The cotton futures (CTK25) market has been losing ground for more than a year, and this month, prices dropped to a 4.5-year low, basis nearby ICE futures. There are bearish fundamental supply and demand elements that have been pressing the natural fiber’s price down. Let’s examine them, how they may change in the coming months, and what clues could signal a price bottom.

Risk Aversion, Tariffs and a Wobbly U.S. Stock Market Are Keeping Cotton Bulls in Hibernation

In early March, the major U.S. stock indexes hit multi-month lows and are still trending lower as a tariffs-driven trade war heats up.

The threat to the cotton market is double-barreled: Tariffs threaten to slow global economic growth, which would likely mean less demand for cotton due to dented consumer confidence leading to reduced apparel purchases. Also, the tariff war could see major U.S. cotton importer China reduce its purchases of American cotton in retaliation for U.S. tariffs slapped on China over the past several weeks.

A potential positive for the cotton market is that futures prices have likely already “baked into the cake” or discounted the negative implications of a global trade war reducing cotton demand. Also, futures traders tend to factor in worst-case scenarios for fundamental developments such as a global trade war and its implications for the cotton market.

In other words, the tariff exchanges and related disputes among major economies may wind up being resolved in the coming months.

Also, the Federal Reserve at its Federal Open Market Committee (FOMC) meeting this week kept its main interest rate unchanged and still expects to cut rates twice in 2025. Chaiman Jerome Powell said on Wednesday that the Trump administration’s policies, including hefty tariffs, have tilted the economy toward slower growth and at least temporarily higher inflation. Still, the U.S. stock market took the FOMC meeting as a positive and the major indexes saw their biggest FOMC-day price gains since the middle of 2024. If the stock indexes can put in market bottoms and start to trend up, that would be a significantly bullish development for the cotton market.

U.S. Cotton Export Sales Remain in the Dumpster

This week’s USDA export sales report showed that net U.S. sales of upland cotton totaling 101,100 running bales (RB) for the 2024/2025 marketing year were down 63% from the previous week and down 59% from the prior 4-week average. Sales reductions of 49.300 RB were seen for China. U.S. cotton shipments of 351,000 RB were down 13% from the previous week, but up 8% from the prior 4-week average. It’s likely going to take U.S. weekly cotton sales abroad of upwards of 300,000 RB to jumpstart a sustainable futures price rally.

U.S. Cotton Acreage Update Coming in Late March

The March 31 USDA acreage report is the next major data point for cotton market watchers. The agency will likely peg U.S. cotton plantings at just over 11 million acres, according to analysts surveyed. However, the USDA Ag Outlook Forum in February forecast “low cotton prices, both in absolute terms and relative to competing crops, are expected to reduce 2025/26 all U.S. cotton planted area almost 11 percent to 10.0 million acres. Assuming abandonment of 16 percent and an average yield of 833 pounds per harvested acre, U.S. all-cotton production in 2025/26 is projected at 14.6 million bales, 1 percent larger than 2024/25.”

USDA’s March supply and demand report saw the agency forecast the 2024/25 marketing year season average upland farm price reduced to $0.63 per pound.

Two Key Outside Markets Presently a Mixed Bag for Cotton

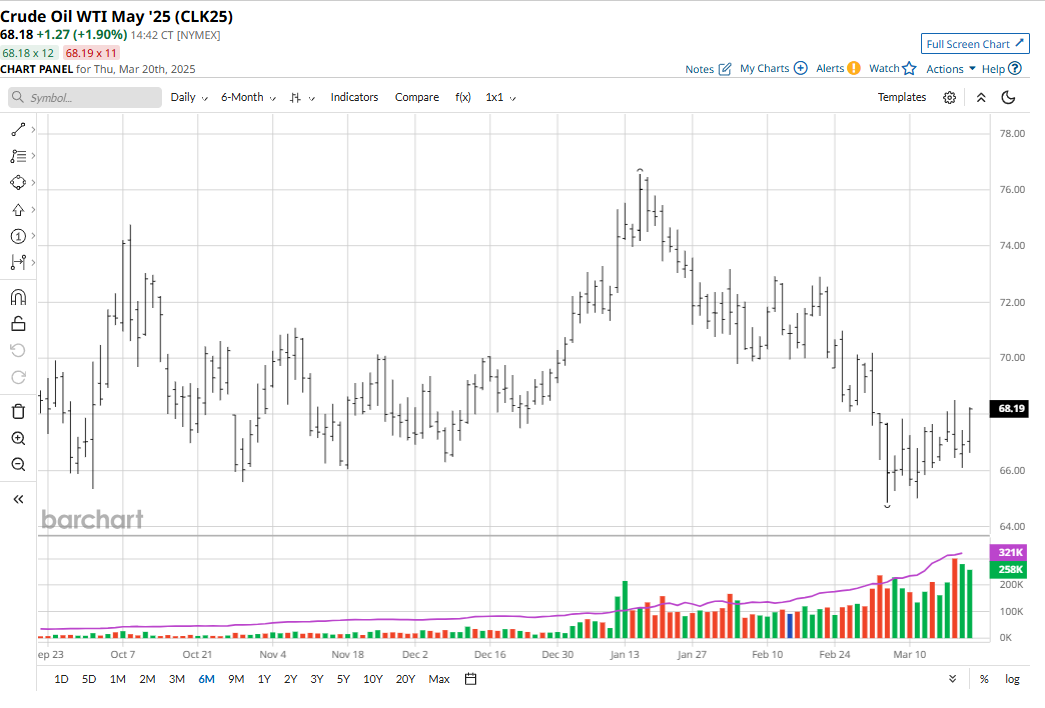

Two “outside markets” that have a significant daily price impact on cotton futures are the U.S. Dollar Index ($DXY) and Nymex crude oil futures (CLK25). The U.S. Dollar Index has been trending lower since mid-January, which is a positive for the cotton market because it makes U.S. cotton more price-competitive on the world market.

However, crude oil prices have also trended lower since mid-January. That’s a negative for most of the raw commodity sector because oil is the leader in the sector. Down-trending oil prices make it extra difficult for other raw commodity markets to sustain price uptrends.

Weather to Become a Bigger Price Factor for Cotton in the Coming Weeks

Weather in U.S. cotton-growing country is always a wild card, especially in the major growing state of Texas. Presently, precipitation is needed in both south and west Texas to provide more favorable soil moisture for spring planting.

Watch for these Early Clues the Cotton Market has Bottomed Out

The following are some early clues that would begin to suggest the major bear market in cotton has finally ended. These are easy to understand and identify technical clues that a major bear market is on its last leg.

- A technically bullish weekly high price close on a Friday.

- Two sessions in a row of big price gains.

- A bullish “key reversal” up on the daily bar chart, whereby a new for-the-move low is scored but then prices reverse course to close solidly higher, near the daily high and have a daily price high that is higher than the previous session’s high price.

- A selling “exhaustion tail” on the daily chart, whereby a new for-the-move low is scored and then prices rebound smartly to close at or near the daily high, creating a big tail on the daily chart.

- Rising daily futures price volume and open interest levels. Strong and sustainable bull moves in futures markets require stronger daily volume and open interest levels.