Of all the sprawling legal contests facing Donald Trump, the one against his family company finally came into focus in a New York court last week.

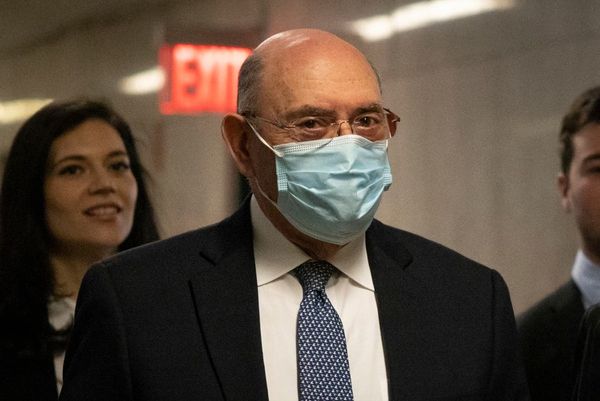

Alan Weisselberg, the longtime financial chief of the Trump Organization, told a jury that he had betrayed the trust of the Trump family when he dodged $1.7m in income taxes on company perks, including a Manhattan apartment, tuition for his grandchildren and luxury cars.

Weisselberg’s testimony is at the center of a criminal case that charges the Trump Corporation and its payroll affiliate, Trump Payroll Corp, with tax fraud. Over the summer, the executive, who remains a paid employee of the company, pleaded guilty to 15 counts of tax fraud and is scheduled to be handed a reduced five-month sentence – but only if he is judged to have testified truthfully in court.

“I believe in telling the truth,” he told the court on Friday, a day after breaking down on the witness stand after testifying that it had been “my own personal greed that led to this”. Asked if he was embarrassed by his actions, Weisselberg said: “More than you can imagine.”

Weisselberg’s task has been to meet the requirements of his plea deal but also to assert that he was acting solely for himself, and not that he was acting “in behalf of” the company, despite acknowledging on the witness stand that the company might have benefited from the arrangement.

Weisselberg, who once described himself as Trump’s “eyes and ears”, has been careful to avoid implicating his boss, or sons Eric and Donald Trump Jr, with knowledge of the fraud. It is a narrow tightrope to walk. On the witness stand on Friday, Weisselberg was asked if he had the best lawyers in town. “I hope so,” he replied to laughter from the jury.

“He’s saying I might be guilty, and the company might be guilty, but none of the Trump individuals are guilty,” said former federal prosecutor Andrew Weissmann.

But that has not prevented prosecutors from reminding jurors that the businesses on trial are “owned by Donald Trump”, as Susan Hoffinger remarked during opening arguments. Neither Trump nor his children have been accused of wrongdoing and the company has pleaded not guilty.

Weisselberg has said that Trump’s children did not discipline him and even raised his salary after they learned in 2017 that he had cheated on taxes for more than a decade. “Were you in fact given a raise … that totaled approximately $200,000?” Hoffinger asked on Friday.

“Correct,” Weisselberg replied, adding that the company also did not discipline other executives who had engaged in similar practices.

Jurors have heard that Trump and his sons would sign tuition checks for as much as $100,000 to pay for private schooling for Wiesselberg’s grandchildren, which were not reported as taxable income.

A guilty verdict against the organization could come with fines and affect its ability to do business in terms of future loans and existing borrowing. “If there are convictions, then it can be hard to borrow money or to get licenses,” says Weissmann. “A violation can also trigger anti-fraud obligations that may be in existing loans.”

A conviction could also potentially bolster a separate civil lawsuit claiming Trump and his three elder children engaged in a pattern of fraudulent and illegal business activity.

In that case, the New York attorney general, Letitia James, was earlier this month granted a request for an independent monitor to oversee the Trump Organization’s submission of financial statements. Trump’s lawyers have said James’s request is “a politically motivated attempt to nationalize a highly successful private enterprise”.

But on Friday, the US justice department appointed a special counsel to oversee criminal investigations against the former president concerning the january 6 insurrection and retention of government documents, a move that came days after the Republican mega-donors Stephen Schwarzman and Thomas Peterffy, along with the cosmetics heir Ronald Lauder, announced they would not be backing Trump’s 2024 presidential candidacy, which was also announced this week.

In court, the excitement that came with Weisselberg’s indictment last year and guilty plea in August, and the hopes that he would become a cooperating witness – which he did not – have not been fully realised in Justice Juan Merchan’s courtroom.

The trial has provided insights into the inner workings of the Trump company, presented here as a familial business in which Donald Trump himself signed Christmas cards and bonus checks until he became US president in 2017, but not drama.

For two weeks jurors have looked a spreadsheets of cable TV bills and other financial records presented as evidence in the case. But fraud trials are rarely feisty, and the quality of the counsel on both sides of the case been able to keep it largely tamped down.

Weisselberg’s lead attorney, Nick Gravante, is known as powerhouse defense lawyer who once worked for Gerald Shargel, whose clients included mob bosses. Gravante also found himself representing Joe Biden’s brother James and son Hunter in a lawsuit over their purchase of a hedge fund in 2006.

“This is an unusual case in that you have very good prosecutors and very good defense lawyers, and both are doing their jobs”, says Weissmann.

Weisselberg’s refusal to flip on his former boss has limited what might have otherwise been insight into the family business. He began working for Trump’s father in 1973 and joined Trump as an executive at his then-fledging Trump Organization in 1986, just as The Donald was becoming a noisy, tabloid-friendly institution in the city.

As Trump’s celebrity grew, and with it his reputation for brashness along with multiple headline-grabbing marriages and divorces, Weisselberg helped the company become a golf, hotel and real estate empire. But he also oversaw many of Trump’s failures in the early 1990s, including casino bankruptcies in Atlantic City and the collapse of the Trump Shuttle airline.

But Weisselberg, pressed on whether he was thinking during his testimony about the prospect of a 15-year prison sentence if Judge Merchan rips up his plea deal, said he was not. “It’s in my mind to tell the truth at this trial,” he said. But he reiterated that while there might have been some benefit to the company from his tax fraud, “it was primarily due to my greed”.