A huge concern for many members of Generation Z and younger millennials is (not) being able to afford a home. For many people, owning property is a pipe dream: unrealistic because of the current economic situation, the whims of the job market, and the system as a whole.

Popular content creator @elyon113, aka Samuel Smeltzer, went viral on TikTok after calculating how much the federal minimum wage in the United States ought to be these days to allow people to comfortably afford to buy a home. Spoiler warning: it’s over 7 times the current rate. Scroll down for his insights. Bored Panda got in touch with Smeltzer for further comment, and he was kind enough to share his thoughts with us. You’ll find our full interview with him below.

More info: TikTok | Instagram | YouTube

Owning property is a dream for young people. However, many employees feel like it’s a nigh-impossible feat with massive housing prices

Image credits: Aukid phumsirichat (not the actual image)

Image credits: elyon113

Image credits: elyon113

Popular content creator Samuel Smeltzer went into detail about the federal minimum wage in the United States

Image credits: elyon113

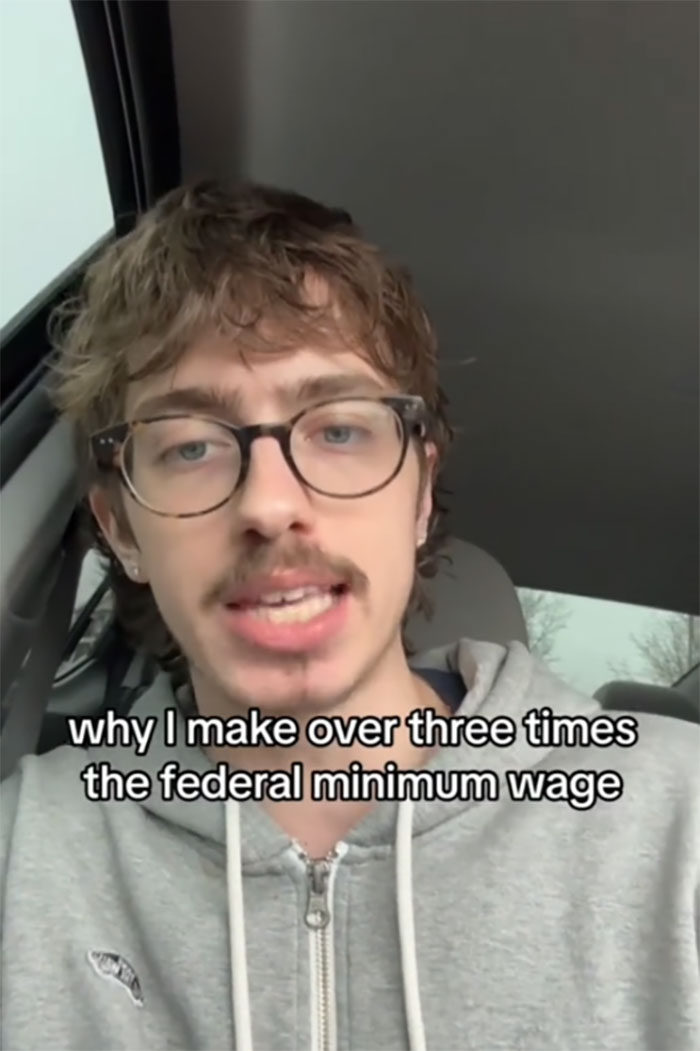

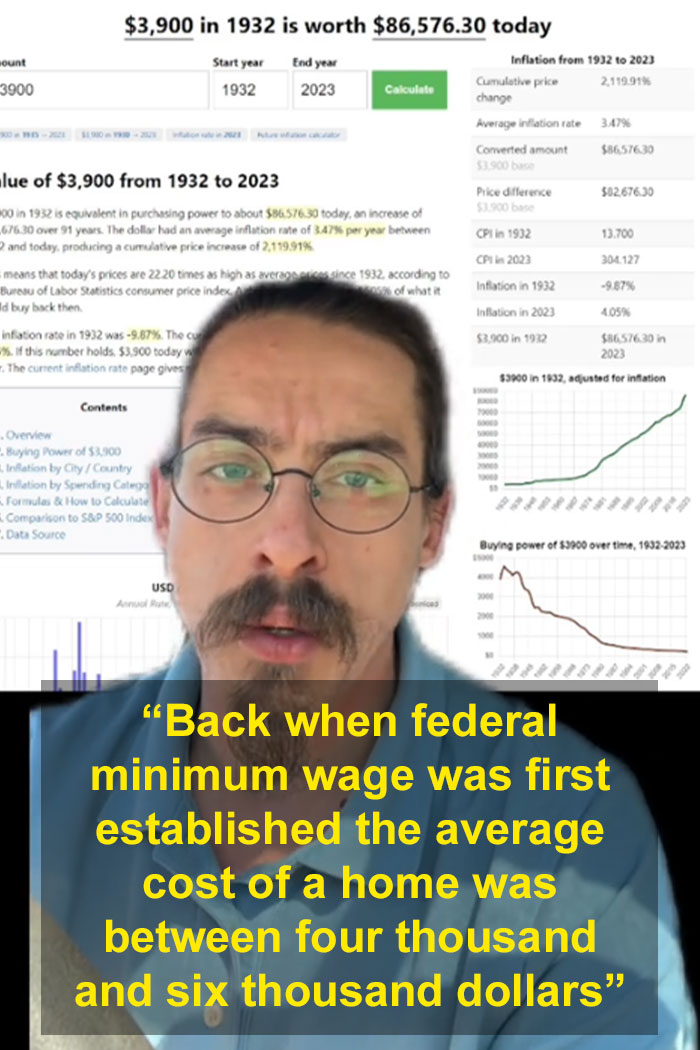

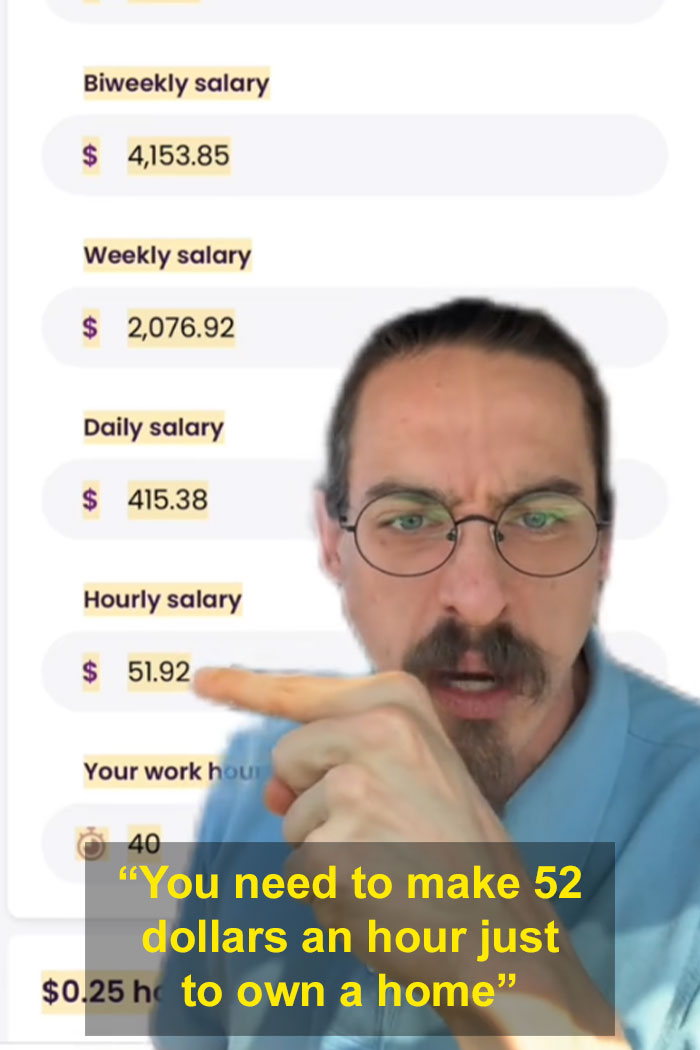

“That’s because federal minimum wage needs to be fifty two dollars per hour and here’s the math behind it. Back when federal minimum wage was first established the average cost of a home was between four thousand and six thousand dollars and if you put the cost of the home into an inflation calculator today that home is only worth a maximum of ninety thousand dollars now.”

