Sports trading cards are enjoying something of a renaissance, fetching greater value than ever before and engendering excitement on a level not seen since their last golden age in the 1990s.

Driving the news: A Mike Trout rookie card sold for $3.9 million last week, breaking the all-time record set in 2016 by the famous T206 Honus Wagner ($3.12 million).

- It's the third time since May that a new record was set for modern cards, after a different Trout rookie went for $900,000 and a LeBron James rookie went for $1.8 million.

The big picture: These record figures are symptoms of a larger trend, with cards becoming a highly valuable asset class over the past few years.

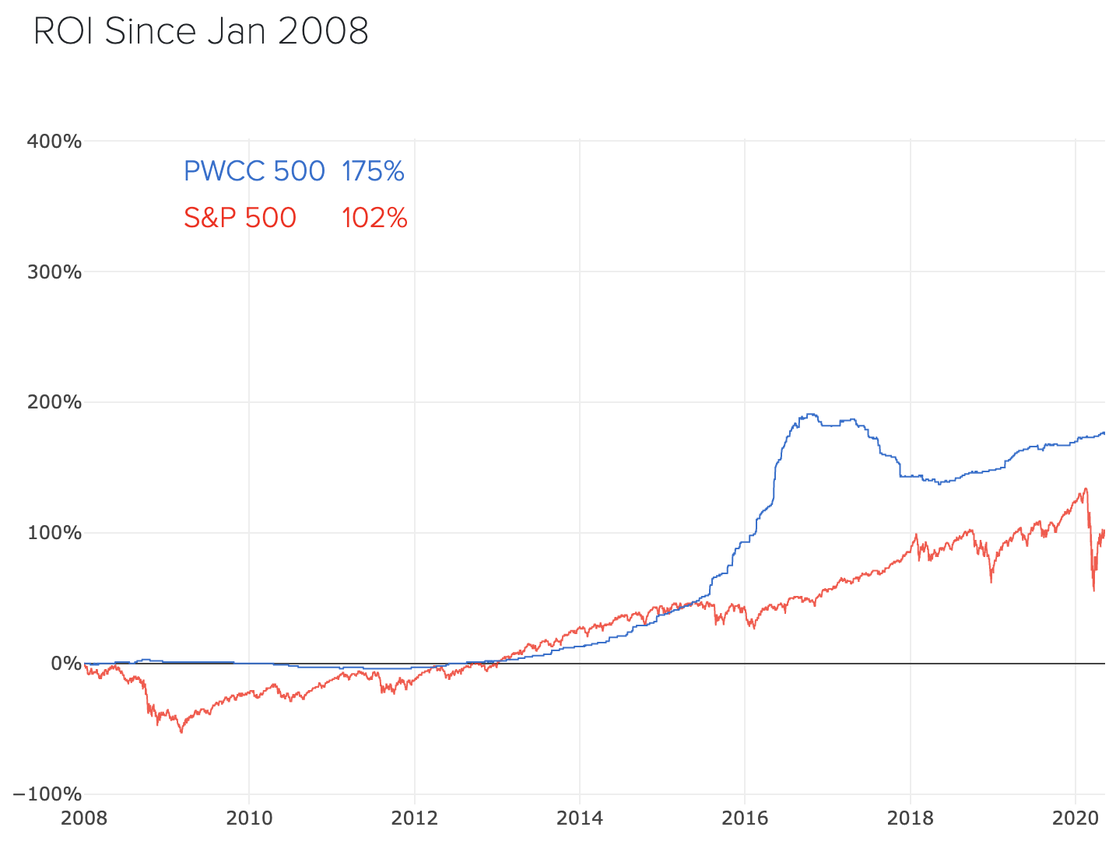

- The PWCC 500 Index, which is essentially the S&P 500 for trading cards, has reported a 12-year ROI of 175% compared to just 102% for the S&P.

- Put another way, if you'd invested in both stocks and trading cards a dozen years ago, your card portfolio would be worth nearly twice as much.

What they're saying: Sports memorabilia appraiser Michael Osacky believes "sports cards are the next generation's art."

- "Buy what you like," he told me. "If the market goes down, at least you still have something you cherish — that you bought for a reason."

- In other words, by investing in something that you can appreciate while it appreciates, you've hedged against a market downturn.

Between the lines: The driving forces behind the recent boom are varied.

- Liquidity: During times of economic unease, people tend to gravitate towards more tangible, liquid assets like cards or gold (which, not so coincidentally, has also reached record highs since the pandemic began).

- Stay-at-home orders: When the lockdown began and boredom set in, sports fans perused their old collections and hopped on sites like eBay to quench their nostalgia.

- Relative simplicity: The engine powering the stock market is complicated, but the value of cards is easy for anyone to grasp. Star players having great seasons yield valuable cards; exciting rookies make for good investments; the scarcer the card, the more it's worth.

Looking ahead: Case breaking, which involves groups of collectors co-investing in high-priced packs of cards and live-streaming their "unboxing," is becoming increasingly popular, with apps being built to optimize the experience.

- Digital collectibles are also on the rise. Paris-based Sorare allows soccer fans to collect and trade digital cards, while also using them to play fantasy games.

- Each player card is certified by a club or league and generated on the Ethereum blockchain, so there's provable scarcity. Each card is unique.

The bottom line: The last golden age of trading cards ended because companies oversaturated the market, which ultimately devalued the product.

- They've since learned their lesson, focusing on fewer, higher-value cards, and the 10-year-olds they used to cater to are now 40-year-olds with money in their pockets and nostalgia in their hearts.