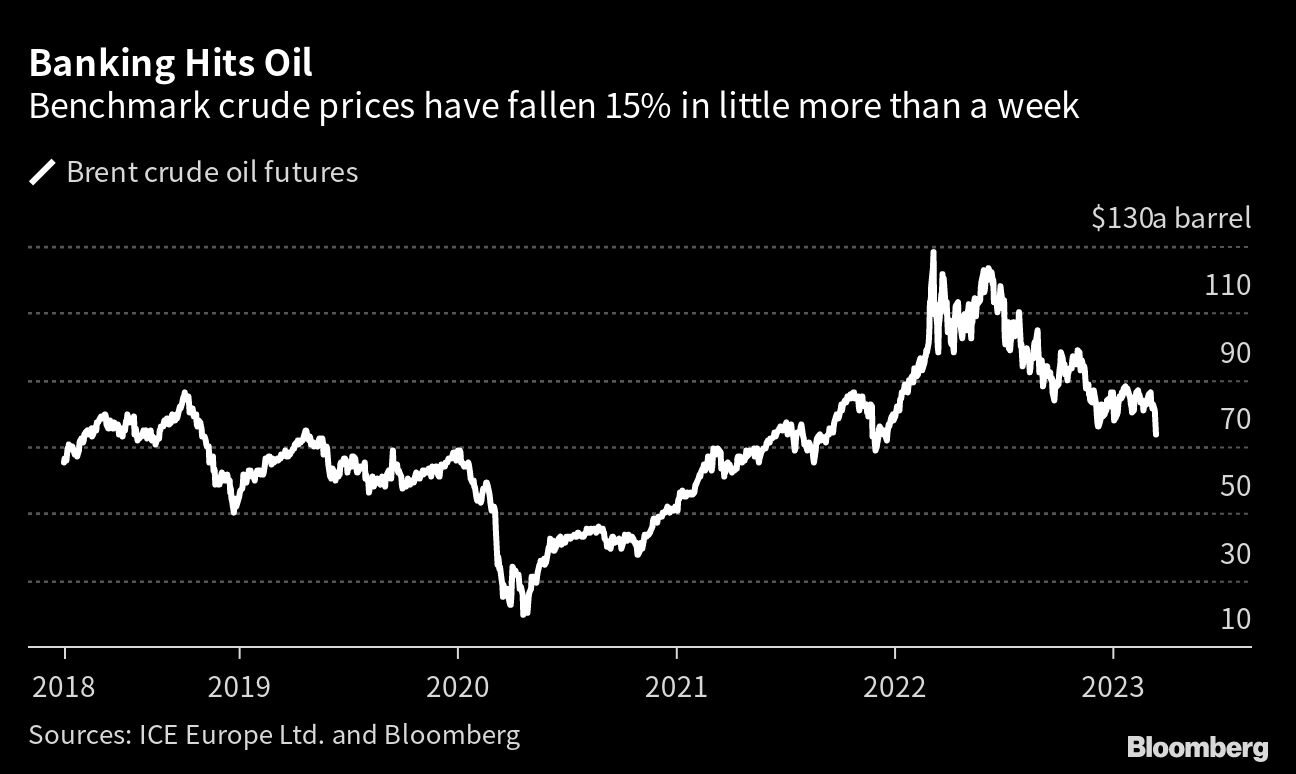

Oil has been perhaps the biggest collateral victim as the banking drama spread from California to Switzerland in recent days. In little more than a week, Brent crude has fallen by $10 a barrel, or about 15%. The speed and magnitude of the selloff has some investors asking: Where’s OPEC+? The oil cartel is, for now at least, in wait-and-see mode, and unlikely to act until the Federal Reserve concludes its next monetary policy meeting on March 22.

In the last few hours, the message I have heard from oil capitals is “no panic.” Perhaps the group is simply putting on a brave face, buying time before it needs to act. Perhaps. While Brent and West Texas Intermediate prices have fallen abruptly, OPEC+ delegates are still encouraged by what they describe as robust Asian demand. China is on the mend, and India is buying a lot.

OPEC+ delegates largely blame the selloff on speculative money leaving the derivatives oil market, rather than any sign of weakness in the physical market. They note, for example, that official selling prices from Saudi Arabia and other Middle Eastern countries have been stronger month-on-month since January. Nothing I have heard sounds as if production cuts are around the corner.

Any post mortem of the recent crash points to a self-fulfilling wave of selling focused on futures and options, rather than the physical market. First, large investors lifted their inflation hedges as the US Treasury market crashed. The wave of selling stopped out some bullish commodity hedge funds, which in turn made them forced sellers, forcing oil benchmarks even lower. That’s when things got really ugly — because the options market came into play.