He calculated how much it should be raised so that someone could comfortably afford a home in this day and age

Image credits: elyon113

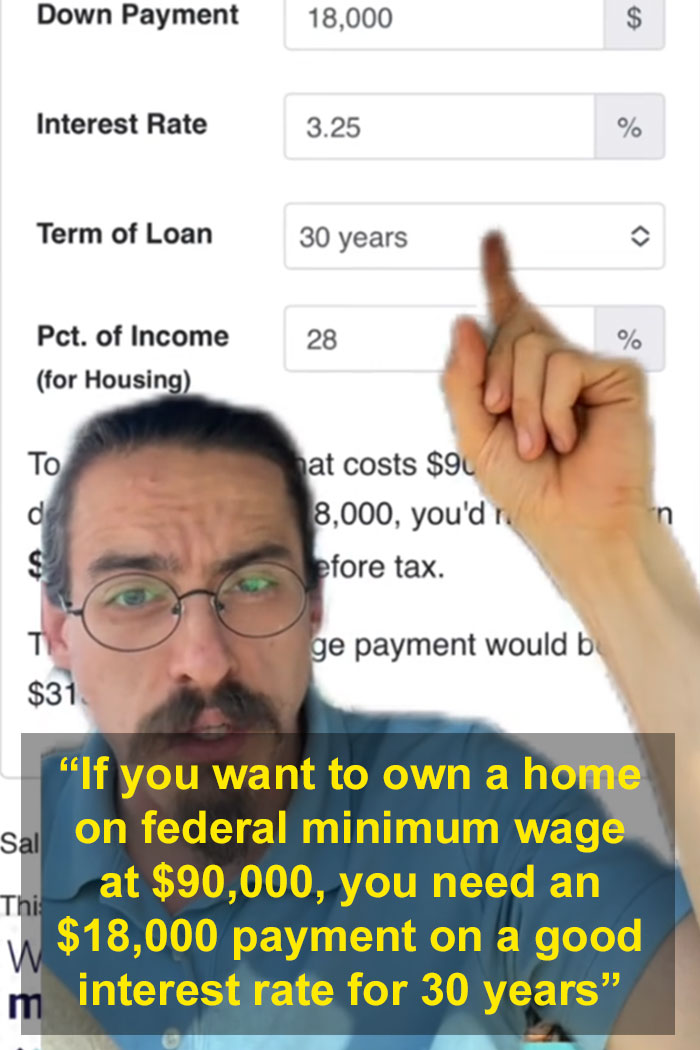

“If you want to own a home on federal minimum wage at $90,000, you need an $18,000 payment on a good interest rate for 30 years and look what you need to earn per year in order to afford that same house when federal minimum wage was established.”

