Macy’s (M) stock was rallying this morning following better-than-expected earnings. However, those gains have not stuck as we push into Tuesday’s afternoon session.

Just as the overall market has rolled over from its morning gains, so too is Macy’s. The stock opened higher by almost 3% and at one point, was up almost 10% on the day.

Now though, Macy’s stock is down 1.6% and near its session low.

So far, the reaction has been mixed in retail. Macy’s delivered better-than-expected results and gave a boost to its dividend and share buyback programs.

After a strong quarter, it has investors rethinking some strategies as it pertains to Macy’s business, even though the stock is not reacting the way bulls had hoped.

The report comes alongside Home Depot’s (HD) post-earnings slide despite a solid quarter and after Walmart (WMT) gave bulls a relief rally after reporting last week.

Macy’s stock has been trying to break out of its recent range, but it’s been struggling to do so. Earnings looked like it could be the catalyst, but we’re not seeing that follow-through at the moment.

Let’s look at the chart.

Trading Macy’s Stock

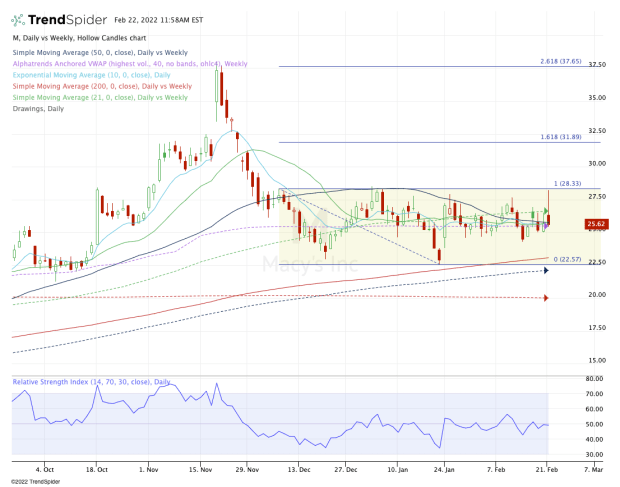

Chart courtesy of TrendSpider.com

On the chart above, I have shaded in the recent trading range. The stock has been stuck between $22.50 on the downside and $27.50 on the upside.

In November, Macy’s stock enjoyed a nice post-earnings pop to the upper $30s, but then went on to fade in a painful decline. Shares declined in eight straight sessions and in 15 out of 19 days.

That pullback allowed the current trading range to develop, giving bulls an opportunity to accumulate the stock.

Those bulls were hoping to be rewarded with another post-earnings surge, but so far it’s not coming to fruition.

On the upside, I would love to see a move over $27.50 and more specifically, over $28.52. A move over the latter opens the door to a monthly-up rotation over the January high. This type of rotation will also help accelerate Macy’s out of its current trading range.

If that were to happen, I’d have my eye on the $30.25 and $32 levels, which are the 50% and 61.8% retracements of the larger range, respectively. Near the latter is also the 161.8% extension from the current trading range ($22.50 to $27.50).

On the flip side, if Macy’s stock goes weekly down below $24.30, it opens the door to the 200-day moving average and the bottom of the recent range.