Earlier this year, Raspberry Pi Holdings PLC launched its IPO (Initial Public Offering) to great fanfare and it seems that this has translated into success, according to a City AM report and the interim results published on the London Stock Exchange.

At the IPO launch back in June 2024, Raspberry Pi Holdings PLC raised approximately £179 million ($225 million), and according to the report, revenue "soared 61% to $144 million in the six months to June 30." H1 2024 profit was stronger than expected, jumping to 47% to $34.2 million. When compared to H1 2023, a time when supply was constrained, H1 2024's EBITDA (earnings before interest, taxes, depreciation, and amortisation) was up 55%, approximately $20.9 million. However, the volume of sales was "marginally lower than expected" higher margin variants, such as the Raspberry Pi 5 providing the stronger unit economics.

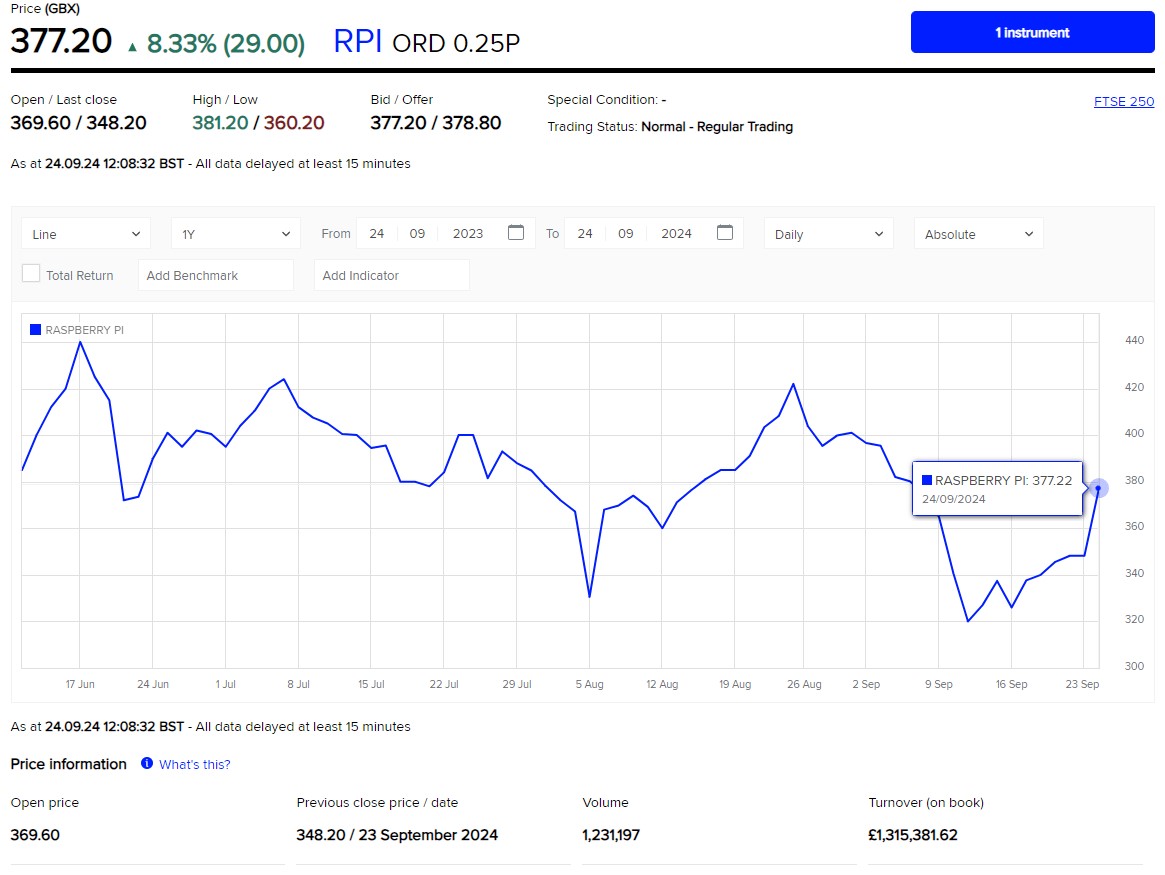

Raspberry Pi was added to the FTSE 250 — Financial Times Stock Exchange of 250 companies between the 101st and 350th mid-cap blue chip companies — on Monday of this week.

As the opening bell sounded on Tuesday, September 24, Raspberry Pi Holdings PLC shares increased by 5%. At the close of trading yesterday, Raspberry Pi was at 348.20p per share, increasing to 375.00p per share at 7am BST today. At the time of writing, this level is holding, but we have seen a current daily high of 381.20p

Source: London Stock Exchange Interim Results

Raspberry Pi CEO and co-founder Eben Upton had this to say regarding the interim results.

"The IPO was the watershed moment of the first half, with Admission to trading just two weeks before the period end. In continued pleasing trading in the first half, we saw strong uptake of our latest flagship SBC, Raspberry Pi 5, the launch of the Raspberry Pi AI Kit, and the successful ramp to production of [Raspberry Pi Pico 2] RP2350, our second-generation microcontroller platform. The higher than usual customer and channel inventory levels which were evident at the time of the IPO have continued to unwind, and there is a growing sense that this will have concluded by the year end. We have an extraordinary team, a world class product set backed up by an exciting future roadmap, and a loyal and engaged customer base that we can continue to grow. In the second half, we have further planned product releases and a number of initiatives to further expand our engagement within our Industrial and Embedded market".

Full details of the above will be announced at 2:30 pm BST via the London Stock Exchange.