Image credits: elyon113

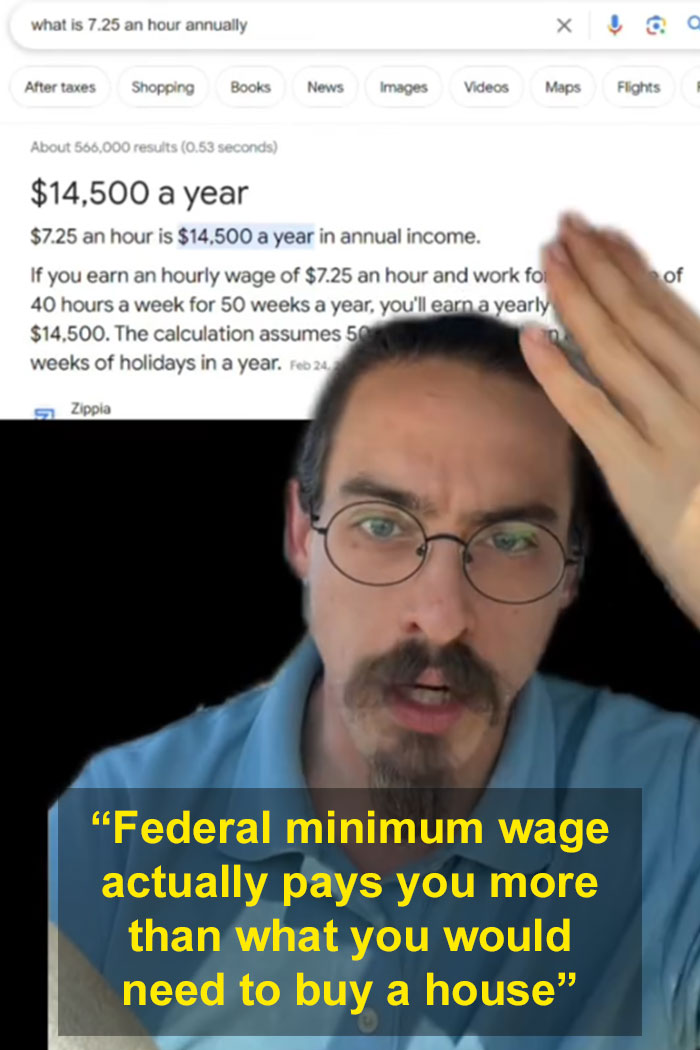

“Look at that. Federal minimum wage actually pays you more than what you would need to buy a house if we hadn’t f****d the housing market by letting hedge funds buy everything.”

Image credits: elyon113

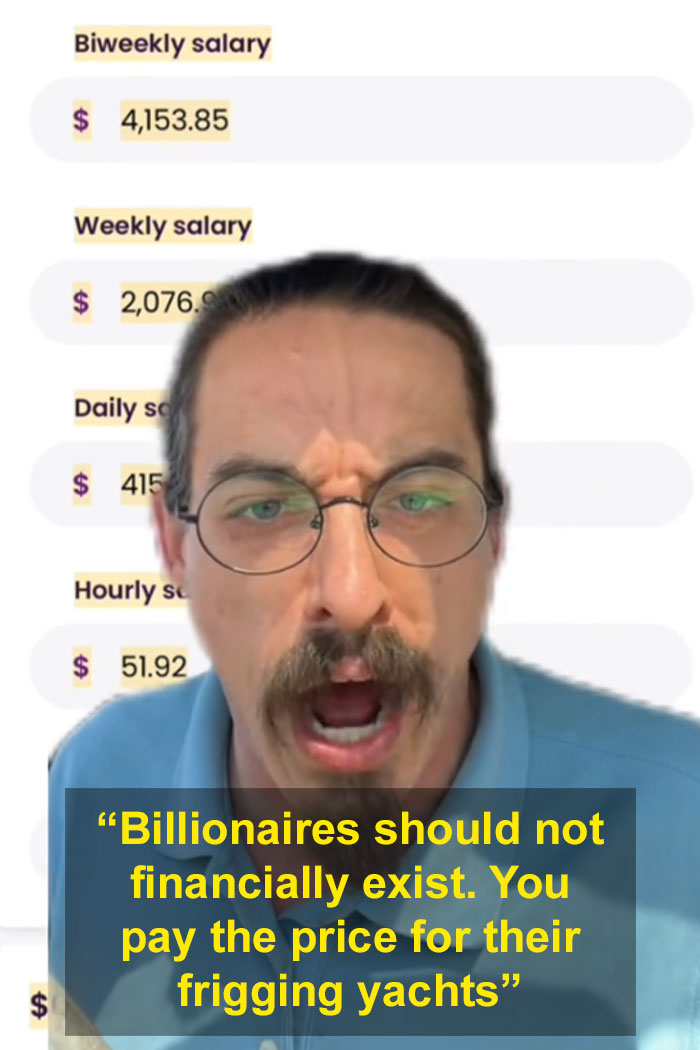

“Because this country decided to prioritize the comfort of the billionaire class over the comfort of ourselves establishing things like shelter, food, and medicine being human rights.”

