Silver (SIK24) has been on a roll lately, and analysts at ANZ reckon that prices for the industrial metal could keep rising to $31/oz or higher by the end of 2024. The bullish projections stem from a mix of factors – slower production growth at mines, coupled with robust industrial demand, pointing towards a supply crunch. The market's already pretty tight, and now, geopolitical tensions between Iran and Israel are only adding to silver's appeal as a safe-haven asset.

But that's not all – the technical indicators for silver are looking pretty solid too. Silver has broken out of a multi-year consolidation pattern, suggesting further price increases on the horizon.

The demand side is also looking promising, with expectations of higher industrial usage - especially from the electronics and solar sectors, as the industrial cycle picks up steam. And let's not forget the broader financial backdrop; the market's anticipating fewer rate cuts from the Fed in 2024, even as inflation remains stubbornly high. That's helping to stoke demand for precious metals and other alternative assets.

Amidst this silver breakout, two exchange-traded funds (ETFs) that offer exposure to the metal are worth a closer look.

The iShares Silver Trust (SLV) tracks the price of silver bullion directly, giving investors fairly straightforward exposure to the metal's price movements. The Amplify Junior Silver Miners ETF (SILJ), on the other hand, is an equity-based ETF that invests in a basket of junior silver miners, offering an indirect way to play the silver game - with all of the increased risks and benefits that entails.

As silver continues its upward trajectory, here's what investors should know about these two top silver ETFs.

iShares Silver Trust (SLV): Direct Exposure to Silver's Luster

The iShares Silver Trust (SLV) is a heavyweight in the silver investment arena, offering a direct and tangible way to gain exposure to the precious metal.

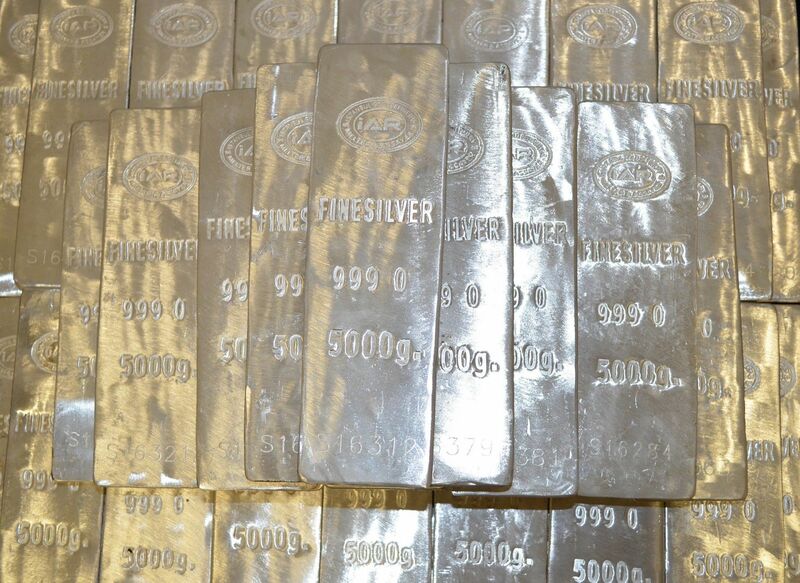

Similar to its close cousin, the massive SPDR Gold Shares (GLD), SLV is specifically designed to track the price of physical silver bullion. Instead of holding stocks or bonds, SLV holds actual silver bars in vaults. This structure allows investors to directly participate in the price movements of silver without the hassle of storing and securing the physical metal themselves.

With assets under management (AUM) amounting to a whopping $12.15 billion, SLV is the largest and most liquid silver ETF out there. This substantial AUM not only underscores the trust's popularity among investors, but also hints at its liquidity; with an average of about 40 million shares traded, it's relatively simple for investors to enter and exit positions with ease.

Like its underlying metal, SLV has been a standout performer this year. The ETF is up more than 19% on a YTD basis.

While SLV's portfolio composition is straightforward, with 100% of its assets invested in silver bullion bars, the fund's expense ratio of 0.50% is relatively high compared to some other silver ETFs. However, the fund's liquidity and direct exposure to the underlying asset may justify this cost for investors seeking a hassle-free way to ride the silver wave.

Amplify Junior Silver Miners ETF (SILJ): Leveraging Junior Miners' Potential

The Amplify Junior Silver Miners ETF (SILJ) is one step removed from silver prices, but offers investors a front-row seat to the growth prospects of small-cap and junior silver mining companies.

The ETF tracks the Nasdaq Metals Focus Silver Miners Index, a benchmark that includes a mix of equity securities from the silver mining and exploration sector. At least 80% of SILJ's assets are invested in the index's components, including ADRs and GDRs that represent these securities.

SILJ's approach is tailored for those who seek exposure to the silver mining industry's highest-growth segment – the small-cap firms that are deeply involved in the exploration, development, and production of silver. The fund's AUM amount to a solid $822 million, with average volume right around 3 million shares.

With a year-to-date gain of 10.5%, SILJ is comfortably outpacing the S&P 500 Index ($SPX), though it's not quite keeping pace with SLV's performance.

Now, the fund's expense ratio of 0.69% might raise an eyebrow for fee-conscious investors, but it's a reflection of the more actively managed nature of the SILJ portfolio.

Peering into SILJ's holdings, we find a roster of companies that are at the forefront of silver mining. Pan American Silver (PAAS) leads the pack with a 12.84% slice of the fund, followed closely by First Majestic Silver (AG) at 10.82%. Capstone Copper (CSCCF), Harmony Gold Mining (HMY), and MAG Silver (MAG) round out the top five, at 6.87%, 5.98%, and 5.41% of the fund, respectively. These companies, along with the rest of the top 10, make up 57.46% of SILJ's portfolio.

Which Silver ETF Is Right for Your Investment Portfolio?

In the end, the two ETFs offer two distinct approaches to investing in silver. On one hand, you've got SLV - the straightforward bullion play that offers a liquid and direct way to ride the silver wave. No frills; just pure exposure to the physical metal.

On the flip side, SILJ brings a unique twist by giving you a seat at the junior silver miners' table. This specialized ETF lets you potentially cash in on the growth prospects of these up-and-coming players in the sector. But while this strategy can offer potentially greater upside if these companies outperform the market's expectations, there's also greater risk involved as these small players navigate their upstart mining operations.

So, it's a matter of weighing your priorities – do you want the simplicity of direct bullion exposure with SLV, or are you willing to take on a bit more risk and cost for the potential upside of the junior mining space with SILJ? The choice ultimately comes down to aligning with your investment goals and risk appetite. Either way, both ETFs offer intriguing options for those looking to add some silver lining to their portfolios.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.