This week, WTI fell into the $65-$70 a barrel range where US shale producers and the government of Mexico have sold forward a lot of their production for 2023. Wall Street banks were forced to sell oil futures to protect themselves against losses arising from the put options they’d sold to the shale companies and Mexico, producing a downward spiral. The feedback loop is known as a negative gamma shock, for one of the Greek letters used by traders to price options.

While carnage spread throughout the derivatives market, OPEC+ officials were taking comfort elsewhere: US refining margins, for example, have remained very strong during the sell-off — evidence that underlying demand remains healthy. And the shape of the Brent futures curve stayed stronger than in December when oil prices last fell sharply. Perhaps, just perhaps, the decline is overdone.

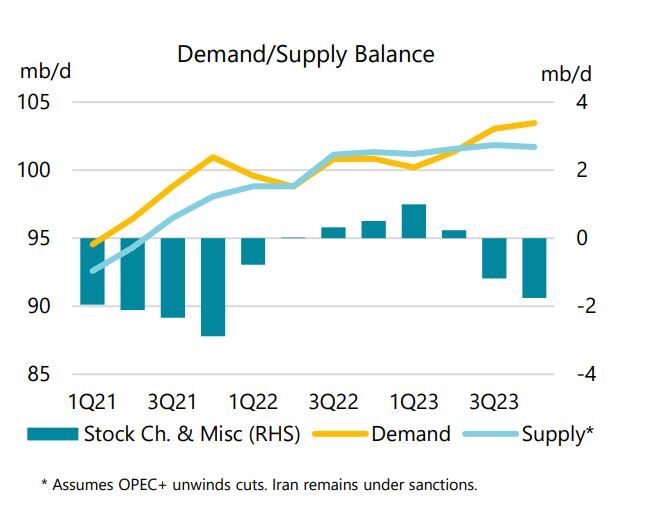

OPEC+ officials believe that the derivatives market will remain turbulent for some time. But ultimately, the strength of the supply-and-demand imbalance expected in the second half of the year should reassert itself, leading to higher prices, or so the argument goes. For oil bulls, the next 10 to 15 weeks will prove difficult, even if the cartel is right on its view about production and appetite.

More concerning for OPEC+ is the fact that the second-half deficit may be a lot shallower than is currently expected. Right now, the International Energy Agency is forecasting that oil demand will outstrip supply by more than 1 million barrels a day between July and September, and by more than 1.5 million barrels from October to December. So far, so good for the oil cartel.

But that rosy forecast is based on a big drop in Russian production that so far has failed to materialize. Moscow pumped 11.4 million barrels a day in January, the most since it invaded Ukraine more than a year ago. So far in March, there’s very little sign of a significant slowdown, despite the Kremlin announcing a cut of 500,000 barrels a day for this month. Having consistently underestimated the strength of Russian production for more than a year, the IEA is again betting on an huge output drop as the year goes. By the third quarter, it expects Russian output to drop to just 10.1 million barrels — a courageous forecast.

If Russian oil production surprises to the upside again, the anticipated market deficit in the second part of the year could halve. Still, supply would run below demand from July to December, forcing consumers to draw their inventories. The real problem for OPEC+ would be if global demand weakens as the banking trouble morphs into an outright recession in the US and Europe.

OPEC+ therefore needs several things to go in its favor. First, it requires that Vladimir Putin makes good on his pledge to cut Russian production — or that Western oil sanctions against Moscow start to force output down. Second, it needs Chinese and Indian crude consumption to not only remain robust, but actually accelerate as the year progresses. And third, it needs that Western central banks can avoid a hard landing, particularly in America.

There’s a fourth variable that can help OPEC+. US shale production growth was undermined last year as drillers focus on returning cash to shareholders rather than boosting output. With WTI oil forward prices for 2024 and 2025 well below $65 a barrel, growth may weaken even further this year. Ironic as it may be, OPEC+ may face stronger-than-expected production from Russia, one of its members, and weaker-than expected from the US, its nemesis. That’s the lopsided world of oil.

A deficit in the second half of the year remains likely — but it may also be smaller than the bulls hope. OPEC+ has its next ministerial meeting scheduled for June in Vienna. But the group will take the pulse of the market when a small group of ministers gather virtually for the Joint Ministerial Monitoring Committee meeting on April 3. If needed, OPEC+ may bring forward that later gathering, and could start jawboning the market. If that occurs, it would be the first sign that the “no panic” is shifting to “a bit worried.”

More From Bloomberg Opinion:

- Biden Walks a Cliff Edge on Alaskan Oil: Liam Denning

- Aramco Mum on Spending Bumper Profits: Elements by Julian Lee

- Long-Dated Oil Prices Are Too Low for Comfort: Javier Blas

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Javier Blas is a Bloomberg Opinion columnist covering energy and commodities. A former reporter for Bloomberg News and commodities editor at the Financial Times, he is coauthor of “The World for Sale: Money, Power and the Traders Who Barter the Earth’s Resources.”

©2023 Bloomberg L.P.