Image credits: elyon113

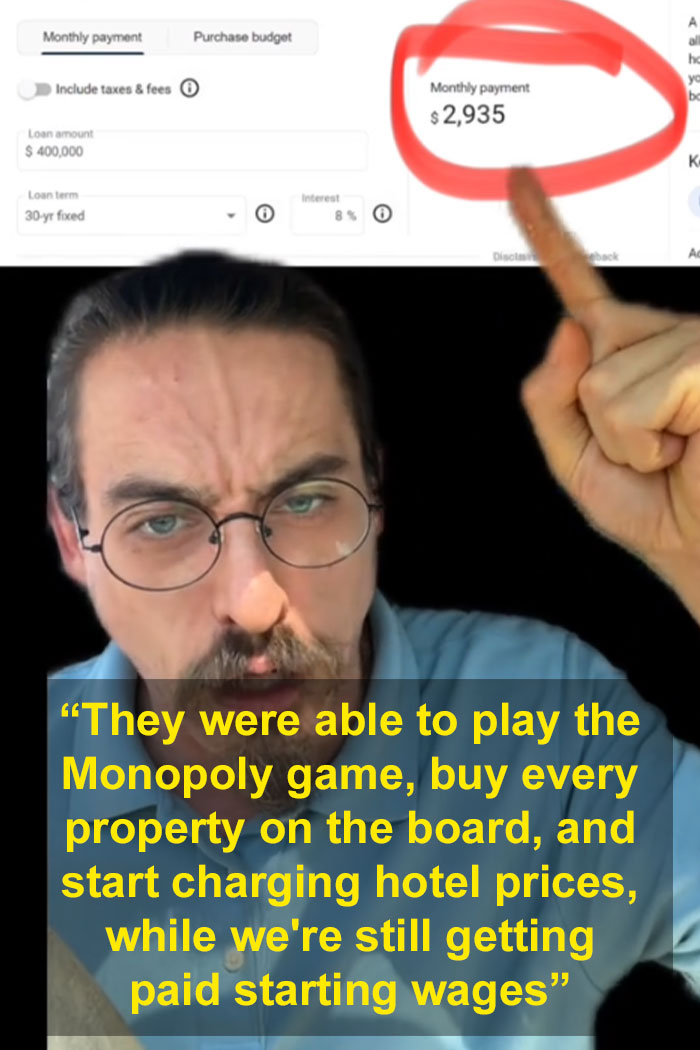

“The billionaire class not having the right to exist, they were able to play the Monopoly game, buy up every property on the board, and start charging hotel prices, while we’re still getting paid starting wages.”

Image credits: elyon113

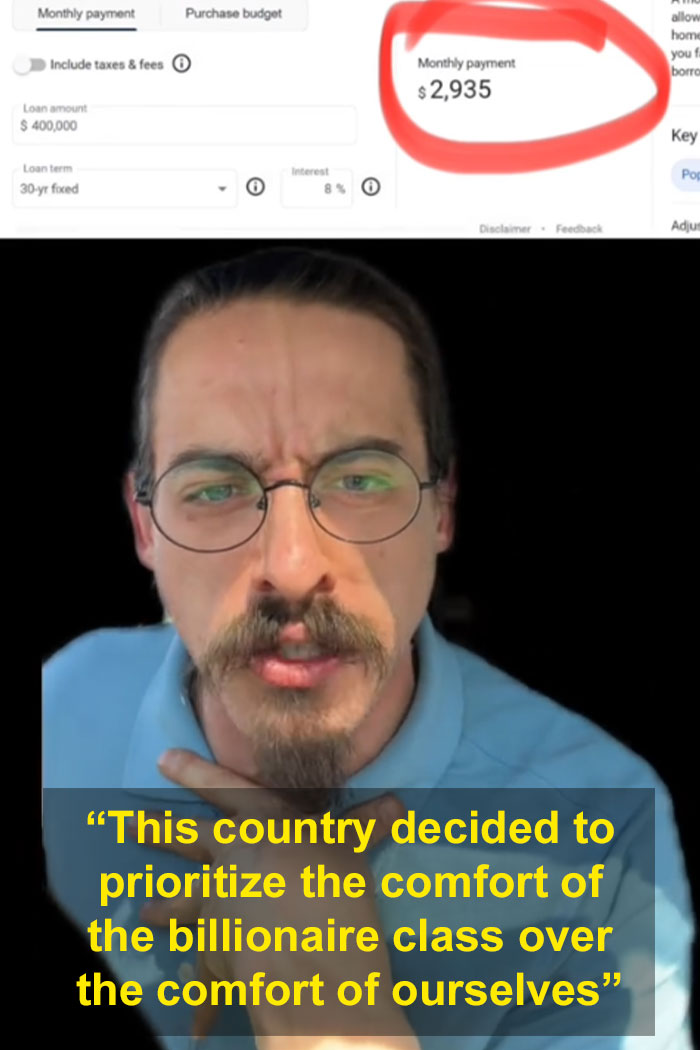

“So now to afford that same home because a bank was able to sell it to a hedge fund who was able to sell it back to you for a profit, now you need to make 52 dollars an hour just to own a home.”

