Shares of RTX Corp (RTX), formerly known as Raytheon Technologies, have declined by more than 11% since the aerospace and defense company reported its Q2 results earlier this week. The steep drop in RTX stock may seem perplexing on the surface, since the company reported revenue and earnings that surpassed analysts' expectations. Moreover, the company raised its revenue and EPS guidance for the full year, too.

So, what happened to RTX after its Q2 results? Why did the defense stock get hit with the heaviest single-day selling since its COVID-era collapse in March 2020? And, most importantly: Is the drop an overreaction and an opportunity for investors to add RTX to their portfolios?

Cash Flow Forecast Spooks RTX Investors

The primary reason behind RTX's post-earnings slide was an unexpected cut to free cash flow guidance for 2023. The company now expects to generate free cash flow of roughly $4.3 billion for the year, down from its earlier guidance of about $4.8 billion. The company cited a defect in engines produced by its subsidiary Pratt & Whitney as the reason behind the slashed forecast, with an estimated impact of $500 million to free cash flow.

Delving into more details, the company said that a “rare contamination” in the powdered metal used to manufacture certain engine parts might actually reduce the life of those parts - prompting the need for an accelerated and widespread fleet inspection. Notably, about 1,200 engines built for the Airbus A320neo between 2015 and 2021 have to be recalled for inspection, according to the company.

Even before the guidance cut, free cash flow was starting to slow at RTX. In the second quarter, operating cash flow from continuing operations fell 44% year-over-year to $719 million, and free cash flow decreased by 76% from the previous year to $193 million.

Solid Results in Q2

Setting aside RTX's cash flow issues for the moment, the company reported otherwise robust numbers for the second quarter of 2023. Poring over the results, RTX displayed growth on a year-over-year basis across nearly all other key metrics and verticals.

Net sales increased by 12.3% yearly to $18.3 billion in the second quarter, while net income rose by 10% from the previous year to $1.9 billion. Adjusted EPS also jumped 11% to $1.29. The results surpassed analysts’ estimates, which called for net sales of $17.54 billion on adjusted EPS of $1.17.

Further, operating profit also rose by 7.8% yearly to $1.46 billion.

RTX's order book also looks strong, as the company bagged orders worth roughly $7.2 billion in the second quarter. Additionally, it reported an order backlog of $185 billion at the end of the April-June period.

Looking ahead, the company raised its revenue forecast for the year to $73 - $74 billion (from $72 - $73 billion) and upped the low end of its EPS guidance to $4.95 - $5.05 (from $4.90 - $5.05).

RTX vs. Top Defense Stocks

With a market cap of roughly $126 billion, RTX is one of the biggest aerospace and defense companies in the world - considerably larger than its peers Lockheed Martin (LMT) ($114.4 billion) and Northrop Grumman (NOC) ($69.4 billion), and only slightly smaller than industry giant Boeing (BA) ($140.0 billion).

When it comes to valuation on the basis of some key ratios, RTX appears to be fairly priced when compared to those peers.

RTX's forward price/earnings ratio is at 19.25 currently - significantly lower than Boeing's forward p/e of 261.84, despite the comparable market caps. Meanwhile, RTX also appears to be undervalued when a comparison is made on the price/book ratio. RTX is currently trading at a p/b ratio of 1.91, which is lower than LMT's PB ratio of 12.45 and NOC's 4.54.

Finally, RTX trumps its peers on the dividend front. With a forward dividend yield of 2.71%, RTX tops both Lockheed Martin (2.64%) and Northrop Grumman (1.64%) in terms of yield.

Analysts Still Optimistic on RTX

The newly revealed engine defects and resulting cut to RTX's free cash flow guidance shocked analysts as well as investors.

“Given that RTX hosted an investor event at the Paris Air Show only last month, we had expected this to be a surprise free set of results,” wrote analyst Robert Stallard from Vertical Research Partners in a note to clients.

Bank of America's Ronald Epstein pressed that same issue further on RTX's earnings conference call, asking Chief Operating Officer Chris Calio, "How could you guys possibly not know about this at Paris when you did this major investor event?”

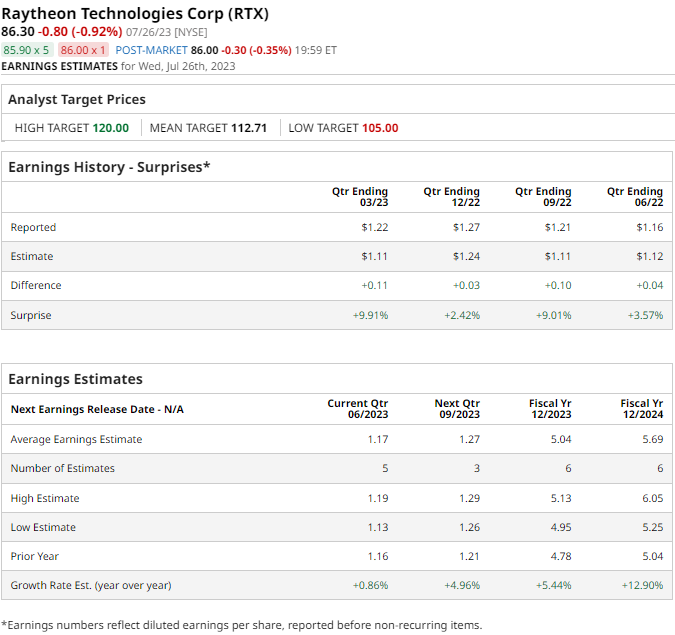

Despite the unwelcome surprise, most analysts remain optimistic on the defense stock. The overall rating is “Moderate Buy” with a mean price target of $112.71, indicating upside potential of about 31% from current levels. Out of 13 analysts covering the stock, 8 have a “Strong Buy,” 1 has a “Moderate Buy” and 4 have a “Hold” rating on the stock.

Looking ahead, analysts are expecting earnings growth of roughly 5% and 5.5% in the Jul-Sep 2023 period and full-year 2023, respectively.

Final Takeaway

Although the company's reduced guidance for free cash flow this year remains a concern, I believe the issue is merely transitory in nature.

RTX's operational strength - reflected by its solid results in the second quarter and growth across all its key verticals - gives it a strong footing in the aerospace and defense sector. Moreover, the company's strong order book and recent wins on this front, coupled with a significant order backlog, offer RTX investors strong revenue visibility for the future.

The company's valuation also appears relatively attractive compared to sector rivals, and a solid dividend yield makes it a compelling choice for those seeking value. With this in mind, the recent sell-off in RTX could represent an opportunity for long-term investors to pick up shares at cheaper prices.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.