Tax season is winding down and refund season is in full swing.

Every spring millions of Americans keep a close eye on their bank accounts and mailboxes waiting for a refund of overpaid income taxes. And for good reason: the average federal tax refund sent to individual filers last year was about $2,400, according to IRS data for fiscal year 2022 (this includes returns filed for the 2021 tax year and 2020 returns that were processed late).

DON'T MISS: The Government May Owe You Part of a $1.5B Sum — But It'll Be Gone Soon

That’s no small sum, particularly for anyone who’s behind on bills or hoping to pad their savings account. A recent survey from GoBankingRates revealed that a quarter of people plan to save their tax refund this year, while 21% said they’ll use it to pay bills and about 19% said they’ll put the cash toward debt. Less than 10% of people said they plan to spend the money treating themselves or on travel.

Having a plan for an anticipated financial windfall is smart, but taxpayers with big plans may be in for a shock. The IRS warned taxpayers back in November to expect smaller refunds in 2023.

That’s because Congress passed a number of sweeping financial aid packages during the pandemic giving taxpayers billions in extra cash—temporarily. Much of the aid was reconciled through federal tax refunds, including stimulus checks and advanced payments of the child tax credit. This caused refunds to be inflated.

Now that those federal relief measures and others have expired, tax refunds are coming back down to Earth.

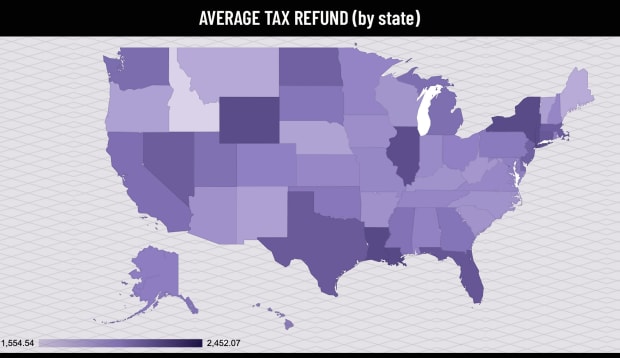

Average Tax Refund by State

The IRS publishes detailed tax statistics online, including data about how many refunds are sent to residents in each U.S. state annually. The latest data is for fiscal year 2022, which ran from October 1, 2021 to September 30, 2022.

We found the average federal income tax refund in each state (and Washington, D.C.) by dividing the total amount of refunds (in dollars) by the total number of refunds. Check out what's typical in your state below so you can prepare for a potentially smaller sum this refund season. Keep in mind that you could be getting a separate tax refund for your state taxes, too.

Frequently Asked Questions About Tax Refunds:

When can I expect my refund for 2023?

The IRS says it pays out the majority of tax refunds in less than 21 days. Taxpayers who e-file and opt for direct deposit over a paper check usually get their refunds faster. Your refund could be delayed because of an incomplete return, in which case the IRS will get in touch with you via mail (if you're getting social media or text messages, or even phone calls, from someone claiming to be with the IRS, it's probably fraud. The IRS prefers snail mail.)

What’s the status of my tax refund?

You can check the status of your tax refund online beginning 24 hours after e-filing your return or four weeks after mailing a paper return. You'll need your Social Security number or taxpayer ID number, your filing status, and the exact amount of the refund calculated on your tax return.

How can I get a bigger tax refund next year?

You can generate a bigger tax refund by having more income taxes withheld from your paychecks or qualifying for additional tax deductions or credits. If you have some financial flexibility, one of the simplest ways to increase your tax refund is by contributing to a pre-tax retirement account, such as a 401(k) or traditional IRA. The amount you contribute won't be counted in your income total for the year, therefore lowering your tax bill and leading the IRS to refund some of the money you paid in income taxes.