Sabre Corporation (SABR) in Southlake, Tex., is a leading software and technology firm that serves the worldwide travel industry, including airlines, hotels, travel agents, and other suppliers.

The company provides commerce, distribution, and fulfillment solutions to its customers to operate more effectively, boost revenue, and give individualized traveler experiences.

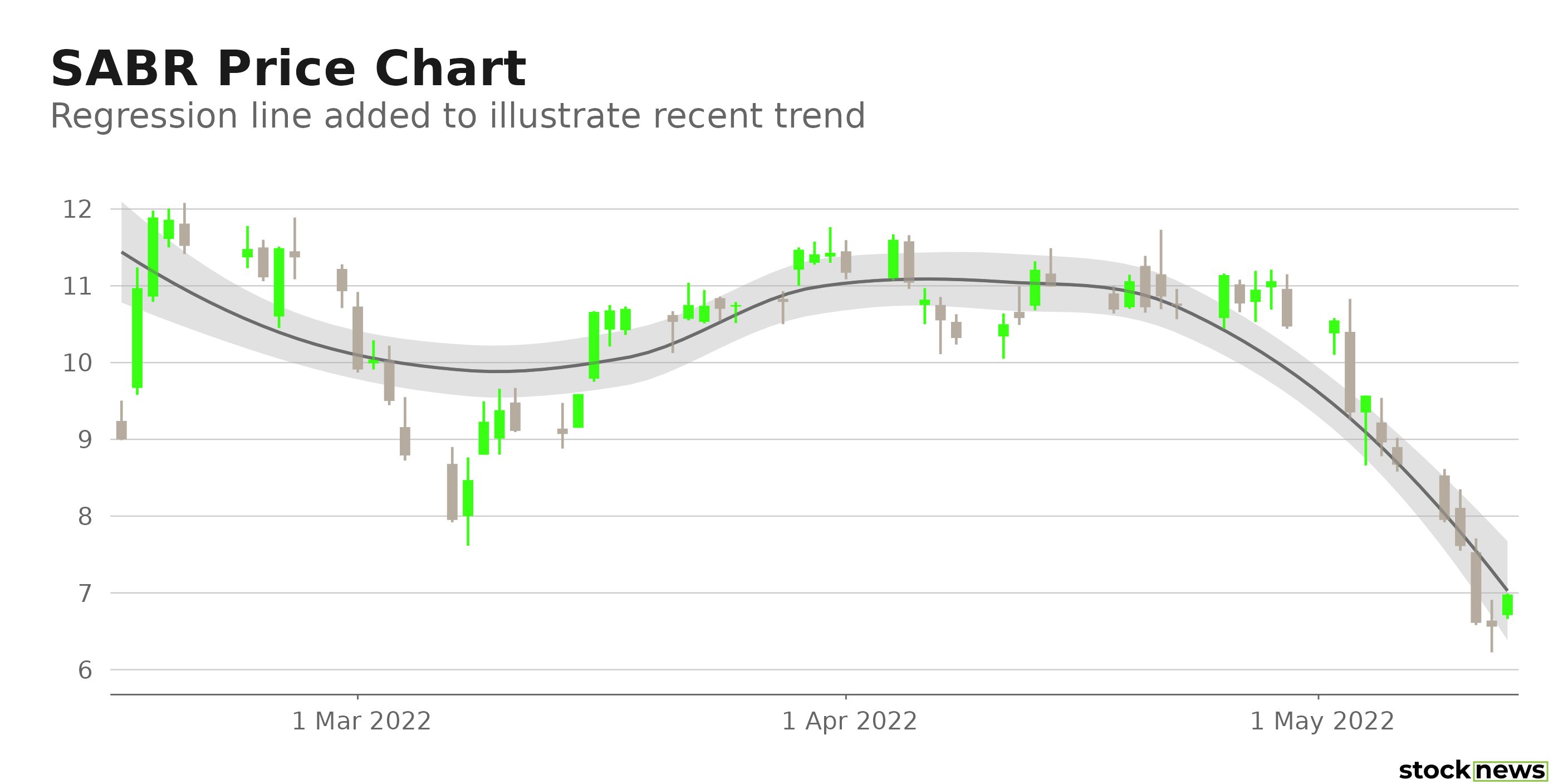

Despite increased demand for leisure travel earlier this year, SABR has failed to regain traction. The stock is down 46.5% in price over the past year and 38% over the past month to close yesterday's trading session at $6.56. In addition, the shares are currently trading 56.6% below their 52-week high of $15.10, which it hit on June 02, 2021.

Here is what could shape SABR's performance in the near term:

Strategic Acquisition

This month, SABR announced the acquisition of Nuvola, a global supplier of hotel service improvement and guest engagement software. Nuvola technology and guest enablement tools are included in the acquisition, as is the integration of Nuvola staff into Sabre. Sabre plans to expand its hotel retailing and merchandising strategy while also increasing its property and operational capabilities by leveraging Nuvola technologies.

Sale of AirCentre Airline Operations Portfolio

In March, SABR completed the sale of its AirCentre airline operations portfolio to CAE, a technology leader in digital flight and crew operations. The $392.5 million transactions comprise the Sabre AirCentre product portfolio, supporting technology, intellectual property, and the transfer of highly qualified AirCentre team members from Sabre to CAE.

Improving Financials

SABR's total revenue increased significantly year-over-year to $584.9 million for the three months ended March 31, 2022. Revenues in its Travel Solutions sector climbed to $534 million from $288.9 million in the previous quarter. Its IT Solution revenues were $191.1 million, up 39.4% from the year-ago value. And its adjusted EBITDA came in at $5.2 million, compared to an adjusted EBITDA of negative $110 million in the prior-year quarter. The company reported $42.06 million in net income versus a $266.10 million net loss in the first quarter of 2021.

