from 2021 to 2022 was similar to the decline from the late 1970s to early 1980s, when the Federal Reserve took an aggressive stance on monetary policy by sharply raising the Federal funds rate.

How Do Housing Recessions End?

The housing market is sensitive to interest rate movements. If mortgage rates start to decline, especially after a period of increases, consumers might look into buying in the housing market. Early signs the housing market recovering from a decline include increases in building permits, housing starts, and home sales.

Is a Housing Recession Always Part of an Economic Recession?

A housing recession doesn’t necessarily have to occur during an economic recession. There could be no recession in the economy, yet the housing market could experience a downturn separately. As shown above in the table on the University of Michigan’s index on buying conditions for houses, dips in buying conditions don’t always indicate an economic recession.

How Long Does a Housing Recession Last?

The end of a housing recession is difficult to predict, but a decline in interest rates could encourage potential homeowners to consider looking into the housing market. A pick-up in the same factors that characterized its decline, such as building permits and housing starts, could also indicate a rebound in housing activity.