Three Chicago-area residents this month were indicted by U.S. Attorney John Lausch’s office on charges stemming from COVID-relief fraud, adding another tiny drop to what has become a nationwide tsunami of similar fraud indictments.

The tsunami could turn out to represent billions in fraud from some $5 trillion in federal relief funds meant to help Americans make it through the worst of the pandemic, as the New York Times reported last week.

The three individuals — a man and woman from Chicago, and a man from Naperville — allegedly submitted fraudulent applications and supporting documents to obtain $2.75 million in small business loans from the Paycheck Protection Program and the Economic Injury Disaster Loan fund. Both those programs were part of the $2.2 trillion CARES Act, passed by Congress in March 2020.

Under CARES (Coronavirus Aid, Relief and Economic Security) Act, the loans were to be forgiven as long as a certain percentage of the money was spent on legitimate business expenses, such as payroll, rent, utilities and other costs. Instead, authorities allege that the three spent most of the $2.75 million to benefit themselves, including to buy real estate and lease or buy luxury automobiles.

Similar scenarios — some even more outrageous, such as the 33 Pennsylvania inmates and accomplices charged with illegally obtaining pandemic unemployment benefits — have taken place elsewhere. So far, 1,500 individuals have been charged with defrauding COVID relief programs; 450 people have been convicted. In the Chicago area, 15 people have been charged with COVID-relief fraud or similar offenses, Lausch’s office reports.

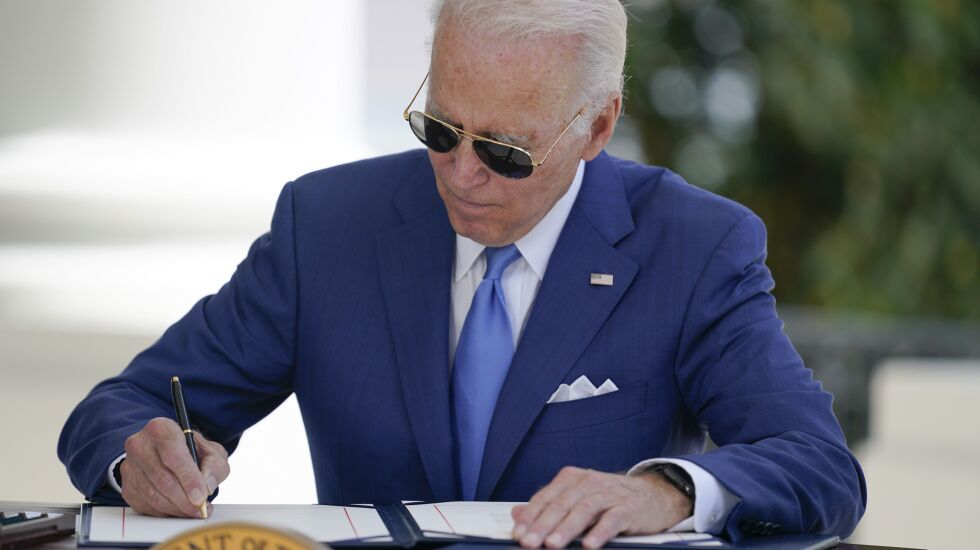

Hundreds of federal investigators, inspectors general, prosecutors and others are working to unravel the crimes. It will take time and money to finish the task, which is why President Joe Biden recently signed legislation to extend to 10 years from five the statute of limitations for prosecuting cases involving the two major relief initiatives, PPP and EIDL.

“There are years and years and years of work ahead of us,” as Kevin Chambers, the Justice Department’s chief pandemic prosecutor, told the New York Times. “I’m confident that we’ll be using every last day of those 10 years.”

The scale of fraud appears massive, yet federal prosecutors must continue to pursue these cases. Lawmakers must make sure they have the resources to do so.

It’s essential to send a message: The guilty will not be allowed to walk away unpunished.

If you lied on a pandemic loan application, filed fake documents pretending to be a struggling small business, stole an unsuspecting person’s identity to file a fraudulent unemployment claim — while other Americans were struggling to make it through the worst public health crisis in a century — you will be prosecuted.

If federal authorities don’t send that signal, what happens the next time a public health crisis or natural disaster strikes and sends the economy into a tailspin? The fraudsters will come out of the woodwork once again, eager to steal and emboldened by the fact that they got away with it the first time.

‘Honor system’ a risk

Meanwhile, federal officials must figure out a better way to prevent fraud before “next time” happens.

That ought to mean a more rigorous initial screening that would, for instance, flag duplicate names on multiple applications, or cross-check the names of individuals applying for relief against the list of individuals named on the Treasury Department’s “Do Not Pay” list. The federal government, recognizing the urgent need to get aid out the door quickly, relied on “self-certification” of aid eligibility — in other words, the honor system.

A review of Economic Injury Disaster Loan applications from March to November 2020 by the Office of the Inspector General for the Small Business Administration found that a lack of adequate screening “led to 75,180 loans of over $3.1 billion, and 117,135 emergency grants over $550 million, being disbursed to potentially ineligible recipients.”

Federal officials themselves have noted that “self-certification” was a major risk factor for fraud. “Validating self-reported information is a key fraud risk management leading practice,” according to the federal website pandemicoversight.gov. The watchdog Government Accountability Office recommends that agencies “take steps to verify reported information, particularly self-reported data and other key data necessary to determine eligibility for enrolling in programs or receiving benefits.”

When disaster strikes, it’s the job of government to step up quickly with the help folks need to get back on their feet.

Americans rightly expect that — and for government to keep cheats from taking advantage of it.

The Sun-Times welcomes letters to the editor and op-eds. See our guidelines.