The ASX 200 has dipped into the red for the fifth trading session in a row and Japan's Kirin Holdings has announced it will pay $1.9 billion to buy health products maker Blackmores.

Disclaimer: This blog is not intended as investment advice.

Key events

To leave a comment on the blog, please log in or sign up for an ABC account.

Live updates

Markets snapshot at 4:30pm AEST

By Sue Lannin

ASX 200: -0.3% to 7,293 points

All Ordinaries: -0.3% to 7,482 points

Australian dollar: +0.5% to 66.31 US cents

Nikkei 225: +0.15% to 28,458

Shanghai Composite:+0.6%at 3,284

Hang Seng: +0.3% to 19,813

Dow Jones: -0.7% to 33,302 points

S&P 500: -0.4% to 4,056 points

Nasdaq: +0.5% to 11,854 points

FTSE: -0.5% to 7,853 points

EuroStoxx: -0.8% to 463 points

Spot gold: +0.5% to $US2,000/ounce

Brent crude: +0.6% to $US78.12/barrel

Iron ore: +2.4% to $US104.90/tonne

Bitcoin: +1.8% at $US28,926

That's all folks!

By Sue Lannin

Thanks for joining us today on the ABC Markets Blog.

Have a great night and join us again tomorrow for all your business and economics news.

Overnight, the latest US economic growth figures are out, as well as home sales.

Tomorrow in Australia, we will get the latest reading on business inflation.

Kirin shares slump in Japan on Blackmores takeover bid

By Sue Lannin

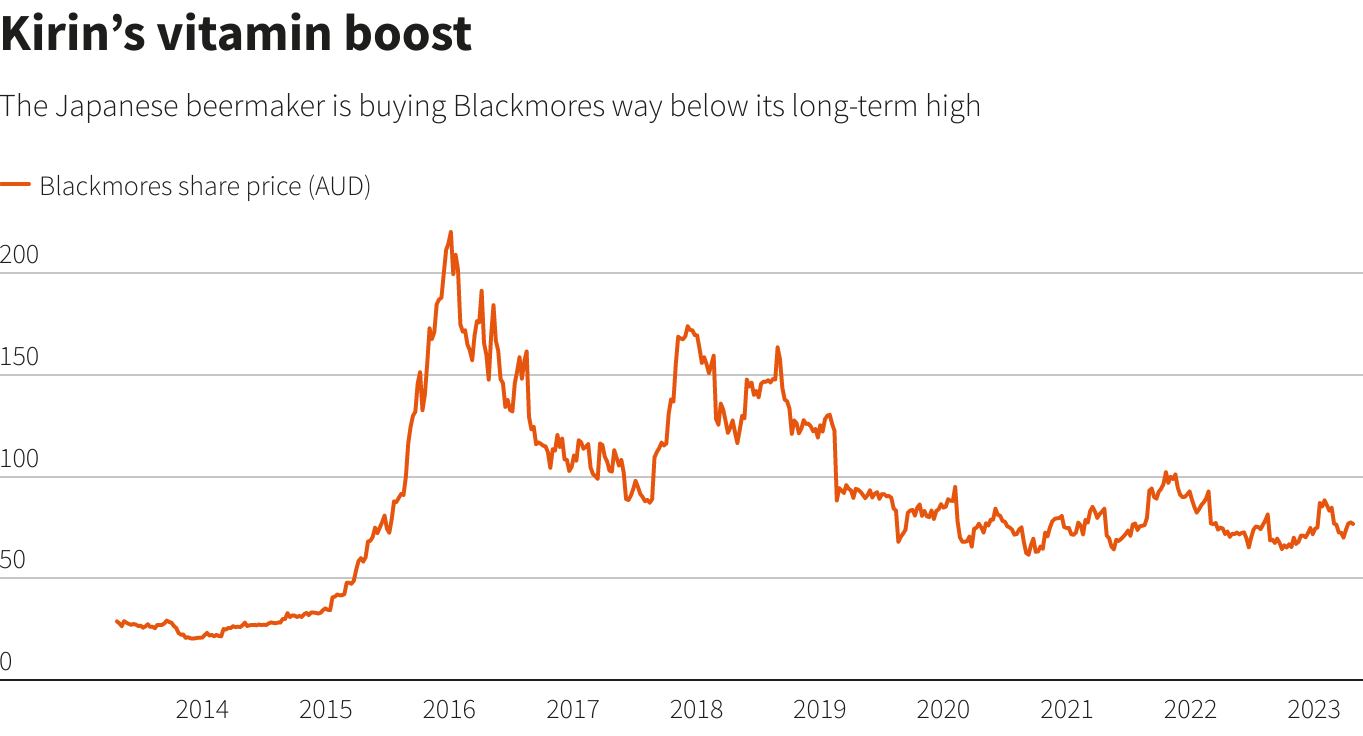

While Blackmores investors were thrilled by the nearly $2 billion takeover bid from Kirin, the Japanese beer maker's investors were less happy.

