A new research report from Antenna is confirming the widely held perception that the streaming business is entering a more mature phase with growth slowing and fickle consumers becoming more likely to cut services.

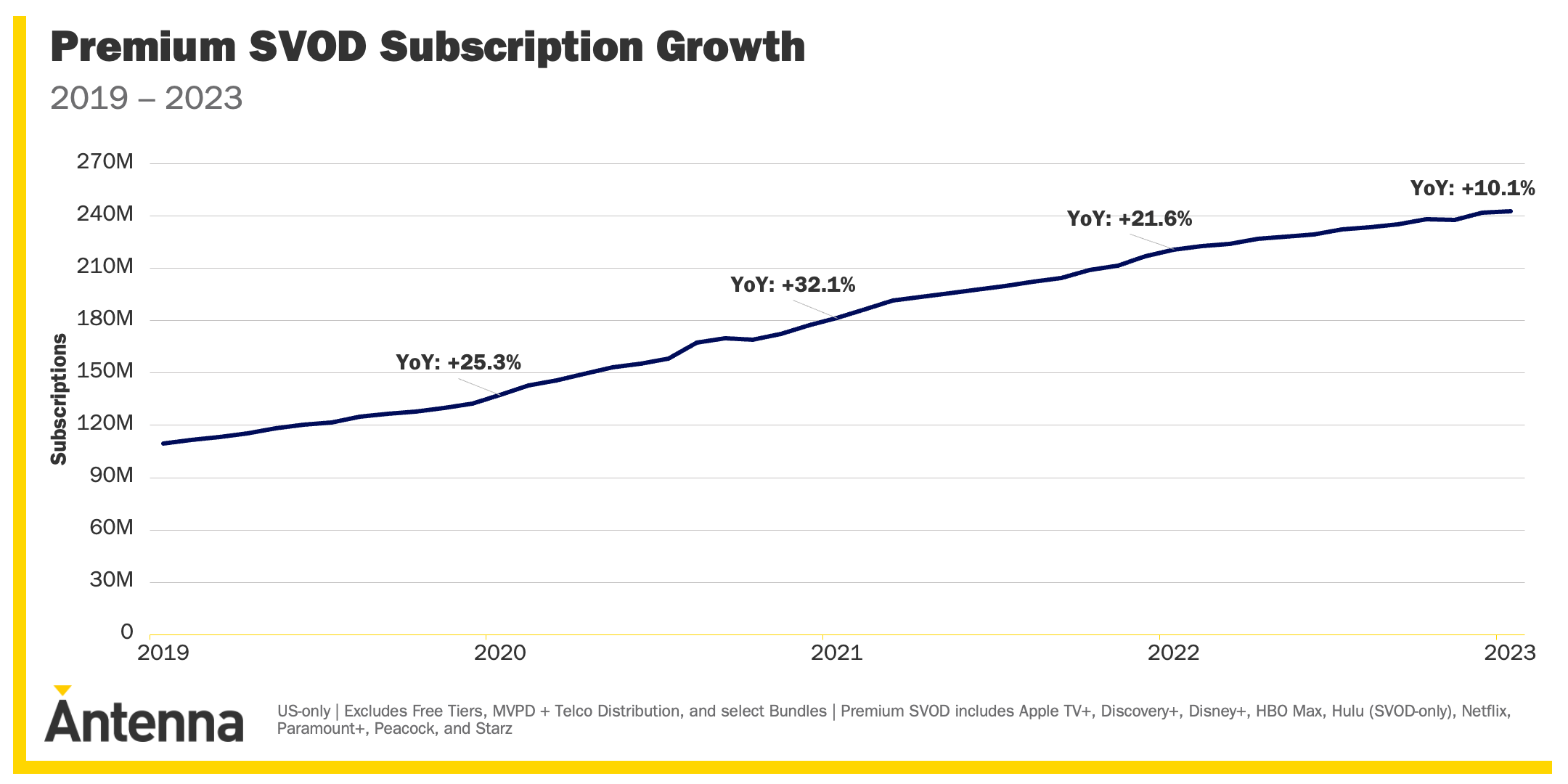

The State of Subscriptions report from Antenna found that the SVOD industry grew by a healthy 10.1% in 2023, a growth rate that some media like broadcast TV would love to see. But that was less than half the growth seen in 2022, when subscriptions rose by 21.6%.

