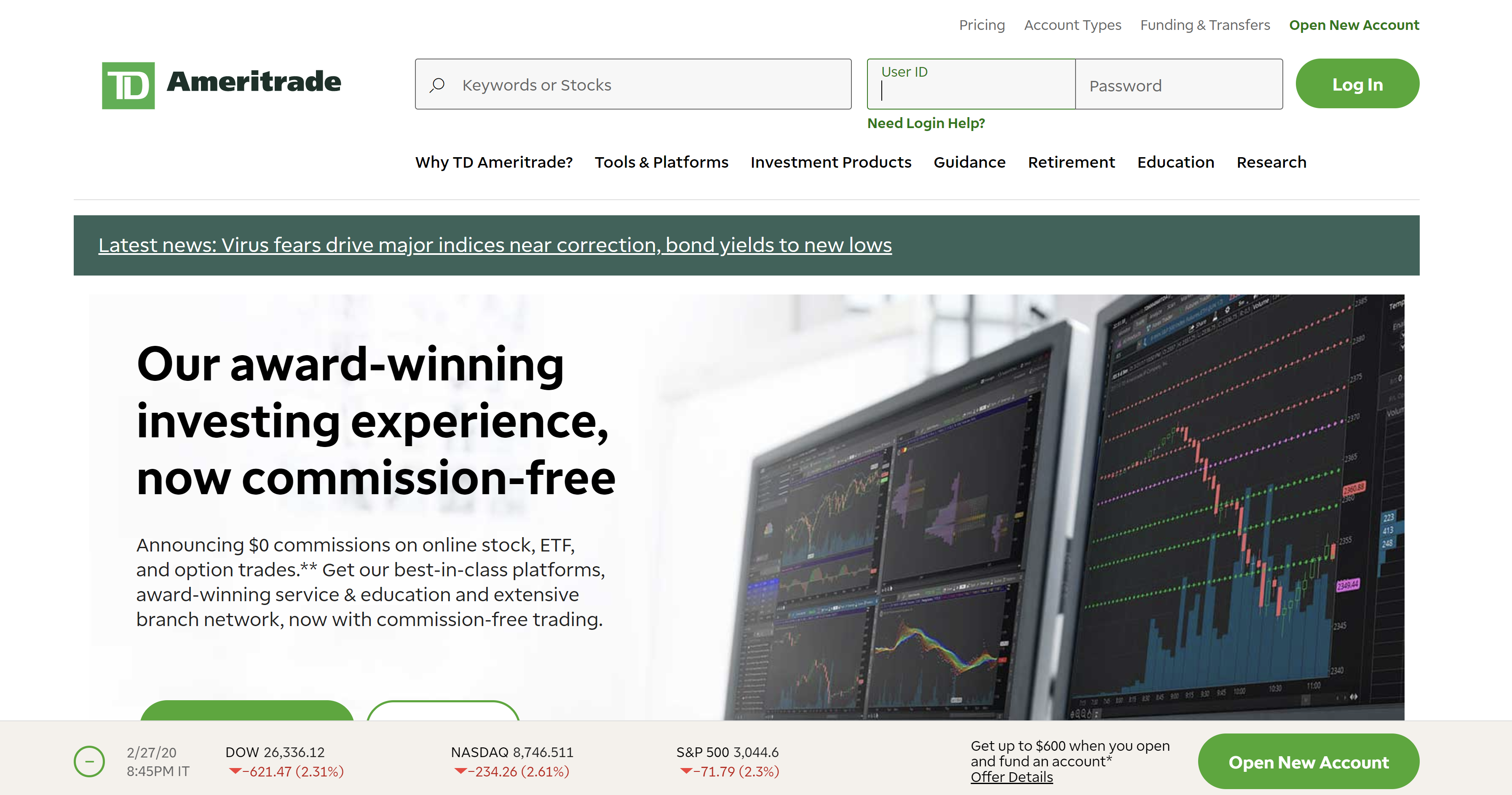

TD Ameritrade is one of the prominent brokerages – no matter whether you are a beginner in the investment arena or even an advanced investor. It recently eliminated the commissions and has become one of the highly prominent choices for online stock, ETF trading, and other trading instruments.

