Building a home can come with hidden costs. Unfortunately, many people don’t think about these costs until it’s too late.

Some buyers succumb to the tricks marketers use to attract them, with upgrades and add-ons blowing out the cost.

Other costs relate to risks of delay, changes in borrowing conditions, unexpected taxes and fees, insurance, compliance with local development standards and even exit fees in some cases.

So let’s explore the sales tactics buyers need to beware of, as well as the five hidden costs of building new homes.

How marketers persuade us to build a home

Marketers of home-building packages use various strategies to attract buyers.

Attractive pricing and promotions

Marketers often attract first-time home buyers and young families by advertising low prices and showing off modern designs.

They will then offer an upgrade or value package. The most common examples we see are deals with, for example, a $30,000 credit on upgrading, $45,000 cashback, or an amazingly cheap house and land package.

Our research found consumers are likely to feel more surprised by higher levels of discounts in the case of high-involvement products such as a buying a house.

The marketers make it seem like you’re getting a great deal, with options to customise the house just the way you like. What they don’t always tell you is the advertised prices usually apply to the most basic version of the home.

Any upgrades, such as granite countertops or hardwood floors, cost more. Often, the base price does not include essential features such as curtains, ceiling fans or air conditioning.

These upgrades quickly add up to more than that $30,000 credit for upgrading or that $45,000 cashback offer. Buyers can end up paying much more than they planned.

Keep in mind most home-building companies act as middlemen who buy and outsource products. They are likely to add charges for most upgrades or fixtures you order through them.

A $200 price tag for a kitchen light bought directly from a retailer such as Beacon Lighting can cost you $300 from the builder. Costs like this add up for a whole house.

What can you do? Note down the code or name of the item and buy it directly. See if the builders can install fittings for a lower cost if you supply them.

Social media and influencers

Influencers can make the process look easy and fun. Our research on influencer marketing and human influencers and virtual influencers shows trusting followers are more likely to follow influencers’ suggestions.

An influencer might, for example, share a video of their “perfect day” in their new home, focusing on the perks without mentioning the hidden costs.

Special deals and time-limited offers like cashbacks are used to make buyers feel they have to act fast, without taking the time to think about the financial commitment. This strategy exploits the fear of missing out, or FOMO.

The goal is to get customers to quickly sign up with a $1,000–$5,000 deposit. That increases customer commitment and stops them backing out.

Carefully check the conditions of the deposit, as you can most likely back out with a full refund if you are not happy with the final price before the final contract is signed, or during a cooling-off period after signing.

What are the 5 hidden costs?

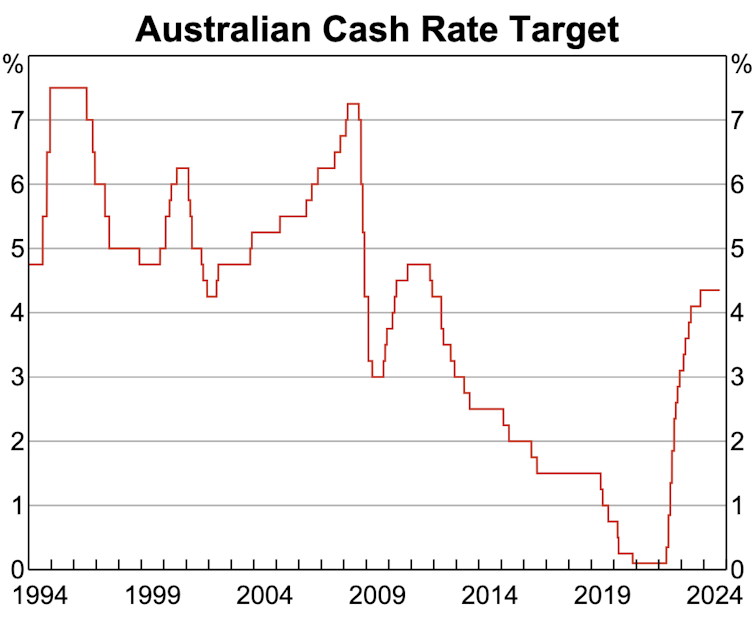

1. Changing interest rates over 30 years

Many home buyers think about interest rates when they get a mortgage, but they often do not consider how rates can change over the years. Even a small increase can mean paying thousands more over the life of the loan.

When buying a home, people hope for lower interest rates, though they cannot predict future economic conditions. The theory of optimism bias could explain why many of us have expectations about a future that’s more favourable to us.

What should temper this optimism is the fact that even seemingly small interest rate changes make a big difference over time. For example, a $700,000 loan over 30 years at 3.5% interest has a monthly repayment of $3,143.31. At 4.5% interest, the repayment becomes $3,546.80. That’s an extra $4,841.88 a year.

Understanding this can help families budget for possible changes and avoid financial stress later on.

2. Delay costs

Delays can happen due to weather, problems getting materials, or other unexpected issues. Timber shortages have affected home building since 2020.

The costs of delay can include having to rent a place to live while waiting for the home to be finished. Renting for three months, for instance, at the national average of $600 a week will cost more than $7,000.

3. Unexpected costs

Apart from predictable costs, such as the down payment and tax or transfer (stamp) duty, other smaller, unexpected costs can add up.

These include bank fees, solicitor fees, building and pest inspections, moving costs, utility connections and home and contents insurance.

These are all essential to ensure the home is safe and secure. But the cost can easily top $5,000.

4. Standardised costs

Many new housing developments have rules about what owners can and cannot do with their property.

These rules might specify paint colours, fence types or landscaping choices, such as planting a set number of large trees.

A development might require home owners to use certain types of trees or materials for driveways, costing an extra $2,000.

More often than not, the land developer will require a refundable deposit of about $1,000–$5,000 when you buy the land for your home. It’s only refunded once the developer has confirmed you have met all the conditions. If you don’t, you won’t get your money back.

Before buying an apartment, first find out how much you have to pay in strata fees and other fixed or ongoing costs.

5. Exit costs

In rare cases, selling the property might attract exit fees. For example, if an owner sells their house within five years, they might face a $5,000 penalty fee for selling early.

This can be an unpleasant surprise and cause problems for families who need to move quickly due to a job change or other life events.

Make sure you read all the conditions of sale before signing.

A market in need of greater transparency

Knowing about these hidden costs of building a home helps avoid unexpected expenses and makes the process less stressful.

For policymakers and advocates, these costs highlight the need for fair marketing practices and rules that protect buyers from financial surprises.

Ensuring more transparency in this market can help make home ownership more affordable and accessible for everyone.

The authors do not work for, consult, own shares in or receive funding from any company or organisation that would benefit from this article, and have disclosed no relevant affiliations beyond their academic appointment.

This article was originally published on The Conversation. Read the original article.