Image credits: elyon113

Image credits: elyon113

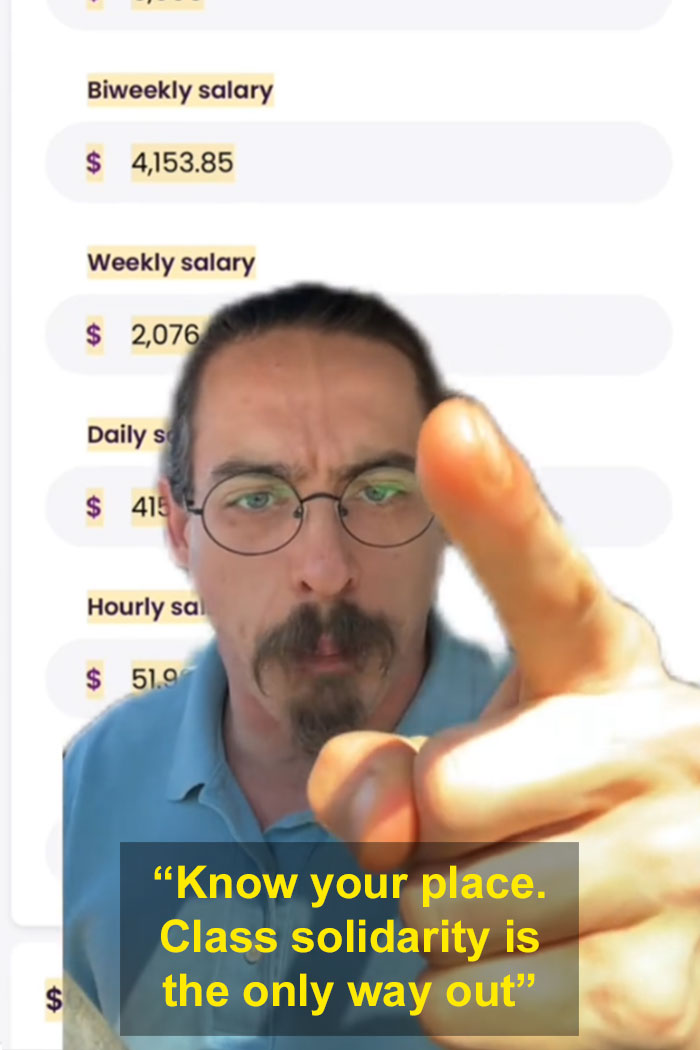

“Billionaires should not financially exist. You pay the price for their yachts. Know your place. Class solidarity is the only way out. It’s not left versus right. It’s up versus down.”

Image credits: elyon113

You can watch Smeltzer’s full viral video right over here

@elyon113 #stitch with @Nic 💫Billionaires shouldnt exist💫 #fyp2024 ♬ original sound – Elyon113

“Homeownership is important to young people because it’s still an investment tool”

According to Smeltzer, the core idea behind his video is that if housing hadn’t been affected by Wall Street hedge fund investors but had instead stayed reasonable, a person could afford a home on minimum wage.

“The $52/hour came from what you need to support a family on one income. Raising the minimum wage comes at the cost of the billionaire class—their yacht payments come from their workers,” he told Bored Panda in an email.

“Raising the minimum wage WOULD affect people. Companies like Walmart profit in the billions every quarter, and those profits belong to the workers. Walmart can EASILY provide that $52/hour wage AND still have money left over for profits. The cruelty is the point. Since the 1980s, more than $50 trillion has been stolen from the working class and that is WHY a home costs $400,000,” Smeltzer said.

He agrees that raising the minimum wage would affect small businesses at the start. “But when America has money in their pockets to spend on stuff, the small business would succeed the most,” he said.

We asked Smeltzer for his thoughts as to why owning property is so important to so many people. “My parents’ first home in 1991 was $28,000,” he opened up to us. The home had three bedrooms, one bathroom, a barn, and one acre of land, as well as an unfinished basement.

“My dad ended up finishing the basement very nicely. I helped a lot when I was little and learned from the experience. When you own your own home, you can do what you want with it, and COVID showed that when people have free money and time, they can MAKE AWESOME STUFF,” he told Bored Panda.

