/Veralto%20Corp%20logo%20and%20site-by%20T_Schneider%20via%20Shutterstock.jpg)

Waltham, Massachusetts-based Veralto Corporation (VLTO) provides water analytics, water treatment, marking and coding, and packaging and color services worldwide. With a market cap of $22 billion, Veralto operates through Water Quality (WQ) and Product Quality & Innovation (PQI) segments.

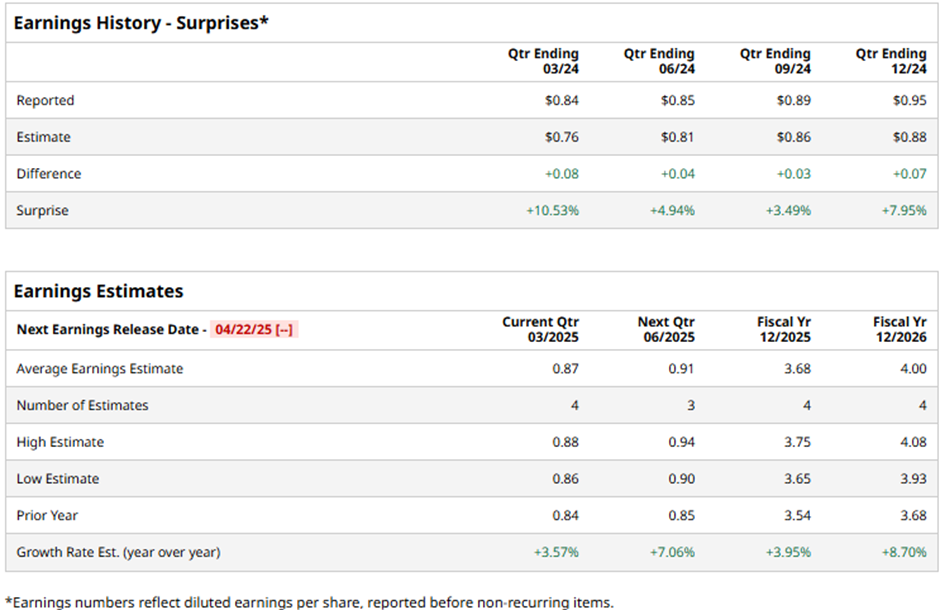

Veralto is expected to release its first-quarter results on Tuesday, Apr. 22. Ahead of the event, analysts expect VLTO to deliver a non-GAAP profit of $0.87 per share, up a modest 3.6% from $0.84 per share reported in the year-ago quarter. On a more positive note, the company has a solid earnings surprise history and has surpassed the Street’s earnings estimates in each of the past four quarters.

For the full fiscal 2025, VLTO is expected to deliver an EPS of $3.68, up nearly 4% from $3.54 in fiscal 2024. Meanwhile, in fiscal 2026, the company’s earnings are expected to surge 8.7% year-over-year to $4.00 per share.

VLTO has observed a marginal 2 bps uptick over the past 52 weeks performing notably better than the Industrial Select Sector SPDR Fund’s (XLI) 6.6% decline and the S&P 500 Index’s ($SPX) 2.7% drop during the same time frame.

Despite reporting better-than-expected financials, VLTO stock plunged 5.1% in the trading session after the release of its Q4 results on Feb. 4. The company’s topline increased 4.4% year-over-year to $1.35 billion, surpassing the Street’s expectations by 20 bps. Meanwhile, its adjusted EPS soared 9.2% year-over-year to $0.95, exceeding analysts’ projections by approximately 8%. However, the company expects its Q1 FY25 adjusted earnings to range between $0.84 to $0.88 per share compared to $0.84 per share in Q1 2024, which didn’t impress investors. On the brighter side, the company expects its FY25 adjusted operating margins to expand 25 bps to 50 bps compared to FY24 and its free cash flow conversion to range between 90% to 100% of GAAP net earnings.

The consensus opinion on VLTO stock is moderately bullish, with an overall “Moderate Buy” rating. Out of the 14 analysts covering the stock, seven recommend “Strong Buy” and seven suggest a “Hold” rating. Its mean price target of $112.31 represents a 28.9% upside potential from current price levels.