Donald Trump’s decision to pause and reduce his tariff plans for dozens on nations was warmly welcomed by Europe’s key financial markets.

In London, stocks shot higher after the US president said he would push back the introduction of some tariffs by 90 days.

Commodity firms and retailers with exposure to the US and Asia, such as JD Sports, made strong gains as they welcomed the change in policy.

However, grocery firms were weaker as analysts were left unimpressed by Tesco forecasting lower profits.

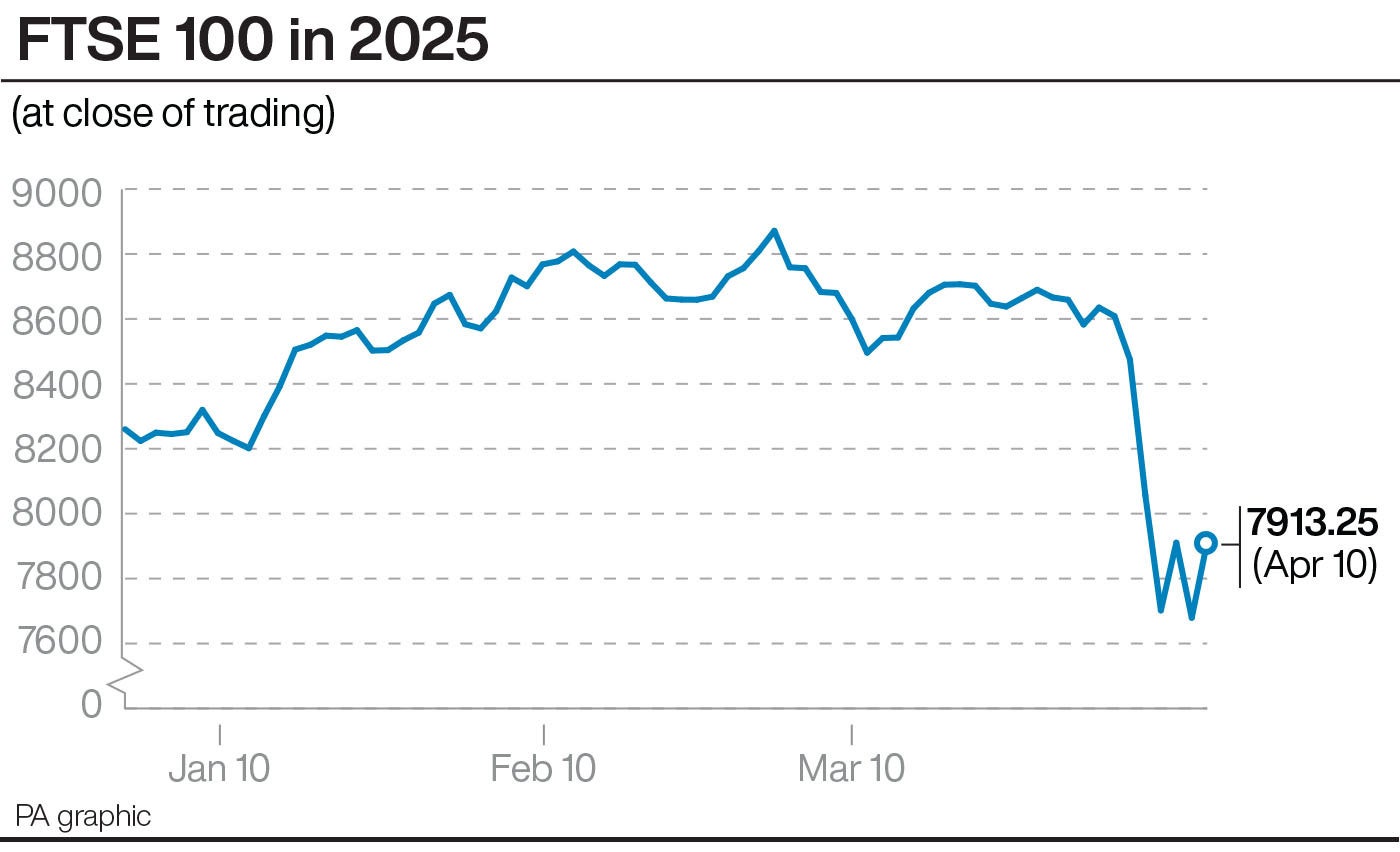

The FTSE 100 finished up by 3.04%, or 233.77 points, to close at 7,913.25.

Nevertheless, Wall Street stocks plunged after the start of trading as the prospect of an all-out trade war between the US and China intensified further.

The Dow Jones and S&P 500 were both more than 4% lower when London markets closed after US inflation also fell by more-than-expected to 2.4% in March.

In mainland Europe, the main indexes still closed firmly higher amid positivity surrounding a reduction in tariffs for EU nations, although they were down from intraday highs.

The Cac 40 ended 3.83% higher for the day and the Dax index was up 4.67%.

Kate Leaman, chief market analyst at Avatrade, said: “The market’s surge following President Trump’s 90-day tariff pause is striking – but not entirely surprising.

“After weeks of rising tension, investors welcomed any sign of relief.

“That said, this looks more like a classic relief rally than a long-term turning point.”

Meanwhile, the pound was up 0.97% at 1.294 US dollars and was down 1.23% at 1.155 euros – its lowest level since December 2023 – when London’s markets closed.

In company news, Tesco closed in the red after the UK’s largest supermarket group indicated the growing UK grocery price war would hit its profits.

It said said it expects to make as much as £400 million less in profit next year as a result of what boss Ken Murphy called “a very competitive market”, amid aggressive price reductions at rival Asda.

Shares in Tesco were down 6.1% at 314.6p, with major competitor Sainsbury’s also lower for the day.

Elsewhere, manufacturer TT Electronics tumbled in value after it warned that US tariffs will knock its profits and risks impacting its ability to keep operating.

It came as the Woking-based manufacturer of electronics also announced the sudden departure of its boss Peter France. Shares dived by 9.9% to 75p as a result.

Digital marketing firm Brave Bison climbed during the session after striking a deal to buy an influencer marketing business from Rupert Murdoch’s News UK for up to £7.6 million.

Shares rose by 13% to 2.6p after announcing the deal, which will also see Mr Murdoch’s firm take shares in Brave Bison.

The price of oil dropped further on the back of increased concerns about global economic growth and the potential impact of this on energy demand.

A barrel of Brent crude oil was down by 3.8% to 62.99 dollars (£48.67) as markets were closing in London.

The biggest risers on the FTSE 100 were 3i Group, up 279p to 3,879p, Barclays, up 18.6p to 260.25p, Intermediate Capital, up 114p to 1,683p, Anglo American, up 126.4p to 1,891.2p, and Rentokil, up 20.9p to 331.8p.

The biggest fallers on the FTSE 100 were Tesco, down 20.6p to 314.6p, Sainsbury’s, down 7p to 228.8p, Aviva, down 3.9p to 496.3p, Reckitt, down 37p to 4,760p, and Croda, down 19p to 2,623p.