The pressure is on Mister Softee, otherwise known as Microsoft (MSFT) , when the software giant reports earnings after Tuesday's market close.

The reason: Investors are starting to ask a question basic to any company spending millions — or, more likely, billions — on artificial intelligence investments: When will we start to see real returns from all that spending?

What can't happen is the AI investing goes on and doesn't show any profits.

Related: Analyst revamps Amazon stock forecast before earnings

"Investors will be very focused on Microsoft's ability to continue to accelerate revenue growth, especially the portion related to AI. If revenue acceleration doesn't materialize and increases in capex continue, investors may be disappointed," Gil Luria, senior software analyst at D.A. Davidson, told Reuters this week.

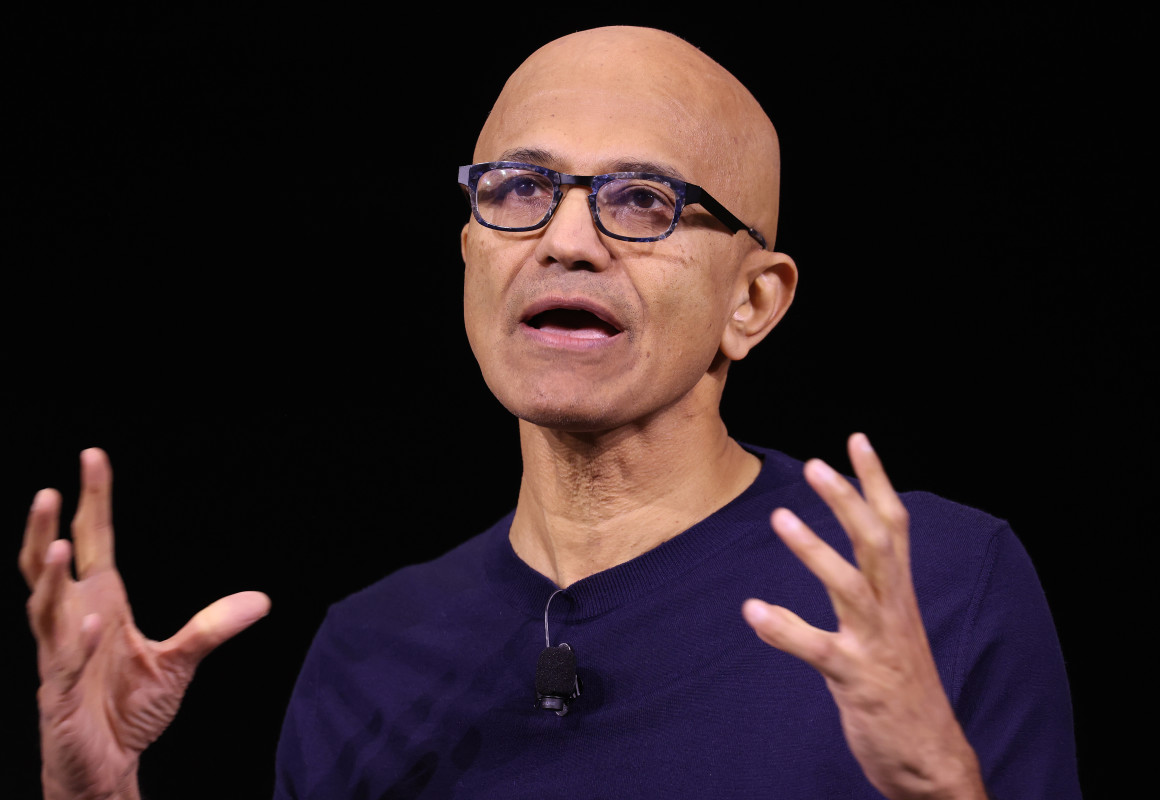

So, Microsoft and CEO Satya Nadella's goal after Tuesday's close is to show that there is a "there" on its huge bet on AI. The stock closed Monday at $426.73, up 1.5% on the day and up 13.5% in 2024.

However, the share price has fallen 8.9% from its peak of $468.35 on July 5. To be fair, it was probably unlikely that Microsoft shares would perform as well as they did in 2023, rising 53.6%.

You might see an acknowledgment of that "there" on Tuesday. The company is expected to report fiscal-fourth quarter revenue of $64.2 billion, up about 14% from a year ago but down from 17% in the fiscal third quarter, which ended at the end of March. Earnings, estimated at $2.90 a share, would be up about 8% from a year ago.

AI is a growing piece of Microsoft's biggest business

The AI question will come up when revenue is reported for Microsoft's intelligent Cloud business. Microsoft's largest business group, the segment includes its cloud computing applications and other technologies. And AI is central to the future of the business.

In the year-ago quarter, Microsoft said its Cloud business grew 15% to $24 billion. Later, the company said 7% of that growth was due to AI. In addition Microsoft said it spent $10.7 billion to support "demand in our cloud and AI offerings."

Meanwhile, Microsoft has invested $13 billion in OpenAI, the startup that's done much of the early work on AI, and it is prepared to invest more.

So, the question will fall on how much Microsoft's cloud business will grow this year and whether the percentage of that growth due to AI is larger than a year ago.

Many investors will look for revenue growth of substantially more than 15% and a bigger-than-a-year-ago contribution from AI.

One can expect more questions about these numbers when the company holds its analyst call at 2:30 p.m. PT (5:30 p.m. ET). Nadella and Chief Financial Officer Amy Hood will be on the call.

A shortfall may spook investors. The unease is due to the market frenzy for all things AI in the first half of 2024 that ultimately spawned worries tech shares were rising too darn fast.

By June 18, Nvidia (NVDA) shares were up as much as 174% on the year- too much for many shareholders who decided to lock in profits. The shares have since slipped 17.6%.

More Tech Stocks:

- Analyst revisits Nvidia stock price target after Blackwell checks

- Cathie Wood unloads shares of rebounding tech titan

- Big tech company files Chapter 7 bankruptcy, closes abruptly

A miss can cost you

Alphabet (GOOGL) shares have fallen 6.7% since its July 23 earnings release because of AI spending worry. (But some analysts and writers, including Barrons' Bill Alpert, have said the selling was a big mistake.)

Microsoft remains a staggeringly profitable company with a net profit margin of 35%. Many of its businesses, such as its Office products, are run as subscription services with high renewal rates. However, its sales of Windows software to personal computer makers have been volatile.

If there is an issue, Luria says it's slower growth in its personal computing business, which includes Windows and the Xbox gaming division. The productivity business — home to the Office suite of apps, LinkedIn, and 365 Copilot — is expected to post growth of about 10%.

This is a huge week for tech earnings overall. Chip maker Advance Micro Devices (AMD) also reports Tuesday. Facebook-parent Meta Platforms (META) , chip-design Arm Holdings (ARM) , and chip maker QUALCOMM (QCOM) are up Wednesday, with Apple (AAPL) , Amazon.com (AMZN) and Intel (INTC) set for Thursday.

Related: Veteran fund manager sees world of pain coming for stocks