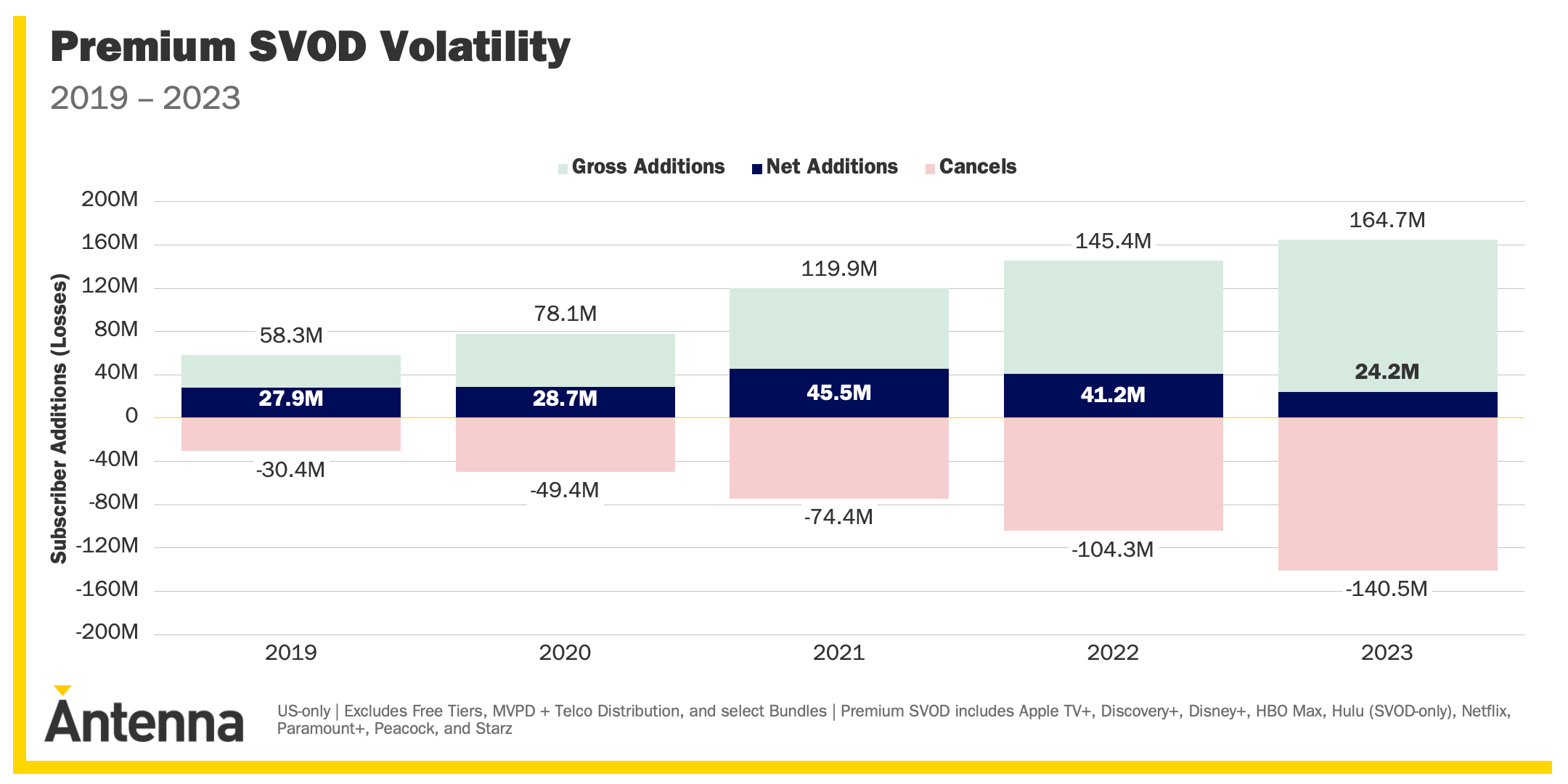

The study also found that streaming companies were working harder for less growth. Antenna’s Weighted Average Churn reached 5.5% at the end of 2023, up 0.8 percentage points from the year prior. In 2023, the industry saw an increase of 19.3 million more gross additions than 2022 but there were 36.2 million more constellations than 2022, which translated into 17.0 million fewer net additions and slower growth.

“Antenna sees the streaming video category entering a new era,” the researchers wrote in the report. “The previous stage was hyper-focused on acquisition – which made sense, as these new brands had to establish a mass audience. But now that the largest players have that scale (and the niche players have introduced themselves to their target audiences), they must shift their focus to managing their Subscribers.”

Total subscriptions were 242.9 million at 2023 with Peacock, Paramount+, and Netflix driving the most sub growth in 2023. Nexflix had 26% of all subscriptions, holding its share for the first time since 2019.

In addition to finding that the churn rate has almost tripled in four years, the data highlighted some important facts about those churners.

Nearly a quarter (23%) fall into a category Antenna calls Serial Churners who have 3+ cancellations of a Premium SVOD Service in the past two years, up from 17% in 2022.

Their data also found that 42% of Serial Churners have canceled a premium SVOD Service 5+ times in the past two years, and 19% have Canceled 7+ times.

The study also found that many people are resubscribing, making win-backs an important strategy, with weighted average resubscribe rate increasing to 30.1% in 2023.

Serial Churners are also an increasingly important target for acquisition strategies, the study found. Serial Churners accounted for all of the growth in acquisition in 2023, driving 60.0 million gross additions in 2023, up +36.2% YoY. In contrast, gross additions by Non-Serial Churners fell -2.0% YoY to 99.5 million, the report found.

The full report can be found here.