Money expert Martin Lewis has shared crucial advice to couples on how they can save hundreds of thousands of pounds through a simple tax loophole for those married or in civil partnerships.

Getting married unlocks a number of tax benefits for couples which can save substantial sums. But there is one that is “by far the biggest benefit of marriage for those who have assets,” said the money saving expert on ITV’s The Martin Lewis Money Show.

“When marriage really counts is when you die,” Mr Lewis told a giggling audience. This is because of an inheritance trick that married couples under 90 can take advantage of when one of them passes away.

He explains that anything left to your spouse is exempt from inheritance tax (IHT), meaning money paid to them is done so tax-free – unlike with other family members.

Crucially, any unused IHT allowance is also passed to your spouse. For most people, this is £325,000 in basic IHT allowance, plus an extra £175,000 if passing on a home to a direct descendant.

That means there is up to £500,000 of tax free inheritance that can be passed on for anyone. But when passing everything on to your spouse, they are also given this allowance – boosting theirs up to £1 million.

Mr Lewis adds: “Now let’s just imagine they did exactly the same thing but they weren’t married.

“In that same scenario, he’s left everything to his partner, so he’s used up his inheritance tax allowance, now if she leaves everything to the kids, she only has half of that, so that’s £500,000 – and is going to be paying tax on it. Well, you know what, depending on the amount you could be talking £200,000 of tax paid because they weren’t married.”

Importantly, this only applies to those who are married or in a civil partnership. For those who are together but not one of these, even if cohabiting, the inheritance allowance carry over cannot be applied.

One partner earning more than the other?

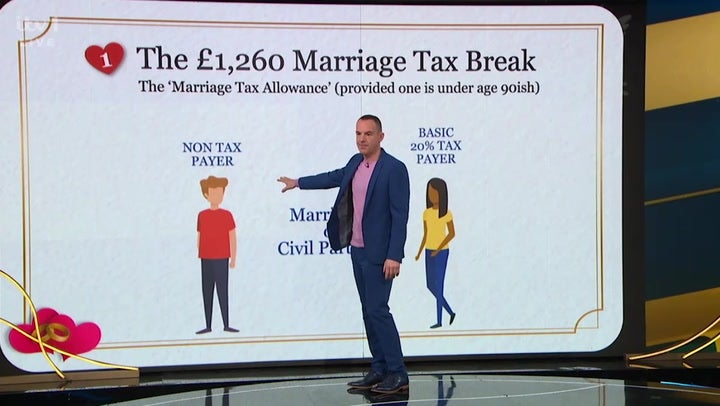

While the inheritance tax allowance transfer the biggest financial perk to being married, there is more. For any couple, the separate marriage tax allowance allows you to transfer £1,260 of your personal allowance to your spouse or civil partner if they earn more than you.

This is the amount you can take home tax-free each year without having to pay income tax, and is currently frozen at £12,570. But if one of the partners is earning below this threshold, they can pass on their allowance to their spouse, boosting it to £13,830.

At the basic 20 per cent rate of tax, this amounts to a tax saving of £252 a year. What’s more, the trick can be backdated for four years, meaning up to £1,008 could be sat waiting for eligible couples who have yet to take advantage.

Income tax is charged on most earnings over the personal allowance, including pensions. So if one partner take home a pension on which they pay tax, and the other doesn’t, the perk can be applied here too.

It’s important to note that you must be born on or after 6 April 1935 to take advantage of marriage tax allowance, and the higher-earning partner must be paying the basic rate of income tax, not higher or additional.

Can money be saved on investments?

Another marriage perk that Mr Lewis points out works in reverse, and applies to savings and investments. Because these can be moved freely between spouses, there are major savings to be made on them when taking into account tax rates.

Putting the money in the right name to ensure the minimum amount of tax paid can go a long way to finding extra cash.

The money expert gives the example of a man paying the higher 40 per cent tax rate with savings that earns interest above his personal savings allowance. Due to his tax bracket, this is £500 a year, after which he pays his usual rate of income tax.

But he is married to a retired woman who no longer earns enough to pay tax. This means her personal savings allowance is £5,000. If her husband transfers his savings to her, she will be able to use her tax-free annual allowance to make massive savings for the couple.

This also applies to money made from capital gains, which carries an annual allowance of £3,000 in the current tax year. Passing on an asset to your partner before selling can ensure you both use up your allowances, making for a total of £6,000 tax-free savings.

What’s more, capital gains tax is normally charged at lower rates for basic income taxpayers than higher income tax payers. This means it will usually be beneficial to sell assets in the name of a partner earning in a lower tax bracket if possible.

When investing, your capital is at risk and you may get back less than invested. Past performance doesn’t guarantee future results.