Stocks ended higher Tuesday, with the S&P 500 hitting a fresh record as investors looked ahead to a holiday-shortened week focused on the impact of new tariff polices and the health of the domestic economy.

The S&P 500 rose 0.24% to a record close of 6,129.58, after touching an intraday record of 6,129.63, while the Dow Jones Industrial Average gained 10 points, or 0.02%, to end the session at 44,556.34 and the tech-heavy Nasdaq closed up 0.07% at 20,041.26.

Updated at 12:57 PM EST

Eye on CPI

San Francisco Fed President Mary Daly echoed the central bank's message of 'patience' on rate cuts at an industry event in Phoenix Tuesday, adding that policy makers need to be "careful ... before we make the next adjustment".

"Policy needs to remain restrictive until I see that we are really continuing to make progress on inflation, " Daly said. "We have to take our time; "Ultimately we need more information to find out what we're really going to do".

The CME Group's FedWatch tool suggests traders aren't expecting any change in the Fed's key lending rate until at least June, when the odds of a quarter point reduction are essentially a coin flip for what could be the only cut of the year.

Last week, the Commerce Department's January CPI inflation report showed the biggest monthly increase in price pressures in more than 18 months, with a headline reading of 3.1% and a core inflation rate of 3.3%.

Federal Reserve Bank of San Francisco President Mary Daly said policy needs to remain restrictive until there’s more progress on inflation https://t.co/iYAzgp9VRb pic.twitter.com/7wkyBzbOOY

— Bloomberg TV (@BloombergTV) February 18, 2025

Updated at 10:35 AM EST

Intel in a spin?

Intel (INTC) shares extended their longest winning streak since the 1980s, and have added more than $200 billion in value over the past two weeks, amid a series of reports that suggest it could team up with chip manufacturing giant Taiwan Semiconductor in the spin-off of its foundry business.

The Wall Street Journal also reported that custom chipmaker Broadcom (AVGO) could also be looking to make a play for Intel's design business once the spinoff, which reportedly has the support of the new Trump administration, is completed.

Intel shares were last marked 6.74% higher in early Tuesday trading to change hands at $25.19 each, a move that would peg the stock's two-week gain at around 32%.

Related: Analyst reworks Intel stock price target amid new spinoff reports

Updated at 9:35 AM EST

Record open

The S&P 500 was marked 8 points, or 0.14% higher in the opening minutes of trading, and hit a fresh all-time peak, while the Nasdaq rising 51 points, or 0.26%.

The Dow slipped 20 points and the mid-cap Russell 2000 gained 3 points, or 0.1% to kick-off the holiday-shortened week.

"Last week the S&P 500 just missed topping its late-January record highs, despite some seemingly negative news about inflation and consumer spending," said Chris Larkin, managing director for trading and investing at E*Trade from Morgan Stanley.

"But overall, the market is still trying to break out of the consolidation it’s been in since early December," he added. "This week kicks off the retail portion of earnings season, but news out of Washington, especially on the tariff front, could continue to be a wild card for the markets."

S&P 500 Opening Bell Heatmap (Feb. 18, 2025)$SPY +0.21% 🟩$QQQ +0.30% 🟩$DJI -0.08% 🟥$IWM +0.16% 🟩 pic.twitter.com/BNNMENla9d

