/A%20concept%20image%20of%20a%20self-driving%20car%20image%20by%20Gorodenkoff%20via%20Shutterstock.jpg)

Light detection and ranging (LiDAR) technology is one of the core components of autonomous vehicl development. LiDAR uses laser precision to map surroundings and detect obstacles in real-time. In fact, it is often the backbone of self-driving vehicles, enabling them to safely navigate roads by identifying other cars, pedestrians, and potential hazards with accuracy.

Thanks to the soaring interest and investments in self-driving technology, the global LiDAR market is on the fast track for massive growth. Projections call for this market to surge from just $2.9 billion in 2025 to a staggering $15.8 billion by 2034, expanding at an impressive CAGR of 20.9%. As competition heats up in this critical, fast-evolving market, one early pioneer is Luminar Technologies (LAZR).

Although the company has struggled to woo investors in recent years, Luminar just notched a major victory. On March 5, the company revealed that its next-gen LiDAR will be powering the new Volvo ES90, which is set to hit production this year. This marks the second Volvo model to feature Luminar’s tech, following the EX90 SUV, which is already reaching customers. With this news sending LAZR shares surging over 8% on the announcement day, here’s a closer look at this self-driving car player.

About Luminar Stock

Founded in 2012, Florida-based Luminar Technologies (LAZR) has spent the past decade developing a cutting-edge hardware and artificial intelligence (AI)-driven software platform designed to enhance vehicle safety and autonomy. Its technology has attracted partnerships with industry giants like Volvo Cars, Mercedes-Benz, Nvidia (NVDA), and Mobileye (MBLY), all leveraging its advanced LiDAR solutions for next-generation vehicles.

With the Volvo EX90 marking the first global production car to feature this technology and now ES90 the second, Luminar is at the forefront of integrating high-precision LiDAR into mass-market vehicles, paving the way for enhanced safety features and autonomous capabilities. Yet, valued at a market cap of roughly $166.2 million, the company is struggling, with its shares shedding 85% over the past year, while the broader S&P 500 Index ($SPX) returned roughly 9.3% during the same stretch.

After a brutal year of underperformance, Luminar’s valuation has plunged to just 2 times sales, a staggering drop from its own five-year average of 79.93x.

Digging Into Luminar’s Q3 Financials

Luminar’s third-quarter earnings, released in November, painted a mixed picture. Revenue slipped 8.6% year-over-year to $15.5 million, missing Wall Street’s $19.1 million target. However, the company showed progress on the bottom line, narrowing its adjusted loss to $0.16 per share from $0.21 a year ago, which was also in line with analyst expectations.

In September last year, Luminar ramped up its cost-saving efforts as part of its ongoing restructuring plan, including reducing its non-technical workforce. These strategic moves, combined with additional cost-cutting initiatives set to unfold in the coming quarters, are expected to deliver approximately $80 million in annual cash savings on a run-rate basis, strengthening the company’s financial position amid a rapidly evolving industry landscape.

Looking ahead to Q4 results, which are scheduled to be revealed after the market closes on March 20, the company anticipates a moderate uptick in revenue compared to Q3 levels. At the same time, strategic production downtime in Q4 is expected to help trim excess inventory levels and align with Volvo’s production schedule while cost-saving measures continue to take effect. As a result, the company projects a significant reduction in gross losses compared to the previous quarter.

Over the longer term, analysts tracking Luminar Technologies project the company’s loss to narrow 32.4% year over year in 2024 and improve another notable 43% in 2025.

What Do Analysts Expect for Luminar Stock?

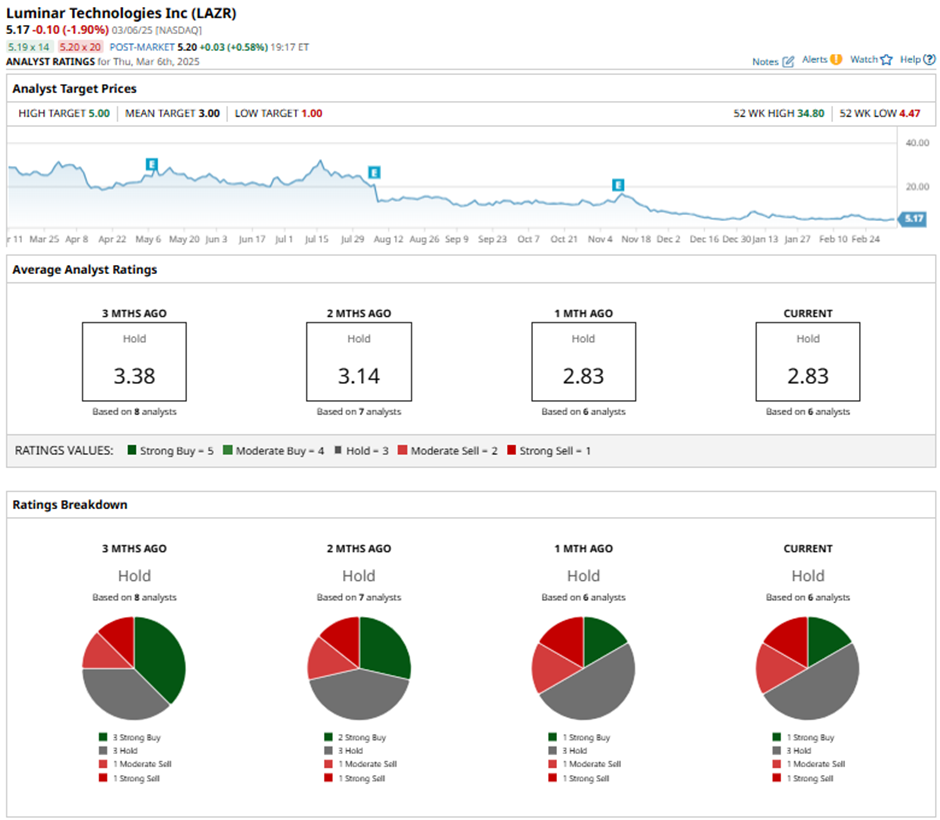

Luminar’s latest breakthrough, securing its LiDAR technology in the upcoming Volvo ES90, has put the spotlight back on LAZR stock. While investors welcomed the news, Wall Street still appears cautious about LAZR, with a consensus “Hold” rating.

Out of six analysts covering the stock, only one is bullish with a “Strong Buy,” while three lean toward a “Hold.” On the flip side, one analyst holds a “Moderate Sell” stance, and another issues a “Strong Sell.” As of writing, the stock is trading premium to both its average analyst price target of $3. The Street-high target of $5 represents roughly 9% upside potential.