19 analysts have expressed a variety of opinions on Dayforce (NYSE:DAY) over the past quarter, offering a diverse set of opinions from bullish to bearish.

The following table summarizes their recent ratings, shedding light on the changing sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 4 | 9 | 6 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 1 | 4 | 2 | 0 | 0 |

| 2M Ago | 2 | 4 | 3 | 0 | 0 |

| 3M Ago | 1 | 1 | 0 | 0 | 0 |

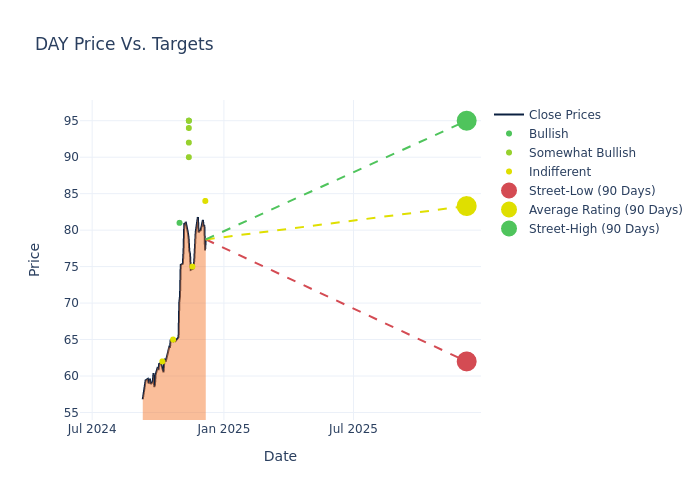

Analysts have set 12-month price targets for Dayforce, revealing an average target of $80.89, a high estimate of $95.00, and a low estimate of $62.00. Observing a 9.4% increase, the current average has risen from the previous average price target of $73.94.

Exploring Analyst Ratings: An In-Depth Overview

The standing of Dayforce among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Raimo Lenschow | Barclays | Raises | Equal-Weight | $84.00 | $80.00 |

| Allan Verkhovski | Scotiabank | Announces | Sector Perform | $75.00 | - |

| Raimo Lenschow | Barclays | Raises | Equal-Weight | $80.00 | $70.00 |

| Jason Celino | Keybanc | Raises | Overweight | $92.00 | $80.00 |

| Arvind Ramnani | Piper Sandler | Raises | Overweight | $94.00 | $82.00 |

| Arvind Ramnani | Mizuho | Raises | Outperform | $95.00 | $85.00 |

| Daniel Jester | BMO Capital | Raises | Outperform | $90.00 | $80.00 |

| Scott Berg | Needham | Raises | Buy | $95.00 | $82.00 |

| Daniel Jester | BMO Capital | Raises | Outperform | $80.00 | $70.00 |

| Steven Enders | Citigroup | Raises | Buy | $81.00 | $75.00 |

| Raimo Lenschow | Barclays | Raises | Equal-Weight | $70.00 | $63.00 |

| Arvind Ramnani | Mizuho | Raises | Outperform | $85.00 | $80.00 |

| Scott Berg | Needham | Maintains | Buy | $82.00 | $82.00 |

| Arvind Ramnani | Piper Sandler | Raises | Overweight | $82.00 | $71.00 |

| Samad Samana | Jefferies | Raises | Hold | $65.00 | $55.00 |

| Arvind Ramnani | Mizuho | Raises | Outperform | $80.00 | $70.00 |

| Jared Levine | TD Cowen | Raises | Hold | $62.00 | $58.00 |

| Steven Enders | Citigroup | Raises | Buy | $75.00 | $74.00 |

| Jason Celino | Keybanc | Announces | Overweight | $70.00 | - |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Dayforce. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from 'Outperform' to 'Underperform'. These ratings convey the analysts' expectations for the relative performance of Dayforce compared to the broader market.

- Price Targets: Analysts provide insights into price targets, offering estimates for the future value of Dayforce's stock. This comparison reveals trends in analysts' expectations over time.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of Dayforce's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on Dayforce analyst ratings.

Get to Know Dayforce Better

Dayforce provides payroll and human capital management solutions targeting clients with 100-100,000 employees. Following the 2012 acquisition of Dayforce, Dayforce pivoted away from its legacy on-premises Bureau business to become a cloud HCM provider. As of fiscal 2022, about 80% of group revenue was derived from the flagship Dayforce platform geared toward enterprise clients. The remaining revenue is about evenly split between cloud platform Powerpay, targeting small businesses in Canada, and legacy Bureau products.

Unraveling the Financial Story of Dayforce

Market Capitalization Analysis: With an elevated market capitalization, the company stands out above industry averages, showcasing substantial size and market acknowledgment.

Revenue Growth: Dayforce's revenue growth over a period of 3 months has been noteworthy. As of 30 September, 2024, the company achieved a revenue growth rate of approximately 16.56%. This indicates a substantial increase in the company's top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Industrials sector.

Net Margin: Dayforce's net margin lags behind industry averages, suggesting challenges in maintaining strong profitability. With a net margin of 0.45%, the company may face hurdles in effective cost management.

Return on Equity (ROE): The company's ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of 0.08%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): Dayforce's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of 0.02%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: With a below-average debt-to-equity ratio of 0.48, Dayforce adopts a prudent financial strategy, indicating a balanced approach to debt management.

What Are Analyst Ratings?

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.