— Wall St Engine (@wallstengine) February 18, 2025

Updated at 7:40 AM EST

Cautiously bullish

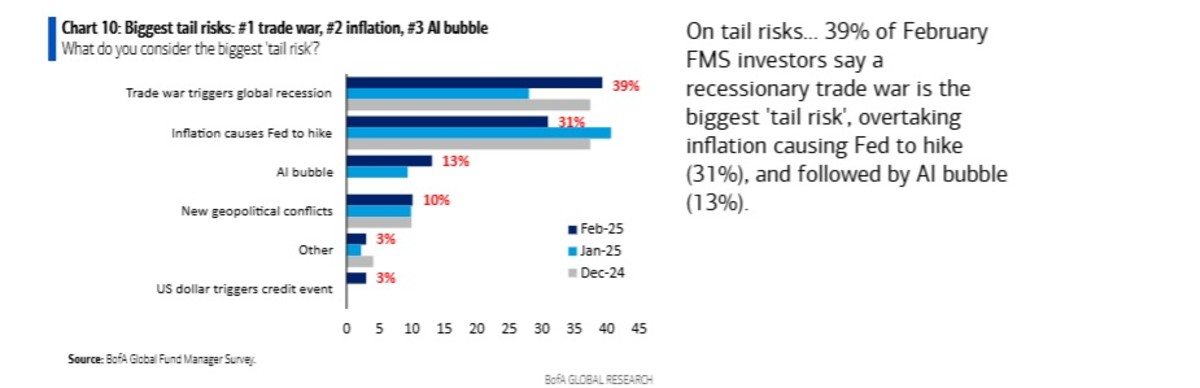

Bank of America's closely-tracked fund managers' survey, which polled investors controlling around $482 billion in assets, showed the lowest levels of cash positions since 2010, suggesting a broadly bullish outlook heading into 2025.

Still, investors are trimming over-valued U.S. stocks in favor of EU-listed companies and bond-linked defensive sectors such as healthcare and utilities, the February survey noted.

"89% of FMS investors view US equities as overvalued, the most since at least April 2001," the survey reported. "Note that decade-to-date, an average 81% of FMS investors have consistently viewed US equities as overvalued."

Stock Market Today

Stocks ended modestly lower last Friday but still managed to book a solid weekly gain of around for the S&P 500 as investors navigated a blizzard of announcements from the White House on tariffs, government spending, technology ambitions and foreign policy directives.

A weaker-than-expected reading for January retail sales, however, paired with a faster-than-forecast inflation report has some investors worried about the impact that new tariffs from the Trump administration will have on domestic growth, and ultimately corporate profits, as the new administration enters its first month in office.

Corporate profits, however, have held up well so far, and with around 383 companies in the S&P 500 reporting for the December quarter so far, collective earnings are forecast to rise 15.3% from a year earlier to $546.3 billion.

Around 43 companies will update investors this week, with investors likely focused on Walmart's (WMT) fourth quarter update after the close of trading on Thursday.

The retail giant, a bellwether for consumer spending health, is also at the forefront of the tariff discussion, given its reliance on imported goods from a host of U.S. trading partners.

Wall Street's early focus Tuesday, however, is likely to center on talks between U.S. and Russian envoys, held in Saudi Arabia and aimed and devising a plan to end Moscow's three-year war on Ukraine.

Related: Stocks are shaking off huge risks for one crucial reason

The talks, however, do not include representatives from Kyiv and President Volodymyr Zelenskyy has said he will not agree to any terms negotiated in his absence.

Heading into the start of the trading day on Wall Street, stocks are set for a modestly firmer open, with futures contracts tied to the S&P 500, which is up 1.23% for the month, priced for a 19 point opening bell gain.

Futures linked to the Dow Jones Industrial Average, meanwhile, are called 39 points higher with the tech-focused Nasdaq called 92 points higher.

In the bond market, a rise in European government bond yields, tied to comments from European Commission President Ursula Von der Leyen that defense spending could be exempt from EU budget rules, triggered an overnight rally in U.S. Treasuries.

Related: Retail sales tumble in January, testing Fed rate cut forecast

Benchmark 10-year note yields were last marked around 10 basis points lower from Friday levels at 4.505% while 2-year notes were pegged at 4.274%.

In overseas markets, Europe's Stoxx 600 hit a fresh all-time high in early Frankfurt trading, and was last marked 0.08% into the green, as tech and defense stocks powered the regional benchmark.

Britain's FTSE 100, meanwhile, was marked 0.16% higher in mid-day London dealing.

More Wall Street Analysis:

- Goldman Sachs analysts warn on Trump tariff impact for stocks

- Analyst predicts stocks likely to join the S&P 500 in 2025

- Every major Wall Street analyst's S&P 500 forecast for 2025

Overnight in Asia, Japan's Nikkei 225 ended 0.03% higher in Tokyo, while solid gains for China tech stocks, tied to a Monday meeting with President Xi Jinping and a host of big tech bosses, helped the regional MSCI ex-Japan index to a 0.47% gain.

Related: Veteran fund manager issues dire S&P 500 warning for 2025