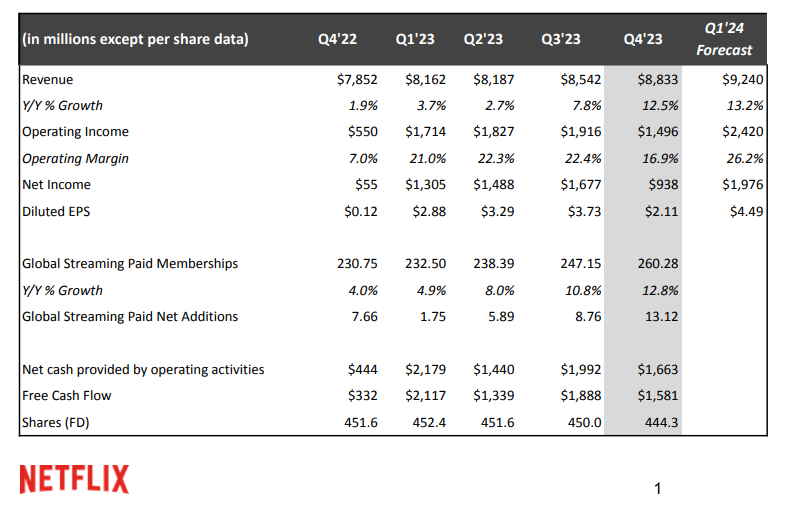

Netflix culminated 2023 with a blowout quarter, significantly surpassing analysts' expectations by adding more than 13.1 million subscribers and growing revenue by 12.5% to $8.833 billion.

The world's top streaming company put more distance between it and everyone else with its second biggest subscriber quarter ever, exceeding 260 million paid members worldwide. It did fall short on expectations for net income, however, coming in with $938 million for the fourth quarter.

For those still doubting that money can be made streaming video: Netflix reported free cash flow in the fourth quarter of $1.581 billion.

Netflix shares were up more than 7% in after-hours trading.

Also read: Netflix Has 'Won the Streaming Wars,' Jessica Reif Ehrlich Declares

And Netflix's full-2023/Q4 letter to shareholders can be found here.

The big subscriber gains came despite an October price-increase announcement that affected, among other regions, the streaming giant's largest quadrant, the U.S. and Canada. Despite that increase, Netflix added 1.75 million customers across "UCAN" in the fourth quarter.

Netflix said it will phase out its cheapest ad-free tier, which runs $11.99 a month in the U.S. Forty-percent of its new signups are now for partially ad-based tiers in its markets that support advertising, the company also said.

Acknowledging the white-hot M&A speculation surrounding its media-industry competitors, Netflix in its shareholder letter reiterated its declaration not to buy a major entertainment conglomerate.

"We’re not interested in acquiring linear assets. Nor do we believe that further M&A among traditional entertainment companies will materially change the competitive environment given all the consolidation that has already happened over the last decade (Viacom/CBS, AT&T/Time Warner, Disney/Fox, Time Warner/Discovery, etc.)," Netflix said.

The company pledged a "high single digit percentage" increase on the $14.2 billion it spent on content in 2023.

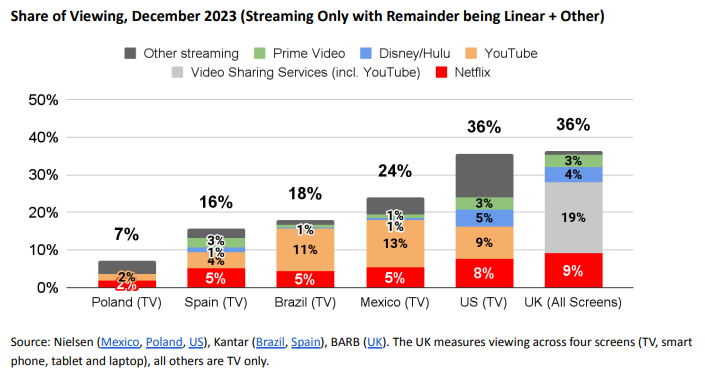

"If we continue to execute well and drive continuous improvement — with a better slate, easier discovery and more fandom — while establishing ourselves in new areas like advertising and games, we believe we have a lot more room to grow," the company added. "It’s a $600B+ opportunity revenue market across pay TV, film, games and branded advertising — and today Netflix accounts for only roughly 5% of that addressable market. And our share of TV viewing is still less than 10% in every country."

The earnings report followed an eventful past several days for Netflix, starting with the departure announcement of longtime film chief Scott Stuber on Monday, as well as the $17 million purchase at the Sundance Film Festival of filmmaker Greg Jardin's horror-comedy It's What's Inside.

On Tuesday morning, Netflix touted its biggest "live sports" deal to date, paying $5 billion for an exclusive multiyear run of WWE Raw in the U.S., Canada, UK and Latin America, among several other WWE-related programming acquisitions.

"WWE is great sports entertainment with a huge, established and passionate fanbase, and we believe this long term partnership will be a big value add for our members," Netflix said in its shareholders letter.

Netflix also came out on top at the Academy of Motion Pictures Arts & Sciences' big Oscar nomination party Tuesday morning, with Maestro, Nyad and The Society of the Snow leading the streaming company to an industry-leading 18 Academy Awards nods. (What's On Netflix has a complete summary of the company's Oscar nominations.)