“My dad sold that house in 2001 for $75,000, and today, it’s worth more than $280,000. Homeownership is important to young people because it’s still an investment tool: you pay your mortgage on time, and you have an ASSET that appreciates in value. I’ve rented since 2017, and in 7 years, I’ve paid my landlord’s mortgage for him, but I’ve got NOTHING to show for my hard work. He owns 4 houses on my block.”

From Smeltzer’s perspective, shelter, food, and medicine must be considered human rights. “The billionaire class does NOT have a right to financially exist. If the rising tide is supposed to lift all boats, what happens to the people without a boat? Because there’s a joke in trickle-down economics, but 99% of you aren’t gonna get it.”

Image credits: Khwanchai Phanthong (not the actual image)

The federal minimum wage in the US has not been raised since 2009

At the time of writing, the federal minimum wage in the United States, for covered nonexempt employees, stands at $7.25 per hour. According to Smeltzer, this number should be $52 per hour if you want to have the same purchasing power and be able to afford property as when the minimum wage was first introduced in the US.

Forbes reports that the average annual salary in the US is currently $59,428, while the average hourly rate nationwide is $28.34.

Back in 1938, the freshly introduced federal minimum wage stood at $0.25 (or $4.74 adjusted to inflation in 2023), according to the Economic Policy Institute.

It grew to $1 in 1956 (equivalent to $9.88 in 2023), $2 in 1974 ($11.30 in 2023), $3.10 in 1980 ($11.49 in 2023 dollars), and $4.25 in 1991 (equivalent to $9.38 in 2023 cash).

By 1997, the federal minimum wage stood at $5.15 (equal to $9.75 in 2023 dollars), grew to $5.85 in 2007 ($8.62 in 2023), was increased to $6.55 in 2008 (aka $9.15 in 2023), and finally rose to $7.25 in 2009.

There have been no further federal minimum wage increases in the US since 2009! That means that the rate of pay has stagnated, and many employees have lost purchasing power. In short, each dollar buys them less.

That being said, many states in the US have their very own minimum wage laws. When these state-mandated wages are higher than the federal minimum, the employee gets the higher of the two. Essentially, this means where you live and work is going to have a huge impact on your earning power.

For instance, if you live in Washington, your minimum wage will be $16.28 per hour. If you live in Washington, D.C., you’ll be getting $17 per hour.

Image credits: Arlington Research (not the actual image)

Many Americans are very pessimistic about purchasing new homes at the moment

As per Investopedia, those in favor of raising minimum wages believe that it’s vital to help incomes keep pace with the increasing costs of living and to lift Americans out of poverty.

On the flip side, opponents of raising minimum wages argue that it might have a detrimental effect on the economy, such as potentially leading to higher inflation, making companies less competitive, and resulting in the loss of jobs.

Whatever side of the fence you fall on, most people will probably agree that employees should be able to earn a fair wage for fair work. They should easily be able to afford food and housing as well as cover medical, education, and transportation costs.

A workforce that struggles with the basics is bad not just on an individual level but for the potential of the economy as a whole. You want an empowered, energetic, and highly motivated labor force, not one that has a grim view of their future, as well as that of their country.

CNN recently reported on a warning shared by the economists at the Bank of America that the US housing market will remain “stuck” until 2026 or later.

It’s likely that home prices will remain high or even rise further. According to the economists, the housing shortage will persist for a few years, while mortgage rates might not fall all that much.

“This will take many years to work itself out. There isn’t a magic fix. The message for first-time homebuyers is one of patience and frustration,” Michael Gapen, the head of US Economics at Bank of America, explained to CNN.

Gapen pointed out that many American homeowners aren’t moving, which means that the supply of homes on the market has shrunk. It doesn’t make sense for many of them to sell and buy new property elsewhere. “Why would I sell unless I have to? Prices have gone up and the mortgage rate is a lot higher. So, I’m content to stay where I am.”

A recent Gallup poll showed the current pessimism in the American real estate market. A jaw-dropping 76% of respondents said that, in their opinion, it’s a bad time to buy a house, while just 21% said that it’s a good time to do so. At the same time, 68% of respondents expected home prices to increase in their local area.

Image credits: Thirdman (not the actual image)

Here’s what some TikTok users had to say after watching the massively popular clip