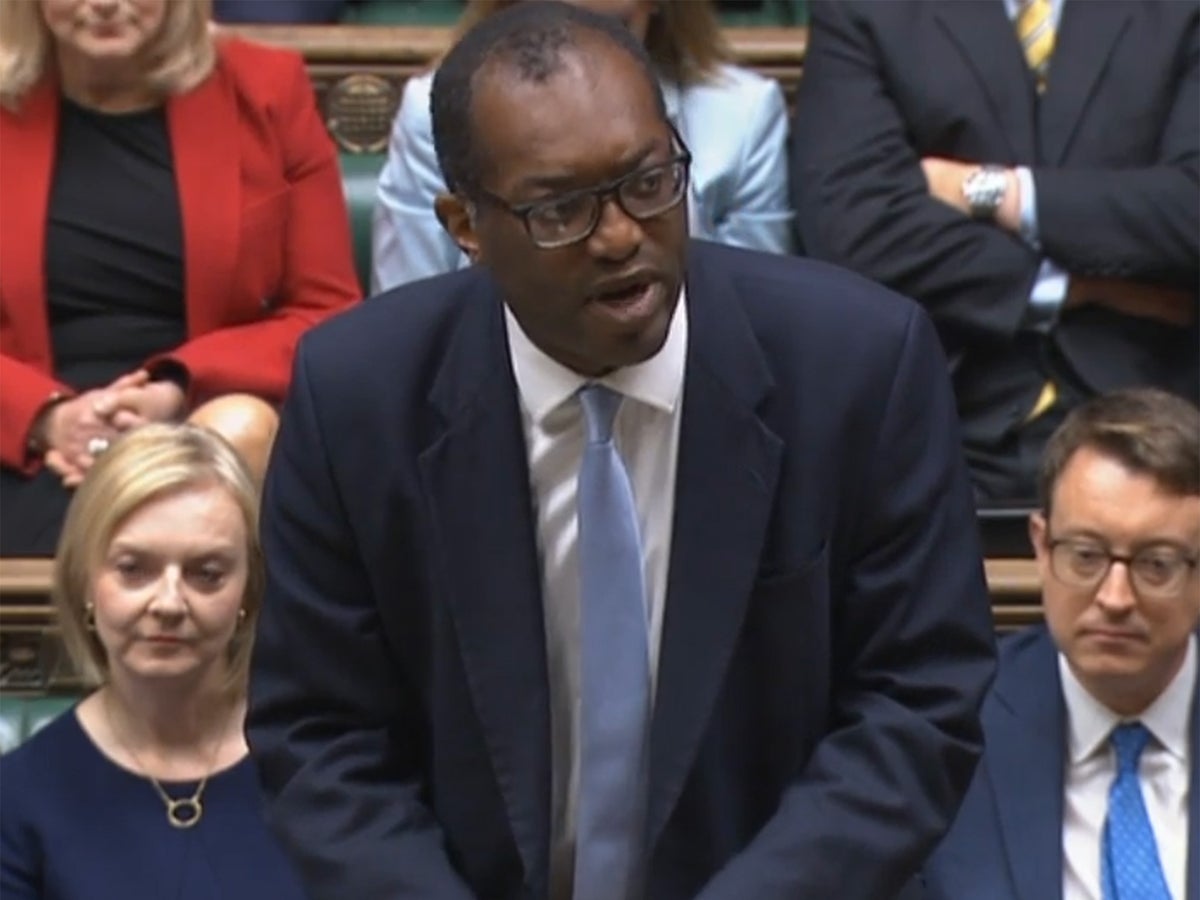

The pound plummeted to a 37-year low after the chancellor unveiled the biggest raft of tax cuts for half a century in a mini-Budget slated by fiscal experts as unsustainable.

In a scathing assessment, the Institute of Fiscal Studies said Kwasi Kwarteng was “betting the house” by putting government debt on an “unsustainable rising path” and “without even a semblance of an effort to make the public finance numbers add up”.

Critics attacked it as benefiting only the wealthy and big business,

Mr Kwarteng’s plan, aimed at raising falling living standards by boosting growth, involves more than £70 billion of extra borrowing.

In a raft of tax cuts costing up to £45 billion annually, he scrapped the top rate of tax for the highest earners, cut stamp duty and brought forward a cut to the basic rate of income tax, to 19p.

Mr Kwarteng also confirmed he will axe the cap on bankers’ bonuses while adding restrictions to the welfare system.

But the price of government borrowing soared even higher amid fears the package had sent UK markets into meltdown.

TUC leader Frances O’Grady said: “This budget is Robin Hood in reverse.”

Rachel Reeves, the shadow chancellor, said it was “a plan to reward the already wealthy”.