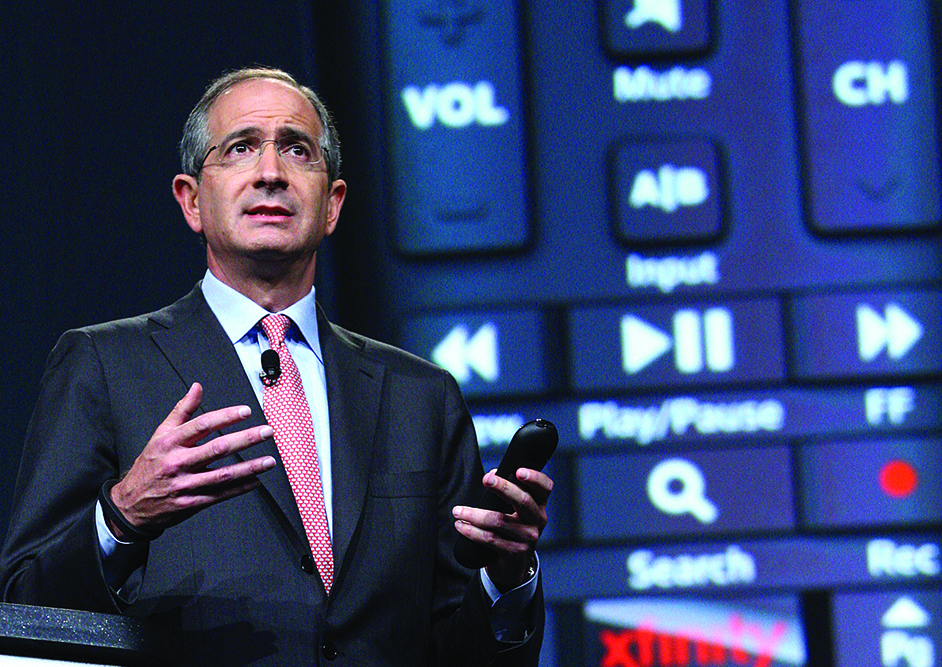

Despite a series of breathless, counterintuitive reports over the past year, Comcast CEO Brian Roberts on Tuesday confirmed that his company will "more likely than not" execute a contractual clause that lets it sell its one-third stake in Hulu to controlling shareholder Disney.

Speaking at the MoffettNathanson Technology, Media and Telecom conference in New York, Roberts said, “I think we have a very valuable position ... What would a willing buyer in a robust auction [for Hulu] pay?”

In 2024, Comcast has a "put call" option to sell its 33% stake in Hulu to Disney, with the streaming platform floor-valued at a minimum of $27.5 billion. That would mean that Disney would have to come up with at least $9.2 billion in cash.

Of course, Comcast has argued that Hulu is worth more than just $27.5 billion, and the two sides have been haggling and positioning for several years.

"I’m pretty certain that when we sell our Hulu stake, it’ll be for more than what we have in it. In fact, that’s contractually certain,” Roberts added.

Last week, Roberts' Disney counterpart, Bob Iger, suggested that recent talks have been more productive. Iger revealed during Disney's Q1 earnings call that the conglomerate intends to combine Hulu programming with Disney Plus.

“I can’t tell you, and I can’t really say where they end up, only to say that there seems to be real value in having general entertainment combined with Disney Plus. And if, ultimately, Hulu is that solution, that’s we’re -- we’re bullish about that,” Iger said.