Last week, U.S. President Donald Trump called on Republican legislators to revoke the CHIPS and Science Act that was passed during the previous Biden administration, as he considers it a waste of taxpayers' money. Republican lawmakers were not exactly enthusiastic about the proposal, as their districts have benefited from investments already made by leading chipmakers. Also, the U.S. government remains legally obliged to distribute already allocated funds ($39 billion), so leading companies that plan to build fabs in the U.S. will get their money.

Supporting this reticence, Bloomberg recalled an earlier prediction of the Semiconductor Industry Association that the U.S. market share on the semiconductor market would have dropped below 10% if it had not been for the CHIPS and Science Act. It suggests that the Trump administration should probably think twice before revoking the law.

$450 billion at stake

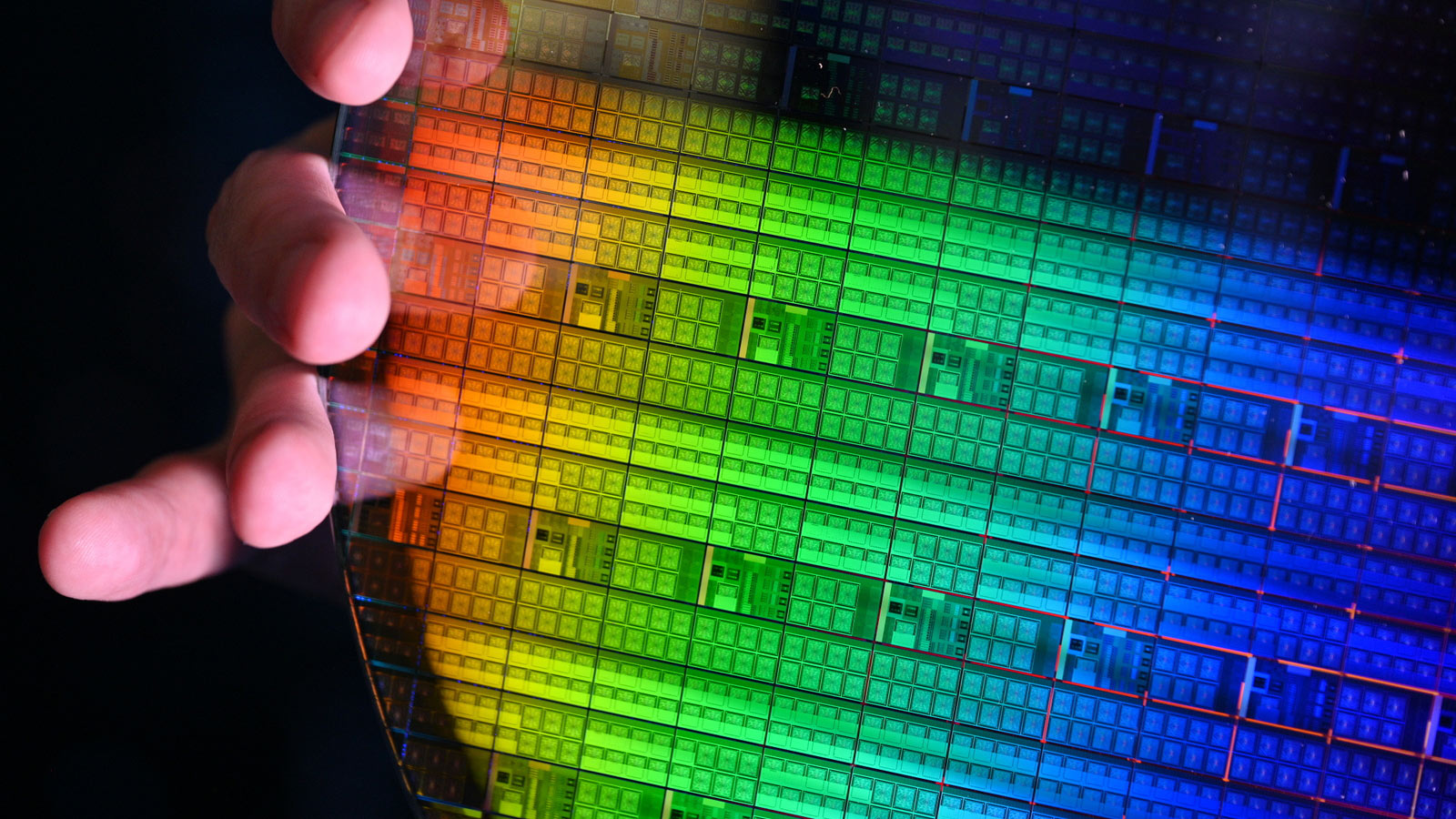

The CHIPS and Science Act, enacted in 2022 under President Biden, is a $52 billion strategy to strengthen U.S. semiconductor manufacturing and reduce reliance specifically on Asian suppliers. The Act provides $39 billion in grants to boost chip manufacturing, $11 billion for research and development, and a 25% tax credit for manufacturing projects. Companies can also access up to $75 billion in loans and guarantees.

The tax credit is projected to cost over $85 billion in government revenue, surpassing original estimates and reflecting significant investment levels. Trump argues that tariffs would better encourage domestic investment while generating federal revenue and plans to introduce new tariffs on semiconductor imports by April 2025. Some believe that TSMC’s commitment to invest an additional $100 billion in its U.S. campus was a way to avoid the imposition of tariffs on chips made in Taiwan.

However, the enactment of the law has already driven nearly $450 billion in private investment by leading semiconductor companies, including Intel, GlobalFoundries, Micron, Samsung, SK hynix, Texas Instruments, and TSMC, just to name a few. To secure their grants and tax credits, these companies signed contracts with the federal government and must comply with a number of regulations. By contrast, TSMC’s commitment seems to be a plan that can change and is not legally binding.

Political Hurdles

Repealing the CHIPS Act faces political hurdles. It passed with bipartisan support, and many Republican-held districts have been chosen for funded factories. A full repeal is unlikely given the narrow Republican majority in the House and the likelihood of Democratic opposition in the Senate.

Despite difficulties in repealing the Act, the Trump administration could attempt to alter certain provisions. Potential changes include removing labor-friendly or environmental requirements. Adjusting benchmarks for fund disbursement or altering contract terms could also be pursued to reshape the program’s impact.

While changes to individual agreements are possible, the Trump administration remains legally obligated to distribute the $39 billion allocated by September 2026. Some contracts allow the government to delay or recover funds under specific conditions, but overall, the administration has limited power to significantly disrupt funding without congressional action.

To overcome these constraints, the administration may consider softer changes, such as removing requirements like childcare facilities at production sites. This approach could offer a political win while avoiding major disruptions. However, companies are wary of contract renegotiations that could delay projects or reduce funding certainty.

Additionally, changes may be difficult to impose and renegotiate in a timely manner. The U.S. Commerce Department, which oversees the CHIPS Act, lost about 40% of its workforce due to federal staffing cuts. However, key teams managing funding negotiations and disbursements were largely preserved to ensure continuity in implementation, according to Bloomberg.