Kirin shares (-1.7 per cent) slumped as investors wiped $US450 million off its share price on the Japanese stockmarket at one point today.

The deal still needs to be approved by Blackmores shareholders, but it looks like Kirin is getting a bargain with the vitamin maker's shares well off their more than $200 highs back in 2016.

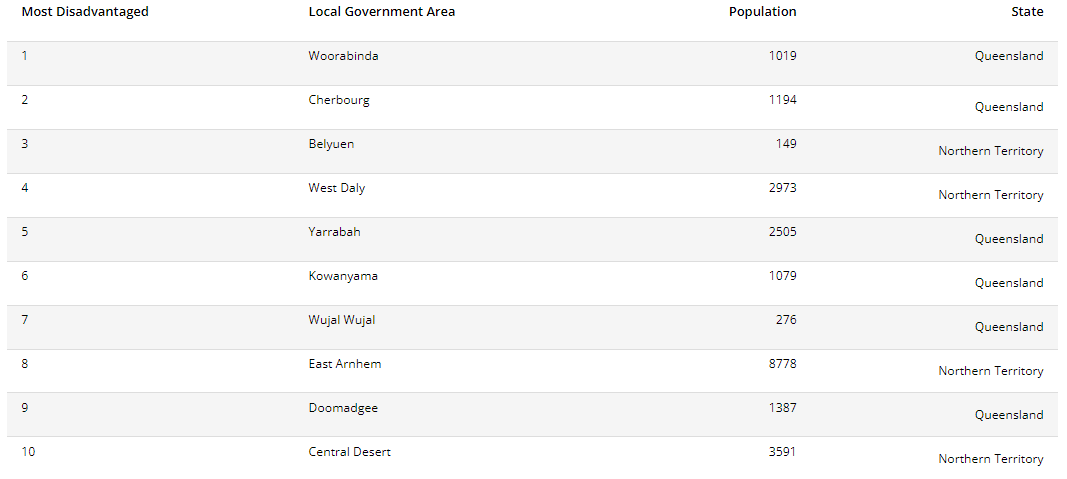

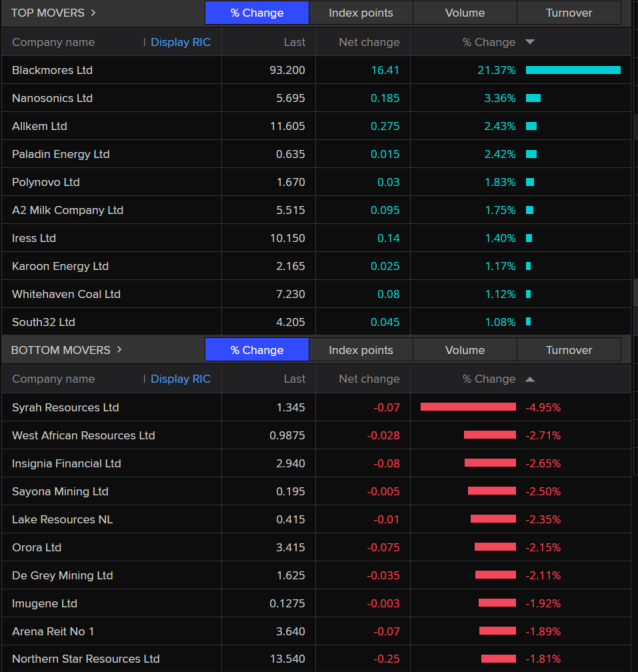

ASX movers and shakers

By Sue Lannin

The best and worst performers on the ASX 200 today as the market finished in the red at a two week low.

Just 4 out of 11 industry sectors finished higher with the market pulled down by educations stocks, industrials, healthcare and financials.

Utilities and miners were among the gainers.

Blackmores (+22.75 per cent) shot up as Japanese conglomerate Kirin agreed to buy the vitamin maker for $1.9 billion or $95 a share.

Casino group Crown has paid a $30 million fine to Victorian authorities after allowing customers to gamble at its Melbourne casino with bank cheques made out to themselves.

Newcrest Mining (-2.1 per cent) fell after reporting a drop in gold production over the third quarter because of production problems at its Caadia mine in New South Wales.

ASX ends in the red for the fifth trading session in a row

By Sue Lannin

The Australian share market lost ground for the fifth consecutive trading day as investors worry about US banks and most industry sectors ended in the red.

The market was dragged down by consumer stocks, industrials, healthcare firms, and banks, with miners and telcos the few bright spots.

The ASX 200 index fell 0.3 per cent to 7,293, while the All Ordinaries index dropped by the same percentage to 7,482.

Vitamin maker Blackmores (+22.1 per cent) surged after Japanese beverage giant Kirin announced it planned to buy the health products firm for $1.9 billion.

Graphite producer Syrah Resources (-9.5 per cent) did the worst.

