Food and fuel price increases and the aftermath of the COVID pandemic are really just the start of the story when it comes to fiscal shocks which have exacerbated government debt vulnerabilities in Africa.

Tightening global financial conditions present a third shock that will cause debt-servicing costs to climb dramatically. This is because central banks around the world are hiking interest rates to rein in inflation that’s running at the fastest pace not seen in recent decades.

After the 2008 financial crisis, borrowing costs had been reduced to relatively low levels due to lower interest rates in developed countries. This enabled African governments to borrow at relatively lower rates.

The triple punch of rising interest rates, rising food and fuel prices and the COVID aftermath will significantly squeeze government budgets, threatening the continent’s fragile post-pandemic recovery.

The strain on government finances will vary across countries. Net importers of essential food items (such as wheat) and fuel have to pay more for imports, and are thus experiencing a much bigger drain on their fiscal resources.

On the other hand, net exporters of oil like Nigeria and Angola are likely to benefit from rising oil prices, and will have more budgetary room for responding to policy demands.

Not all African countries are experiencing the same squeeze on their public finances. But the triple punch of shocks has markedly increased the number that are at high risk of – or are already in – debt distress that require sovereign debt restructuring. Unfortunately, the only system in place for debt restructuring – the G20’s Common Framework for Debt Treatment – has proved ineffective for a number of reasons. These include the absence of clear procedures and timelines for debtors and creditors, a lack of clarity on how different creditors will be treated, and the growing geopolitical rift between the US and EU on one side and China and Russia on the other.

This is why an alternative system to the framework must be put in place without delay to alleviate the debt problems faced by African countries. Failure to do so will make it difficult to restrain Africa’s debt and imperil its fragile post pandemic recovery.

The shocks

According to the International Monetary Fund, African countries spent only about 2.6% of GDP on average in 2020 to cushion the impact of COVID-19 on firms and households. And as government revenues plummeted in response to the sharp economic downturn induced by the pandemic, budget deficits widened. This added considerable strain on government debt which was already elevated.

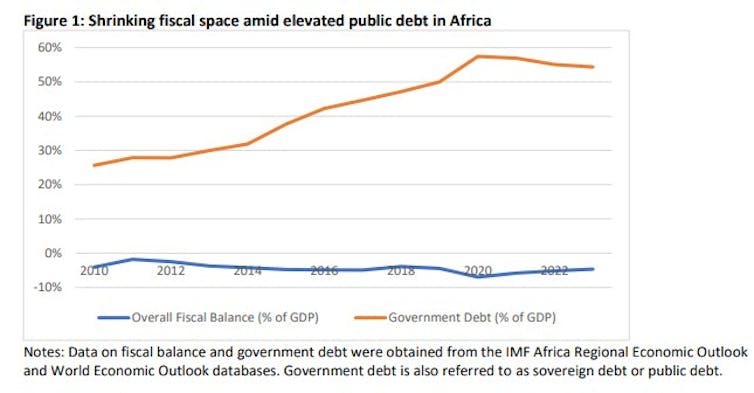

As shown in Figure 1, fiscal balances further deteriorated when the pandemic struck, which constricted fiscal space and drove up government debt burdens in Africa.

Between 2019 and 2021, government debt as a percent of GDP spiked from a pre-pandemic level of 51% to a pandemic-era of 61% for the median country in Sub-Saharan Africa. Zambia’s default on its sovereign debt in 2020 was a harbinger of trouble ahead.

The IMF and World Bank now consider 23 low-income African countries to be at high risk of, or already, in debt distress. This calls into question whether they will be able to keep up with their debt repayments.

Seven countries – Chad, Congo Republic, Mozambique, São Tomé and Príncipe, Somalia, Sudan and Zimbabwe – are in debt distress, meaning that they are having trouble servicing their public debt. The other 16 African countries are at high risk of debt distress. Cabo Verde and Zambia stand out as the only two where public debt exceeded 100% of GDP in 2021.

A handful of others including Ghana, Guinea-Bissau and Gambia are at risk. Ghana’s sovereign debt jumped from 63% in 2019 to 82% in 2021, while Guinea-Bissau’s sovereign debt edged up from 66% to 81% over the same period. Gambia’s debt showed no signs of easing, and has remained elevated at an average level of about 84% since 2019.

IMF and World Bank assessments of a country’s risk of experiencing public debt distress are based on two main types of debt sustainability analyses. The first considers a country’s projected debt burden and its vulnerability to shocks. The second assesses the risk of external and overall public debt distress using a country’s macroeconomic environment and other country specific factors.

For this reason, a country with a relatively lower public debt ratio could also still be vulnerable. For example, Ethiopia was deemed to be at high risk of debt distress even though its sovereign debt of 53% of GDP in 2021 was relatively lower.

Restructuring

Given this state of affairs, sovereign debt restructuring has become inevitable. The G20’s Common Framework has not been effective amid growing mistrust among the different parties involved. Any optimism that it could be improved has been dented further by escalating geopolitical tensions between the US and EU on one side and China and Russia on the other.

Therefore, expecting both sides to sit down and coordinate with other G20 members to negotiate new debt terms with African governments and other sovereign debtors in the developing world is a long stretch. This casts further doubt on the G20 as a negotiating forum.

This is why an alternative system must be put in place without delay to alleviate Africa’s debt problems in a timely manner.

Failure to do so will make it difficult to restrain Africa’s debt and will weaken its post pandemic recovery.

In the past, sovereign debtors relied on the 22-member Paris Club of wealthy creditor nations to negotiate debt restructurings. However, this time around, the Paris Club can no longer be used as the lead forum for debt treatments. This is largely because China is now one of Africa’s largest creditors, but is not one of the Paris Club’s members.

Policy responses

A return to debt sustainability will create fiscal room for African policy makers to stave off risks to the post-pandemic recovery in the face of multiple shocks that are teaming up to elevate sovereign debt pressures. But fiscal policy must be carefully targeted to avoid adding to debt vulnerabilities. This can be done in several ways.

First and foremost, policy makers should direct fiscal resources to protect the most vulnerable households affected by the cost-of-living crisis being wrought by the war in Ukraine.

Second, policy makers should use any budgetary room created by restraining debt to heal pandemic scars that are holding back the economic recovery. This includes supporting companies that can survive or recover, but are saddled with debt or cannot raise the financing to support themselves.

Support should also target new productive companies that are innovative and contribute to growth, jobs, and overall economic development. Additionally, workers set back by the pandemic should be given assistance to learn in-demand skills and adjust to new careers.

One of the deep scars of the pandemic was the severe disruption to schooling which led to a surge in teen pregnancies. Re-enrolling girls in classes by supporting community-based programs like Kenya’s Project Elimu will help limit the loss in human capital, and should be a top priority for policy makers.

Finally, African governments should use technical assistance support from multilateral lenders (IMF and World Bank) in areas that strengthen debt sustainability. These include debt management reforms, improved government revenue collection, smarter public investment programs, and debt sustainability analysis.

Jonathan Munemo ne travaille pas, ne conseille pas, ne possède pas de parts, ne reçoit pas de fonds d'une organisation qui pourrait tirer profit de cet article, et n'a déclaré aucune autre affiliation que son organisme de recherche.

This article was originally published on The Conversation. Read the original article.