Martin Lewis has shared “easy peasy” advice on how consumers can save up to £180 a year by using an app-only banking account to purchase goods and services.

Mr Lewis, founder of the Money Saving Expert website, urged customers to sign up for a Chase bank current account to receive up to £15 a month just by spending.

He added that it had other benefits and was the cheapest for spending overseas. He also told customers to consider signing up for a new HSBC account to receive £205 of free cash.

The deal from HSBC allows you to claim the £205 by setting up an HSBC Advance or Premier account. Only new customers will receive the £205.

“Right now there’s a bank that will pay you for opening an account, but you don’t need to use its switching service. You don’t need to switch to it so you can keep your old bank and your normal banking systems up and running,” he said on his BBC podcast.

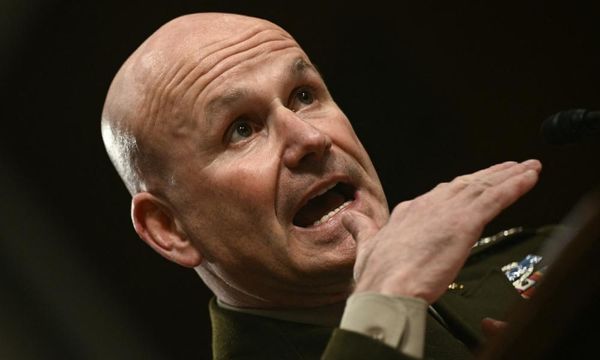

Martin Lewis said it took two minutes to sign up to the current account which customers can save up to £180 a year with— (PA Archive)

Mr Lewis also shared how couples can claim more than £205.

“In fact, if you’re a couple, and I have already had many people doing this, both of you can do it. So there’s £205 each, which would be £410 between two of you,” he said.

Customers switching to a NatWest Reward or RBS Reward current account can also pick up a £200 switching bonus. But you must switch from a different bank, deposit £1,250 into your account and log into the mobile banking app within 60 days.

On meeting these requirements you’ll receive the £200 free cash after seven calendar days. Meanwhile, customers switching to a TSB Spend and Save or Spend and Save Plus current account can receive a £200 switching bonus.

Mr Lewis has also issued an urgent plea to chancellor Jeremy Hunt for an overhaul of Lifetime ISAs.

He asked Mr Hunt to overhaul “unfair” aspects of Lifetime ISAs, which are often used by first-time buyers, arguing young savers should not be essentially fined when they buy homes over the £450,000 limit.

Mr Lewis said: “Jeremy Hunt I am calling on you today. If you want to help first-time buyers, before any new clever schemes, fix the broken dead-duck scheme of Lifetime ISAs.”