Some of the features that it offers you include zero commission, an exceptional set of tools and products, comprehensive research, and a no account minimum.

What is TD Ameritrade all about?

TD Ameritrade is an online brokerage platform based out of Omaha, Nebraska. The company has grown into a considerable investment portal with a wide range of acquisitions and mergers. It does offer investments in just about every type of vehicle, and that includes stocks, bonds, mutual funds, and ETFs.

It provides a combination for both online and mobile trading platform for investors. It also has a comprehensive set of research tools that can be helpful enough in building confidence for the least experienced investors. The tool provides you access to a host of investment analysis tools.

TD Ameritrade aims to work just as well for both new investors and established ones, because of both the zero minimum account as well as the extensive array of research and guidance on how to build your portfolio.

Features

Some of the features offered by the AD Ameritrade include the following –

- Commission-free trading – TD Ameritrade provides commission-free trading for a host of trading instruments. In 2019, the company decided to cut down the commission. Some trades, however, come under a fee format of $0.65. There are over 4100 mutual funds, and all ETFs are available for free.

- Investor Education – The digital education offerings available through the service are comprehensive. There is plenty of educational content in the form of videos, articles, slideshows, and quizzes. The platform also offers you reports from resources such as Morningstar, Credit Suisse, CFRA, The Street, and many others.

- Visual Trading Simulator – This is basically designed for use for the likes of advanced and frequent traders. The service is available through the mobile trader app and the other platforms offered by TD Ameritrade.

- Portfolio analysis and reports – Ameritrade provides you access to highly customizable portfolio analysis. The service is available both on its trading platform and the thinkorswim platform. You can even consolidate external accounts for a good look at your assets.

- Mobile Trading – TD Ameritrade offers not one, but two specialized mobile apps in tune with its two trading platforms. This can go a long way in enhancing your experience in terms of improved trading experience. Mobile trading made simple; the apps work as a perfect extension of the online platform.

The platform offers you tradability across the following securities –

- Stocks

- Bonds

- Mutual funds

- ETFs

- Futures

- Forex

- Foreign ADRs

- IPOs for qualified accounts

The customer support offered by TD Ameritrade is comprehensive. Being one of the promising investment organizations in the US, it has set up an extensive customer support network.

The customer service can be reached through the chat option on mobile and online platforms. The 300 branches across all states will ensure the option of in-person assistance in case your issues are not addressed by the phone, email, or chat support. Support is also available on the following channels Monday to Friday 7 am to 6 pm: text, Facebook Messenger, Twitter direct message, Apple Business Chat, and Amazon Alexa.

As stated before, TD Ameritrade provides you access to two mobile apps – the TD Ameritrade Mobile app and TD Ameritrade Trader app. These are designed for standard and thinkorswim platforms. However, note that TD Ameritrade Mobile apps are only available on iOS. The mobile apps mimic each of the desktop features and offer practical functionality on the go.

