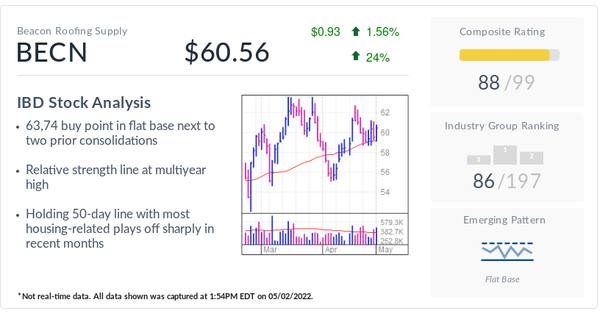

With its next quarterly earnings report scheduled for May 5 after the market closes, Beacon Roofing Supply is roughly 4% under a 63.74 buy point. The pattern is a second-stage flat base, a bullish indicator because early stage bases (stages 1 and 2) are more likely to succeed than later stage ones. Beacon stock rose 1.4% Tuesday afternoon to 61.42.

Beacon stock has a 91 Composite Rating, meaning it's outperforming more than 90% of all stocks on a group of key metrics. Among its other key ratings, the Philadelphia-based company boasts a 90 Relative Strength Rating, and an 85 EPS Rating. Its B- Accumulation/Distribution Rating on an A+ to E scale shows more buying of its shares than selling by large institutional investors such as mutual funds and ETFs.

Looking For The Best Stocks To Buy And Watch? Start Here

Beacon Stock Rising Amid Forecast 121% Profit Surge

Beacon reported higher quarter-over-quarter earnings and sales growth last quarter. Earnings per share jumped 46% on a year-over-year basis to $1.47, up from 39% growth the prior quarter. Revenue grew 11% to $1.76 billion, up from 7% growth the prior quarter.

Analysts are looking for a first-quarter surge of 121% EPS growth for the quarter, and 12% growth for the full year.

Highly Rated Peers In Building Products Group

Beacon stock earns the No. 6 rank among its peers in the Retail/Wholesale-Building Products industry group. GMS, W.W. Grainger and Applied Industrial Technologies are also among the top-rated stocks in the group. Beacon Roofing stock has climbed 426% from a Covid crash low 11.67 in late March 2020.

Understand that buying a stock just ahead of earnings involves risk since you typically don't have enough time to establish a profit cushion before the latest quarterly numbers come out. Be sure to follow sound buy and sell rules to minimize your exposure.

Note: Dates for earnings reports are subject to change. Check the company's website for any updates.

Please follow James DeTar on Twitter @JimDeTar