To gain an edge, this is what you need to know today.

Making Money From Crowd Stampede

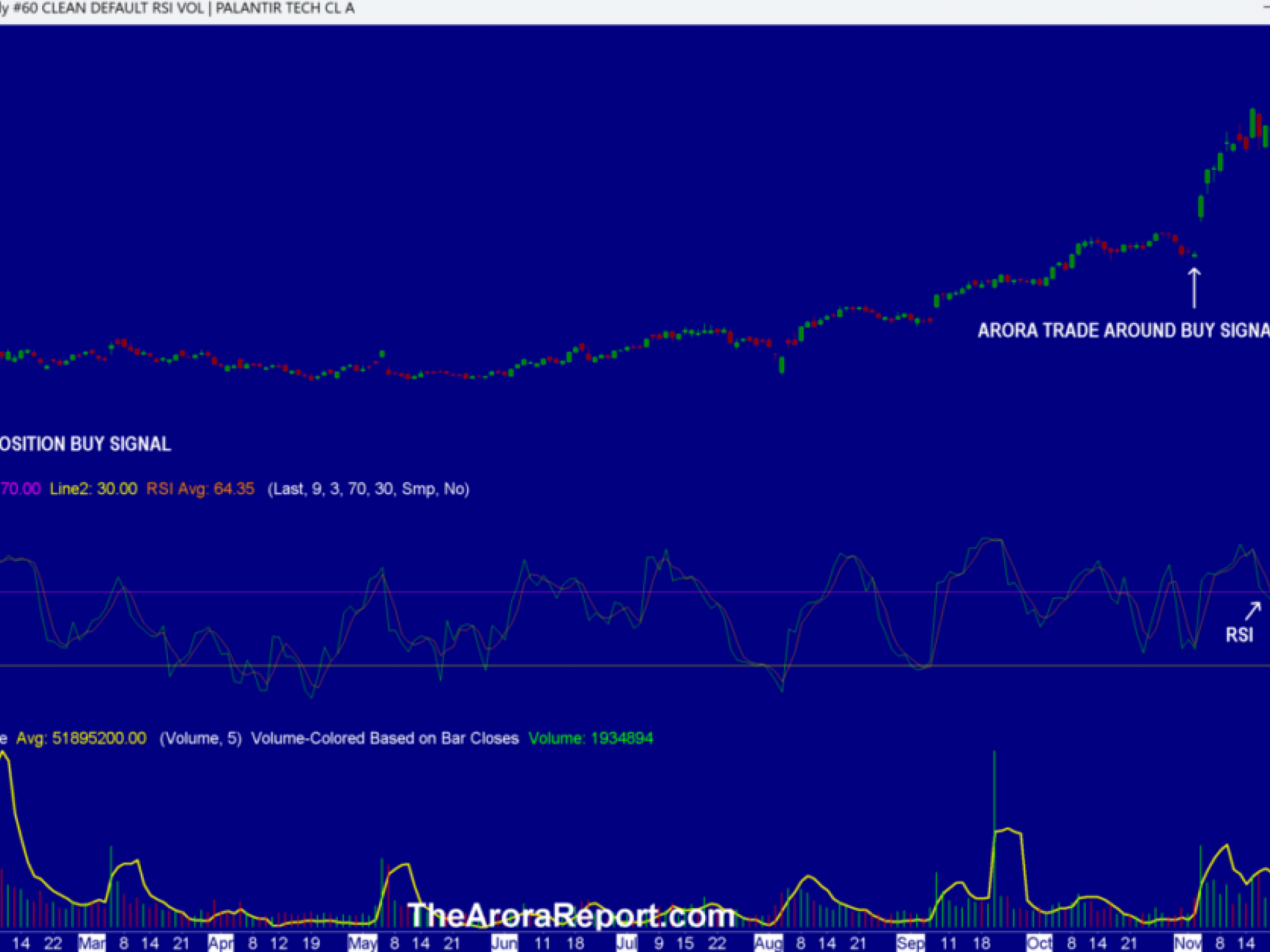

Chart of Palantir Technologies Inc (NASDAQ:PLTR).

Note the following:

- This article is about the big picture, not an individual stock. The chart of PLTR is being used to illustrate the point.

- The chart shows that PLTR stock has gone vertical.

- The chart shows that the Arora core position was bought at $20.15.

- The chart shows when the Arora trade around position signal was given. A trade around position is a technique used by billionaires and hedge funds that can dramatically increase returns and reduce risks.

- As full disclosure, The Arora Report system is close to giving another signal for a new trade around position on PLTR.

- Palantir is a defense contractor providing mostly AI-based software.

- Being a defense contractor is a complex business. Historically, it has taken defense contractors a very long period, many acquisitions, and storied histories to become large.

