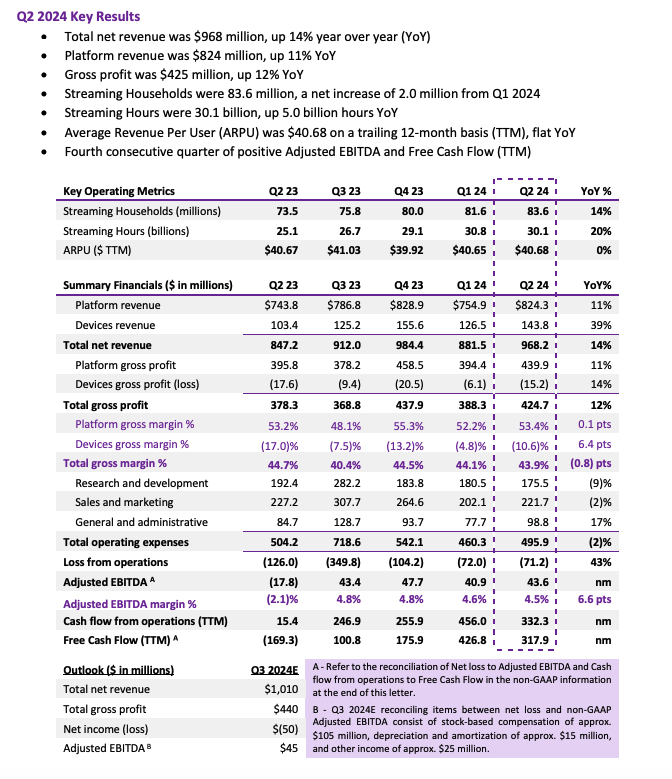

Roku continued to exceed the expectations of doubting analysts, growing its user ranks in the second quarter, growing its quarterly revenue by 14% to $968.2 million and increasing the number of active user households by 2 million to 83.6 million.

Equity analysts had predicted that the streaming company would generate revenue of only $937.9 million in the April to June period.

Engagement time on the Roku platform was up 20% year over year to 30.1 billion hours, while average revenue per user was virtually flat at $40.68.

Q2 marked Roku's fourth consecutive quarter of positive adjusted EBITDA and free cash flow.

Roku's stock was up over 5% in after-hours trading as this sentence was being typed.

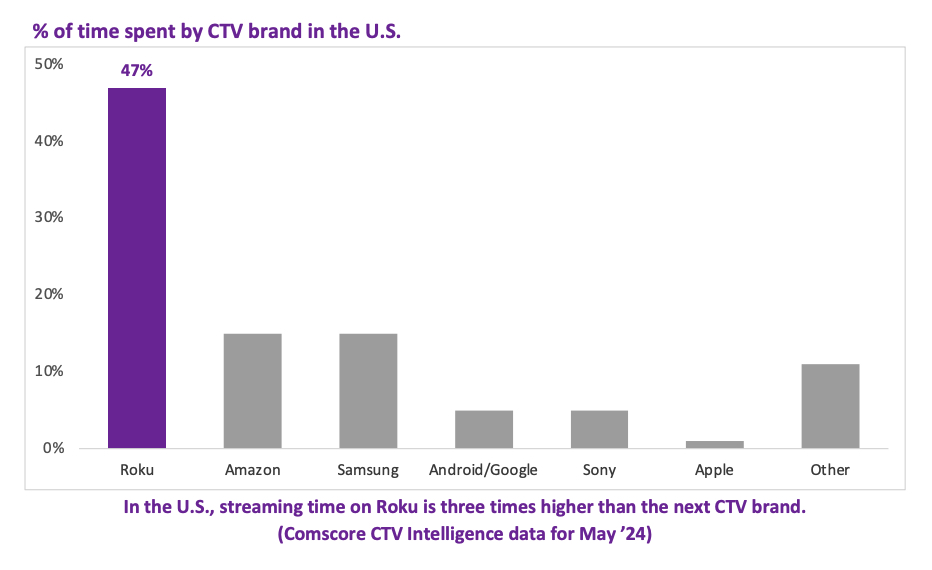

Here's a money shot from Roku's Q2 2024 shareholder letter:

With the Roku platform an afterthought in important markets like Europe, equity analysts for some time have written off the company as doomed to be overridden by larger tech companies in the TVOS market, including Amazon, Google and Samsung.

But at least domestically, Roku’s hegemony is still expanding.

“For Q3, we estimate total net revenue of $1.010 billion growing 11% YoY, with Platform revenue growing 9% YoY and devices revenue growing 24% YoY. We expect Q3 total gross profit of $440 million and Adjusted EBITDA of $45 million, reflecting our ongoing operational discipline,” Roku CEO Anthony Wood and chief financial officer Dan Jedda said in the latest shareholder letter.