Amidst all the talk of tariffs on products entering the US, it can be easy to forget there are strict regulations surrounding chips going out of the country, too. Lest we forget about such export restrictions, Nvidia has just revealed (via the Associated Press) that new ones are expected to cost the company a lot of money.

This info was spotted in an SEC filing, in which Nvidia says that "first quarter results are expected to include up to approximately $5.5 billion of charges associated with H20 products for inventory, purchase commitments, and related reserves."

According to Nvidia, this is off the back of the US government informing the company on April 9 that a license is required for export to China "H20 integrated circuits and any other circuits achieving the H20’s memory bandwidth, interconnect bandwidth, or combination thereof."

Following this, again according to Nvidia, "On April 14, 2025, the USG informed the Company that the license requirement will be in effect for the indefinite future."

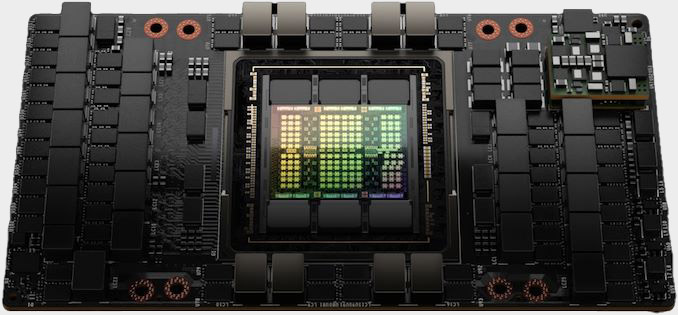

The H20 is essentially a modified version of the H100 GPU, a powerful 'Grace Hopper' architecture that sits on the datacentre side of the aisle just across from 'Ada Lovelace' RTX 40-series processors. Both of these have been succeeded by 'Blackwell' architecture chips, but Hopper chips are still incredibly powerful and populate many of the biggest tech companies' server racks.

The H20 was made to comply with China export restrictions that started to come into effect in 2022 and later restricted export of powerful chips such as the H100 and even less powerful ones such as the H800 and A800. Thus the scaled-back H20 was born, and since then it's been the most powerful AI chip that China's been able to get its hands on.

Now, according to Nvidia's SEC filing, it looks like even this chip will no longer be allowed to be exported to China without license from the US government. And clearly the China H100 market must have been a big one if Nvidia is claiming $5.5 billion charges associated with the new regulations.

According to Reuters, "two sources familiar with the matter" claim that Nvidia didn't warn some Chinese customers about these new export rules. This apparently meant that some companies were expecting H20 deliveries by the end of the year.

Regulations such as these are no joke, either, as we've already seen breaking them can risk some serious repercussions. TSMC, for instance, might be fined over $1 billion for allegedly breaking export rules after one of its chips was found in a Huawei processor.

Still, while the $5.5 billion charges surely must sting, that's nothing compared to the amount that Nvidia is planning on investing in US-based chip production. Just a few days ago, the company announced plans to invest $500 billion in "AI infrastructure" in the US.

With these new reported export rules and the looming threat of semiconductor tariffs, the chip industry writ large—not to mention, of course, the burgeoning and booming AI industry—is in uncertain waters.

And while PC gaming tech is a little downstream from all this, it's most definitely the same stream. Here's hoping that after this $5.5 billion Nvidia will still has the money to pump into more RTX 50-series stocks.