Nike (NKE) will be in focus on Tuesday after the close, as the athletic-apparel retailer gears up to report its fiscal-third-quarter results.

Nike stock had been trading well. From the October low to the 2023 high, the shares rallied 59%. But over the past six weeks, the stock pulled back more than 11%. Is this simple consolidation or a sign of more weakness to come?

That’s tough to say, as retail has been a very mixed bag.

Companies like Target (TGT), Costco (COST) and many others have seen disappointing earnings reactions.

Others, like Ulta Beauty (ULTA) and Dick’s Sporting Goods (DKS), have recently hit all-time highs and have reported strong results.

Don't Miss: Bank Stocks Remain Pressured. XLF Chart Support Is a Line in the Sand.

Given that Nike tends to be in the higher-end and “stickier” part of retail given its customer base — and given the clear momentum we’re seeing in sporting goods via Dick’s — it’s reasonable to have a bullish bias on Nike into the print.

The latest pullback helps cement that belief, as expectations have now come down a bit as well. Let’s look at the chart.

Trading Nike Stock Ahead of Earnings

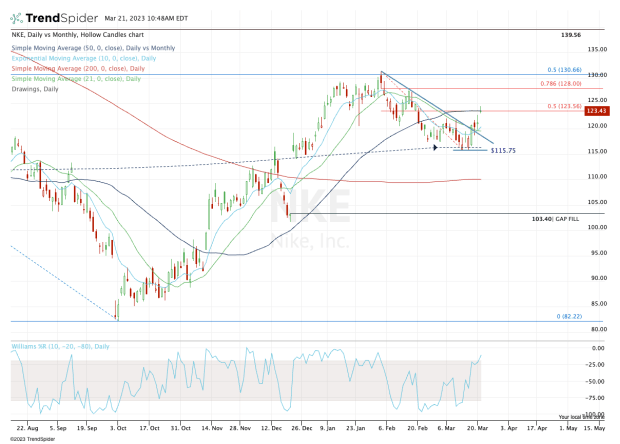

Chart courtesy of TrendSpider.com

Shares of Nike pulled back gradually over a six-week span, coughing up about 11.5% in the process.

The stock ultimately found support at the 50-month moving average and near the $115.75 area.

We’ve seen a pop over the past few days, as the stock broke out over downtrend resistance (blue line) and reclaimed the 10-day and 21-day moving averages.

Now Nike stock is pausing at the 50-day moving average and 50% retracement of the current decline. And we’re at a crossroads.

Don't Miss: Is the Drop in Caterpillar Stock Done? A Look at the Charts

If Nike continues higher, see how it handles the $128 level. Above that opens the door to the recent high at $131.31. Above both levels and Nike could march up to the $138 to $142 zone.

On the downside, the bulls want to see the stock pull back to the $115.75 area and hold there. A move below $115 and a close below $115.75 could open the door down to the 200-day moving average currently near $110.

A painful decline could ultimately set the stage for Nike stock to fill the gap near $103.50.