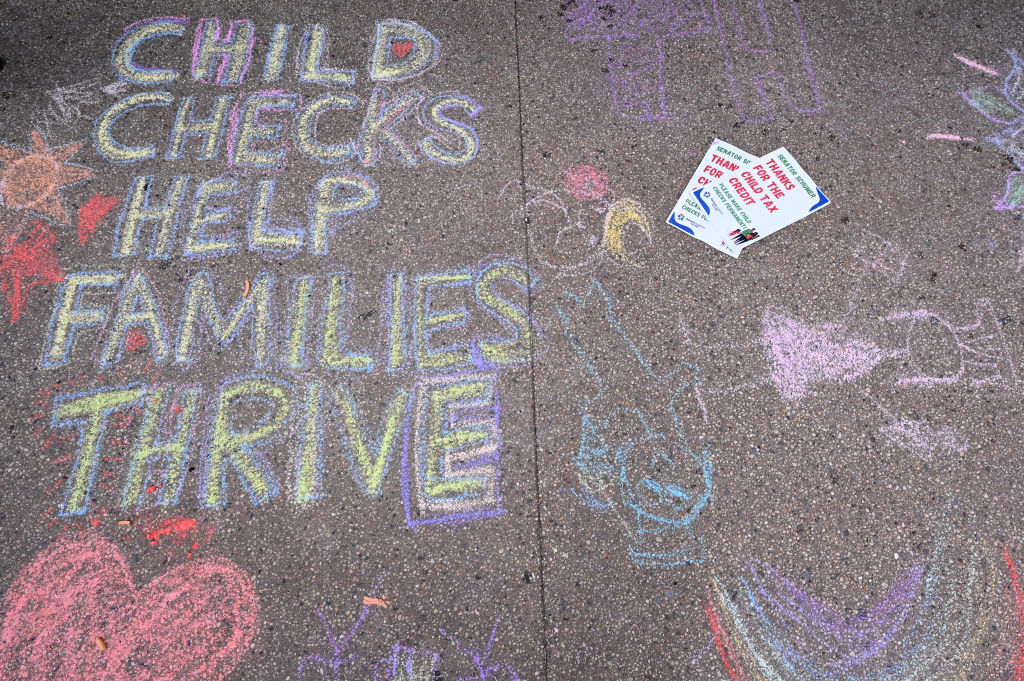

New York Gov. Kathy Hochul proposed expanding the Empire State Child Credit as part of her 2025 State of the State executive agenda to triple its current worth.

The proposal aims to increase the maximum annual credit to $1,000 per child under age 4 and up to $500 per child between the ages of 4 and 16. Currently, New York families can get up to $330 per child. According to the governor, the increase would benefit 1.6 million New York taxpayers and as many as 2.75 million children.

Hochul’s latest pledge comes as nearly 80% of New York families are struggling to afford groceries, according to data from No Kid Hungry. To add insult to injury, families commuting to lower Manhattan are facing steep tolls as part of NYC’s new congestion pricing this year.

Here’s what you should know about Hochul’s new child tax credit expansion proposal, and how it may ease the strain in your pocket if successful.

New York child tax credit increase

Last year, more than 1 million New York families received the Empire State Child Credit without any need to apply for financial aid.

As Kiplinger reported, some $350 million in NY state revenues were delivered to eligible New Yorkers through August, helping parents afford childcare expenses, food, and other necessary items.

Gov. Hochul’s plan would triple the maximum credit amount for infants and nearly double the amount for older children, but the changes would be phased in over two years.

- Eligible families with children under 4 would get a maximum $1,000 credit in 2025

- Those with kids between the ages of 4 and 16 would get a maximum of $500 credit during the 2026 tax year

Additionally, the proposed expansion would adjust the income threshold for the credit, helping middle-class families gain eligibility.

- Households with incomes up to $110,000 would get the full $1,000 credit for younger children and $500 for older children

- The benefit would gradually decrease until phasing out at a $170,000 income level

Millions of children would benefit from the CTC expansion

Gov. Hochul’s pledge comes a year after she successfully expanded the Empire State Child Credit to include newborns and children under 4. In 2023, the credit was only available for children 4 years and older.

That measure alone broadened the credit’s availability to more than 600,000 previously excluded children last year.

If successful, Hochul’s new proposal is estimated to reduce child poverty by 8.2%. When combined with other policy changes by Gov. Hochul, including expanding subsidized child care, it would reduce poverty levels by 17.7%.

According to the Governor's office, the impact of the expansion would be notable:

What’s next for New York taxpayers in 2025

Millions of New York families would greatly benefit from Gov. Hochul’s proposed expansion of the Empire State Child Credit. Not only is the cost of quality child care rising, but inflation is also putting pressure on the price of everyday goods and services.

Separately, a recent survey from No Kid Hungry revealed that families across New York were struggling to keep up with the rising costs of food.

- 79% of New Yorkers said it was harder to afford groceries last year, up 6% from 2023

- 85% said the cost of food outpaced their income

- 58% of New Yorkers said they were stressed about affording nutritious food compared to the previous year

While an expansion to the Empire State Child Credit would be welcome, NY residents are also battling other new taxes this year that are taking a bit out of their earnings.

As reported by Kiplinger, New York City’s new congestion pricing tax increased toll costs for commuters entering lower Manhattan. The tax has faced major backlash and multiple lawsuits contesting the fees.

So, stay tuned to any changes that may impact your taxes in New York.