On top of rampant inflation, strikes, business gloom and rising interest rates, bad news about our shopping habits was all but inevitable. The volume of goods being sold in the UK is now falling, according to the latest monthly data from the Office for National Statistics (ONS), with food purchases the number one culprit.

Consumer sentiment is at record lows for the second month running, according to the closely watched GfK consumer sentiment survey. People are now more downbeat than in the depths of COVID or even during the global financial crisis.

With the UK economy already apparently in the early stages of a recession, we asked retail specialist Professor Leigh Sparks from the University of Stirling for his perspective.

What’s the big picture?

Times are hard as people start to feel the effects of the soaring costs of consumer goods, energy and petrol – it was £1.97 for a litre in Stirling this morning. If you’ve seen a decline in your benefits, or you’re paying more in national insurance, or your pay is not keeping up with inflation, your income has reduced. This has been a multiple shock for people – in a very short period of time.

In food in particular, patterns are beginning to shift. We’re seeing tighter budgets – for example reports of people putting things back at checkouts when they reach £30 in purchases. There’s some evidence of people switching to cheaper brands and stores. Convenience stores are doing far better than big stores, as consumers search for bargains and value. Also, ONS retail sales figures are often revised downwards.

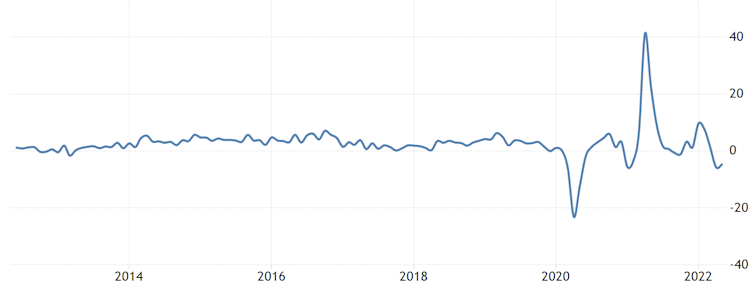

UK retail trading volumes (year on year)

Why are food purchases driving the drop rather than optional items?

Because the cost of living is hitting people very urgently and directly. Food is a much bigger percentage of retail sales than other categories, and the cost is going up rapidly. Anything grain-related is being hit by Ukraine. The farm-related agriculture index is showing ridiculous spikes.

Heatwaves in places like Spain are not helping. Some British facilities, which grow a lot of the country’s greenhouse tomatoes, peppers and so on, didn’t switch on this year because energy prices were rising so fast.

Overall sales volumes in non-food are unchanged in the ONS data, but it varies considerably between categories. Clothing has increased, though that may well be seasonal. It’s being offset by falls in household goods, furniture and departure stores – big purchases are being postponed.

How does this compare to previous crises?

The 40-year high in inflation and the consumer sentiment lows in a survey dating back around 50 years tells you these are very difficult times. It has also come on the back of the pandemic, Brexit and a decade of austerity. People are far less resilient as a result, so it’s affecting them more quickly than it might have done.

The energy price spike is comparable to 1973 and inflation was close to 20% in the early 1980s, but consumer behaviour is currently being affected by fears about what comes next. If the supply of products remains a problem because of the pandemic, war and global warming, what then?

The GfK data shows that consumers are feeling negatively affected already, but the bigger negative for them is the macroeconomic situation in 12 months’ time. They look at the sheer acceleration in the cost of living and worry it will continue.

Is consumer sentiment too negative?

There may be some excessive negativity around the macroeconomic outlook. At the Tiverton and Wakefield by-elections in the UK, lots of voters were reported on their doorsteps as saying that the government is doing nothing about the cost of living. It’s hard to know if that’s being over-emphasised by the media because it fits the present narrative, but people certainly have reason to worry.

The geopolitical situation might make things worse, particularly when winter comes and demand for energy goes up. I would also point to the massive use of food banks: the number of people struggling at the lower end has been steadily increasing, so they are starting from a low base.

Which retailers will be winners and losers?

The cost of heating, lighting and power for retailers is going up. And unlike for households, there’s no energy price cap to help businesses. So now that consumers are also cutting back, all the calculations for retailers about cost vs income are changing.

Budget retailers like Aldi, Lidl, Home Bargains and B&M are going to benefit. Among other big retailers, those that will hold up best will be those that give good discounts such as through loyalty cards or value/own brand products. In categories such as furniture, household and big purchases, there’s an opportunity for retailers offering good prices – Dunelm, for example.

Where it becomes difficult to comment on individual retailers is because you don’t know their stock position. Many might have stock hangovers from COVID, and are therefore carrying high capital costs. They will have difficult decisions to make about offloading it, so there could be some real bargains for consumers.

Do we expect collapses?

There has been a shakeout in recent years of companies that either built too many stores or had high costs or just weren’t that good. So there may be casualties or there may not be.

Most management teams have never had to trade through high inflation. How quickly teams adapt will be the difference between surviving and not surviving. For example, high inflation changes how you have to manage cashflow. It changes the price at which you buy stock, how long you are willing to hold it for and how much you are willing to pay for storage.

Is there an optimist’s case?

There are still people who have money and are looking for interesting things to buy. During the pandemic, we’ve also seen good performances from local independents, and people thinking local, acting local and spending local – those are bright spots.

More generally, if we get on top of energy costs, including petrol, that would be a big shift: it would make consumers more positive and bring down inflation, and therefore some of the narrative would improve.

Steven Vass, Business + Economy Editor, The Conversation

This article is republished from The Conversation under a Creative Commons license. Read the original article.