- With Palantir, it is the first time that a company has become the largest defense contractor by market cap in the blink of an eye. More remarkable is that Palantir has achieved this feat not through a long storied history and not through acquisitions. Palantir has reached this status through a momo crowd and meme crowd stampede.

- The chart shows that money is to be made by taking advantage of momo crowd and meme crowd stampedes. Over the years, we have helped our members make money from these stampedes on a number of stocks. Of course, prudent investors should have risk controls in place and be patient.

- As full disclosure, PLTR was recently added to the ZYX Buy Core Model Portfolio. As full disclosure, Rtx Corp (NYSE:RTX) is also in the ZYX Buy Core Model Portfolio.

- RTX is the second largest defense contractor now by market cap.

- Here is a comparison of a few key metrics between PLTR and RTX.

- PLTR trailing PE is 354. RTX trailing PE is 34.

- PLTR forward PE is 151. RTX forward PE is 19.

- PLTR price/sales is 65. RTX price/sales is 2.

- Based on the ZYX Change Method quantitative screen, the highest reasonable valuation of PLTR is under $40. PLTR is trading at $71.74 as of this writing in the premarket.

- The very long term Arora target for PLTR is $123 – $136.

- The foregoing also illustrates the extreme positive sentiment in the stock market.

- This morning, the stock market is front running Fed Chair Powell. Powell will be speaking later today. The hopium is that Powell will be dovish and indicate a rate cut is coming in spite of a large set of data showing that it is imprudent to cut rates at this time.

- Buying in the early trade is largely focused on large cap tech stocks as well as speculative junk stocks.

- Also adding to the buying are comments on Salesforce Inc (NYSE:CRM) and Marvell Technology Inc (NASDAQ:MRVL) conference calls regarding AI.

Magnificent Seven Money Flows

In the early trade, money flows are positive in Apple Inc (NASDAQ:AAPL), Amazon.com, Inc. (NASDAQ:AMZN), Alphabet Inc Class C (NASDAQ:GOOG), Microsoft Corp (NASDAQ:MSFT), NVIDIA Corp (NASDAQ:NVDA), and Tesla Inc (NASDAQ:TSLA).

In the early trade, money flows are negative in Meta Platforms Inc (NASDAQ:META).

In the early trade, money flows are positive in SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust Series 1 (NASDAQ:QQQ).

Momo Crowd And Smart Money In Stocks

Investors can gain an edge by knowing money flows in SPY and QQQ. Investors can get a bigger edge by knowing when smart money is buying stocks, gold, and oil. The most popular ETF for gold is SPDR Gold Trust (NYSE:GLD). The most popular ETF for silver is iShares Silver Trust (NYSE:SLV). The most popular ETF for oil is United States Oil ETF (ASCA:USO).

Bitcoin

Bitcoin (CRYPTO: BTC) is range bound.

Protection Band And What To Do Now

It is important for investors to look ahead and not in the rearview mirror. The proprietary protection band from The Arora Report is very popular. The protection band puts all of the data, all of the indicators, all of the news, all of the crosscurrents, all of the models, and all of the analysis in an analytical framework that is easily actionable by investors.

Consider continuing to hold good, very long term, existing positions. Based on individual risk preference, consider a protection band consisting of cash or Treasury bills or short-term tactical trades as well as short to medium term hedges and short term hedges. This is a good way to protect yourself and participate in the upside at the same time.

You can determine your protection bands by adding cash to hedges. The high band of the protection is appropriate for those who are older or conservative. The low band of the protection is appropriate for those who are younger or aggressive. If you do not hedge, the total cash level should be more than stated above but significantly less than cash plus hedges.

A protection band of 0% would be very bullish and would indicate full investment with 0% in cash. A protection band of 100% would be very bearish and would indicate a need for aggressive protection with cash and hedges or aggressive short selling.

It is worth reminding that you cannot take advantage of new upcoming opportunities if you are not holding enough cash. When adjusting hedge levels, consider adjusting partial stop quantities for stock positions (non ETF); consider using wider stops on remaining quantities and also allowing more room for high beta stocks. High beta stocks are the ones that move more than the market.

Traditional 60/40 Portfolio

Probability based risk reward adjusted for inflation does not favor long duration strategic bond allocation at this time.

Those who want to stick to traditional 60% allocation to stocks and 40% to bonds may consider focusing on only high quality bonds and bonds of five year duration or less. Those willing to bring sophistication to their investing may consider using bond ETFs as tactical positions and not strategic positions at this time.

The Arora Report is known for its accurate calls. The Arora Report correctly called the big artificial intelligence rally before anyone else, the new bull market of 2023, the bear market of 2022, new stock market highs right after the virus low in 2020, the virus drop in 2020, the DJIA rally to 30,000 when it was trading at 16,000, the start of a mega bull market in 2009, and the financial crash of 2008. Please click here to sign up for a free forever Generate Wealth Newsletter.