Poor Profitability

SABR's 0.35% trailing-12-months asset turnover ratio is 44.7% lower than the 0.63% industry average. Its trailing-12-months cash from operations stood at a negative $356.33 million compared to the $82.7 million industry average. Also, its trailing-12-months ROA, net income margin, and ROC are negative 11.7%,31.9%, and 7.1%, respectively.

POWR Ratings Reflect Uncertainty

SABR has an overall C rating, which equates to a Neutral in our proprietary POWR Ratings system. The POWR ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

Our proprietary rating system also evaluates each stock based on eight distinct categories. SABR has an F grade for Stability and a C for Quality. The stock’s 1.91 beta is in sync with the Stability grade. The company's poor profitability and improving financials are consistent with the Quality grade.

Among the 81 stocks in the C-rated Technology – Services industry, SABR is ranked #46.

Beyond what I have stated above, you can view SABR ratings for Growth, Momentum, Value, and Sentiment here.

Bottom Line

SABR has been benefiting from growing travel demand since late last year, allowing it to report large year-over-year revenue increases in the first quarter. However, the stock is currently trading below its 50-day and 200-day moving averages of $10.10 and $10.08, respectively, indicating a downtrend. Moreover, considering its low-profit margins, we believe investors should wait before scooping its shares.

How Does Sabre Corporation (SABR) Stack Up Against its Peers?

While SABR has an overall C rating, one might want to consider its industry peers, PC Connection Inc. (CNXN), Fujitsu Limited (FJTSY), and Information Services Group Inc. (III) which have an overall A (Strong Buy) rating.

SABR shares were trading at $6.93 per share on Friday morning, up $0.37 (+5.64%). Year-to-date, SABR has declined -19.32%, versus a -16.02% rise in the benchmark S&P 500 index during the same period.

About the Author: Pragya Pandey

Pragya is an equity research analyst and financial journalist with a passion for investing. In college she majored in finance and is currently pursuing the CFA program and is a Level II candidate.

Should You Buy Sabre Corp. on the Dip? StockNews.com