Top executives from Disney, Fox and Warner Bros. Discovery have consistently insisted that their joint venture to launch the Venu Sports streaming bundle in the fall of 2024 would not harm the pay TV industry or accelerate cord cutting.

Right from the start, a number of analysts have doubted that assessment. Now a new survey from Aluma provides new notable and compelling data supporting the idea that the Venu service will negatively impact the already crumbling pay TV industry.

The issue is important not only for pay TV operators but also for broadcasters who have staked much of their financial future on extracting ever larger sums of money from retransmission consent deals with pay TV operators.

In earnings calls right after the sports streaming service was announced, the backers of Venu Sports argued that the new service targets cord cutters and would not hurt the pay TV industry.

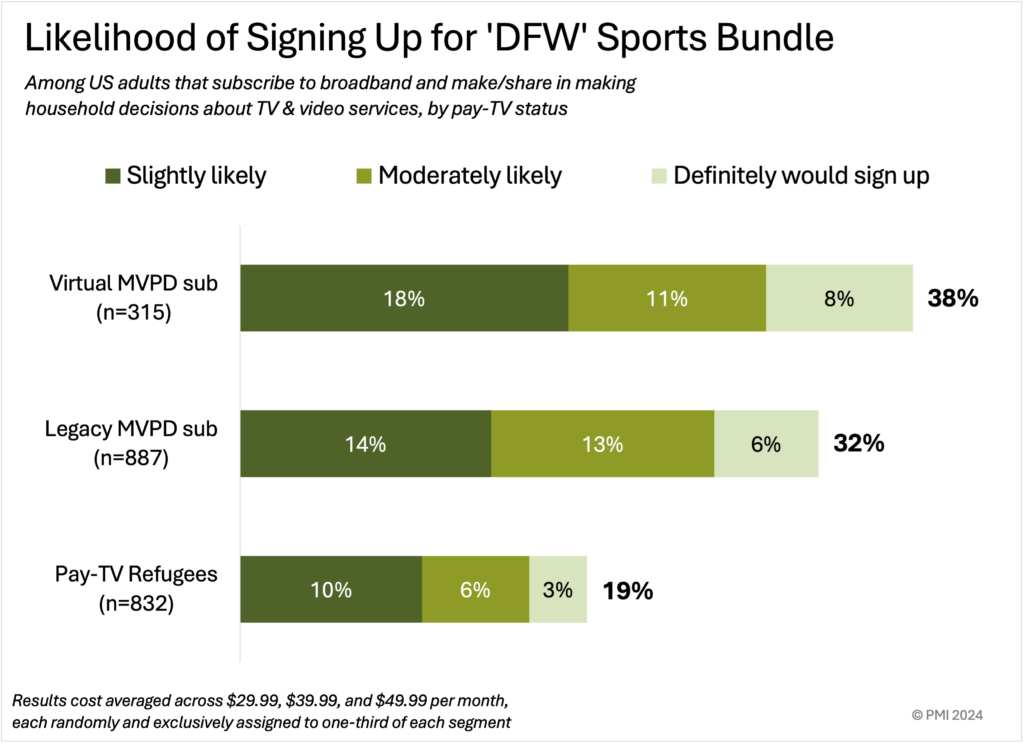

However, the new Aluma Insights study finds that pay TV subscribers are far more inclined than non-subscribers to sign up for the Disney, Fox, and Warner Bros. Discovery (DFW) sports bundle when it launches. One-in-five pay TV subscribers are at least moderately likely to sign up for the DFW bundle, double the rate of those without pay TV, reports Michael Greeson, principal analyst, at Aluma Insights.

The data is based on cost-averaged interest across three randomly and exclusively assigned price points: $29.99, $39.99, and $49.99 per month.

Among the pay TV customers likely to sign up for the DFW bundle, 39% are at least moderately likely to cancel their pay TV service as a result. And MVPDs are taking notice, Greeson explained.

“A loss of even 10% to 15% of the already-declining base of paid subscribers would severely diminish the ability of operators to stay afloat,” noted Michael Greeson, principal analyst at Aluma. “And if those launching the DFW bundle intend to rely on demand from those without pay TV, they can forget about it. Less than one-in-ten are legitimate prospects for the service.”

In other words, the most lucrative audience for the DFW bundle is pay-TV subscribers, not at all what MVPDs want to hear, Greeson noted.

The analyst also notes that the potential impact of the DFW bundle on pay-TV subscriptions spurred virtual MVPD Fubo to file an antitrust lawsuit against the three companies. It charges that these networks continue to thwart Fubo’s service by forcing it to buy bloated channel bundles in order to distribute the high-value live sports they own.

“If the Department of Justice does not enjoin the DFW venture or level the playing field for Fubo to license their content at rates larger operators enjoy, Fubo could lose as much as 10% to 15% of its subscriber base by summer 2025,” Greeson noted.

The data also raises some interesting questions about how successful the streaming JV might be.

One factor that could constrain uptake of the new bundle is price. At the moment, there is a modest consensus it will launch at $50 a month. If it does, it would lessen its disruptive potential. Aluma’s research found that only 11% of decision-makers are at least moderately likely to sign up for the bundle at $49.99 per month, half the demand at $29.99 a month, the Aluma data showed.

The data comes from March and April 2024, when Aluma Insights surveyed 2,032 US adults that use a broadband internet service at home, watch TV at least once a month, and who make or share in making decisions about their household’s TV and video services. Respondents were randomly drawn from a panel of over three million double-opt-in participants managed by a top-5 sample vendor. Quotas were set to represent the population in focus using data from Aluma, Pew, and US Census data.