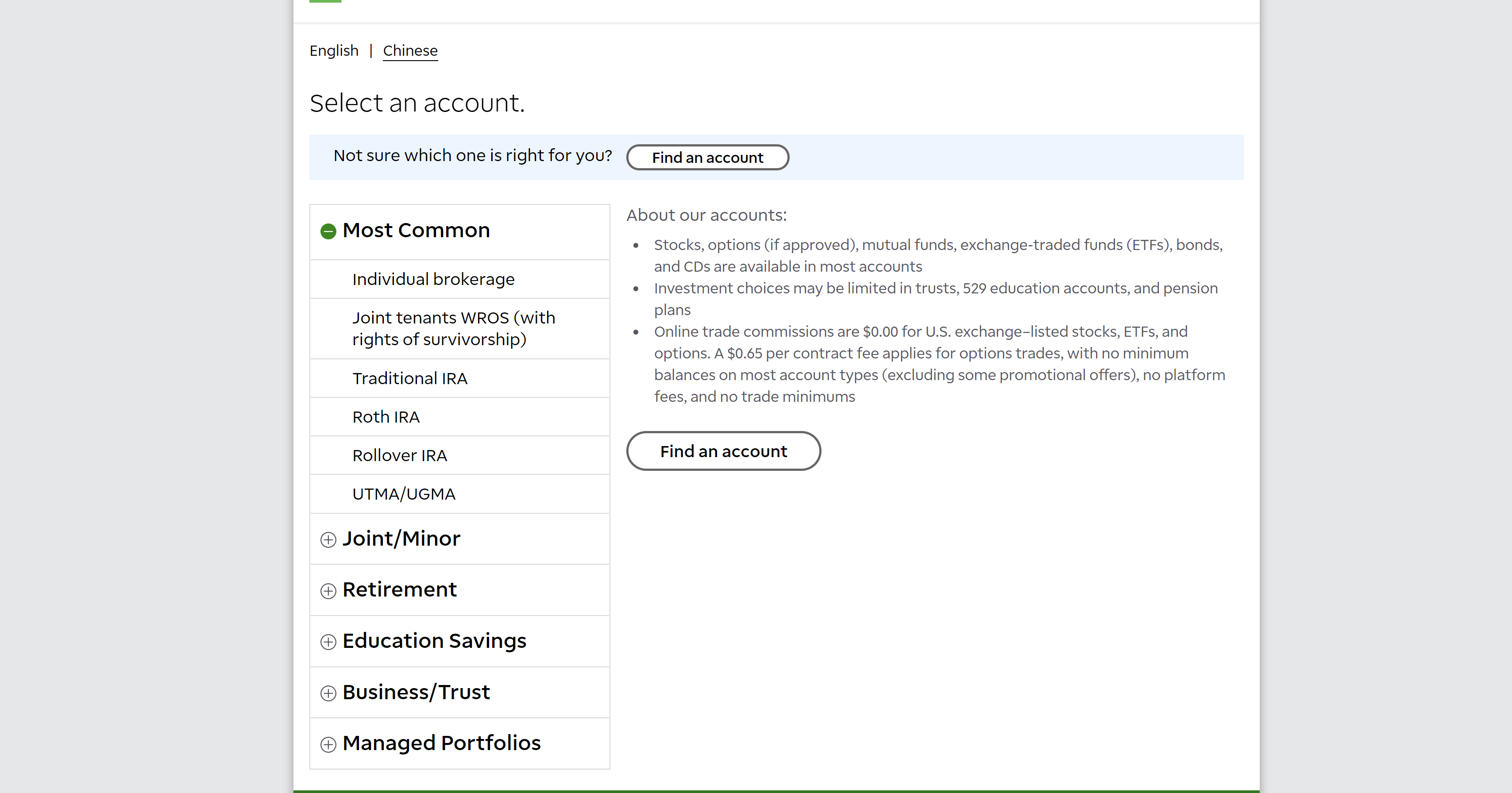

You can opt for a multiplicity of accounts with the platform. Each of the account types is formatted for your exact requirements

- Standard accounts – You can have both individual and joint accounts with TD Ameritrade and gain access to comprehensive products

- Retirement accounts – These would include IRA, Roth IRA, or Rollover IRA accounts. They can be well suited for taking care of your retirement goals

- Education Accounts – Want to save for education? You can opt for state qualified 529 plans and similar

- Managed Portfolios – A highly tailored investment portfolio managed by the professionals. The plans are backed by the experience of TD Ameritrade Investment Management

The above accounts apart, you can also have access to Specialty accounts and margin trading as well.

Who is TD Ameritrade suitable for?

Well, the online brokerage platform is suitable for a wide range of investors. No matter what level of experience you have, the platform offers something for you :

- Beginner investors

- Advanced traders

- Investor education/advice

- Commission-free trades

- Fund investors

Final verdict

With no commission on stock, ETF, and other trades, it does offer an impressive set of tools for investors. The portfolio building guidance, courses, and high-end research are a few great features that should make it especially useful to learn the basics of investment.

- Best forex trading platforms: trade and invest on your Android or iPhone