What Are Nonfarm Payrolls?

The term nonfarm payrolls, broadly defined, refers to the number of jobs in the private sector and in government—be it at the local, state, or federal level—that are added or lost each month. They represent roughly 80 percent of all workers who contribute to gross domestic product.

Nonfarm payrolls, though, do not include farm employees (as the term indicates), proprietors, private household employees, unpaid volunteers, and the unincorporated self-employed. Those who serve in the military are also excluded.

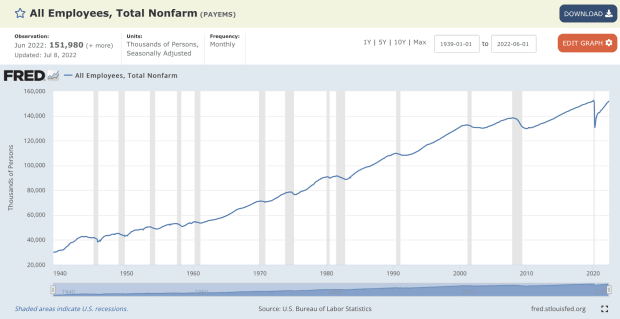

Nonfarm payrolls are among the oldest data gathered on employment, stretching back to 1939. In the early part of the 20th century, agriculture made up a larger share of workers than it does now, and an indicator on jobs outside farming made sense as industrialization spread across the country.

The data are listed as Total Nonfarm Payroll Employment in the monthly Employment Situation Report, or jobs report, which contains important information on the state of employment in the U.S.

How Are Nonfarm Payroll Data Compiled?

The Bureau of Labor Statistics, a government agency that oversees employment data, compiles nonfarm payroll data as part of the monthly establishment payroll survey (formally known as the Current Employment Statistics survey). The poll measures nonfarm employment, hours, and earnings by industry in the 50 states, the District of Columbia, Puerto Rico, the Virgin Islands, and about 450 metropolitan areas and divisions.

About 131,000 businesses and government agencies—representing approximately 670,000 worksites—are surveyed each month. It covers estimates on nonfarm wage and salary jobs—not on the number of people employed. For example, a person working two jobs—one on salary and the other by the hour—is counted twice in the survey.

Results from the survey released in the monthly report break down employment by industry, including professional and business services, leisure and hospitality, healthcare, transportation and warehousing, construction, mining, and the government.

Why Are Nonfarm Payrolls Important?

Nonfarm payrolls offer insights into the state of employment across the country. The number of jobs added or lost in a month can indicate the strength of the economy and how the Federal Reserve might act on monetary policy. A pick-up in jobs might show that companies are hiring more people. With money in their pockets, people could spend more on groceries, dine at restaurants, take vacation trips, or renovate their homes. These bits of information gleaned from payrolls can feed into other economic indicators, like real wages.

At the same time, a strong job market might mean that the economy could be growing too fast, and that in turn might lead to inflationary pressures—namely higher wages. As such, nonfarm payrolls are considered a leading indicator on the economy.

A strong employment number might cause Fed officials to consider raising its key interest rates in a move to curb inflation. Conversely, a weak payroll number might give pause for the central bank to act on monetary policy. A series of weak data, though, might lead to a lowering of interest rates in a bid to boost the economy.

The payroll data is usually taken into account alongside the unemployment rate to provide a broader view of the economy at large. An increase in nonfarm jobs and a decline in the unemployment rate could suggest that the economy is on a strong footing. On the flip side, a decrease in nonfarm payrolls and higher unemployment could show that economic growth is slowing or that the economy could be slipping into recession.

Growth or declines in a particular job sector can offer clues about where the best or worst employment opportunities might be for those seeking work. A pick-up in jobs growth in technology, for example, might indicate a need for those skilled in computer science, mathematics, or electrical engineering. This sort of data might also indicate which sectors of the economy are performing the best or worst.

Below is a graph of nonfarm employees, by total per month, from January 1939 to June 2022. The data show a steady increase in nonfarm jobs over that period. During recessions and in some months shortly after, payrolls tended to decline.

How Do Financial Markets React to Nonfarm Payrolls?

Investors and analysts tend to view an increase in nonfarm payroll jobs as a positive for the stock and bond markets. It suggests that economic growth is on track. A stronger-than-expected payrolls report, though, might mean that the economy is expanding quickly, and that might cause financial markets to decline amid concern that the Fed could be leaning toward a tighter stance on monetary policy.

Conversely, a drop in nonfarm payrolls in a particular month might worry some investors into thinking that economic growth could be slowing. A series of weak numbers could give central bank officials a dovish position on interest rates.

When Are Nonfarm Payroll Data Released?

The Bureau of Labor Statistics releases on the first Friday of the month at 8:30 a.m. ET data on nonfarm payrolls of the prior month. The press release is titled Employment Situation Summary and includes other important information on jobs, such as the unemployment rate.

The other important survey released with the establishment survey is the Current Population Survey (CPS), or household survey, which is conducted by the Bureau of Census for the Bureau of Labor Statistics. Results from the survey show data on the labor force, employment, unemployment, persons not in the labor force, hours of work, earnings, and other demographic and labor force characteristics.