Markets snapshot at 2:50pm AEST

By Sue Lannin

ASX 200: -0.4% to 7,282 points

All Ordinaries: -0.4% to 7,472 points

Australian dollar: +0.2% to 66.07 US cents

Nikkei 225: steady at 28,417

Shanghai Composite:+0.2%at 3,270

Hang Seng: +0.1% to 19,773

Dow Jones: -0.7% to 33,302 points

S&P 500: -0.4% to 4,056 points

Nasdaq: +0.5% to 11,854 points

FTSE: -0.5% to 7,853 points

EuroStoxx: -0.8% to 463 points

Spot gold: +0.5% to $US1,998/ounce

Brent crude: +0.3% to $US77.94/barrel

Iron ore: +2.4% to $US104.90/tonne

Bitcoin: +1.8% at $US28,926

Australia Post to cut 400 jobs as it faces annual loss

By Sue Lannin

Australia Post chief executive Paul Graham says the postal service and courier will sack 400 people as it continues to lose money.

He made the announcement at an American Chamber of Commerce function in Melbourne in a speech called "Delivering a Better Tomorrow."

Mail volumes have fallen by two thirds since 2007-2008, with per household mail volumes expected to halve over the next five years because of the rise of email, apps, and smartphones.

Mr Graham warns the "essential community service" is heading towards unprecedented losses and that without change, Australia Post's viability is at risk.

"We are spending more and more money to deliver fewer and fewer letters," he said.

"We are also seeing declining foot traffic across our Post Office network as digital services replace over the counter transactions."

"As a result, we will post a financial loss this financial year with our letters business, after posting a $189 million dollar loss for the first 6 months of this financial year alone."

"It’s a stark message but the Australian community must understand that without change to their national postal service, its long-term viability is at risk."

Mr Graham called on both sides of politics to set aside party politics and act in the national interest to save Australia Post.

The postal service's chief executive says the Australian Postal Corporation Act urgently needs updating, as do some regulations.

"Australia Post is one of the last of Australia's great, publicly owned commercial endeavours," he said.

"In short, we want to simplify the way we work where we can – and amplify the way we work where we must."

"We are a business that generates over $9 billion in revenue and in the past six months we have invested more than $200 million in new facilities, fleet, and technologies to improve our delivery and post office services."

"We want to keep delivering essential public services to Australian communities and businesses – without taking a penny from consolidated revenue."

"That is funding that should go to schools and hospitals, not Australia Post."

Public consultation on a Federal Government discussion paper on Australia Post's future closes at midnight.

The company increased the cost of postage in January from $1.20 to $1.20, which it says it still one of the lowest prices for basic mail in the OECD.

Australia Post has more than 4000 post offices across the country and 65,000 staff and contractors.

Changes at Australia Post could greatly affect regional and rural communities where many banks have closed branches, and locals depend on the post office for banking, mail, bill paying and shopping.

Energy Account: Australia

By Gareth Hutchens

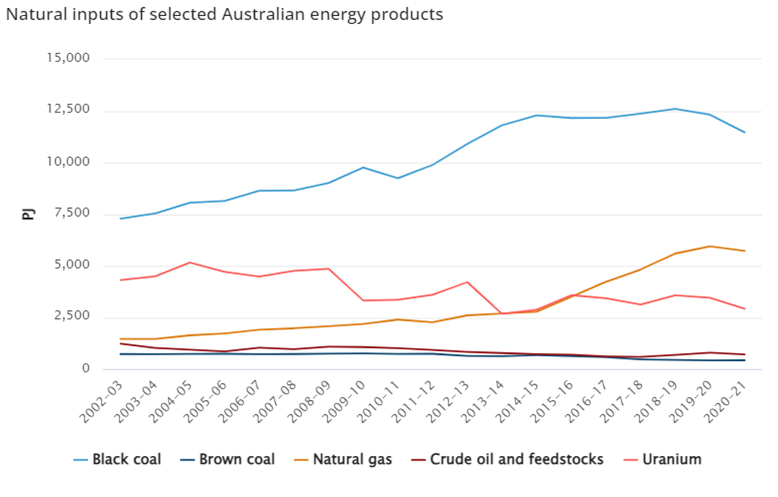

The Bureau of Statistics has released new figures on the use of energy in Australia in the 2020-21 financial year.

It says Australia's energy was supplied from:

- Domestic production (29,980 petajoules)

- Imported products (2,044 PJ)

Production for exports and domestic use

Of that 29,980 PJ in domestic production, 21,886 PJ was directly extracted from the environment:

And huge amount of that energy was exported overseas:

- Black coal (11,464 PJ was produced, of which 90% was exported)

- Natural gas (5,730 PJ of which 75% was exported as LNG)

- Uranium (2,920 PJ of which 99% was exported)

- Crude oil and feedstocks (718 PJ of which 83% was exported)

- LPG (160 PJ of which 81% was exported)

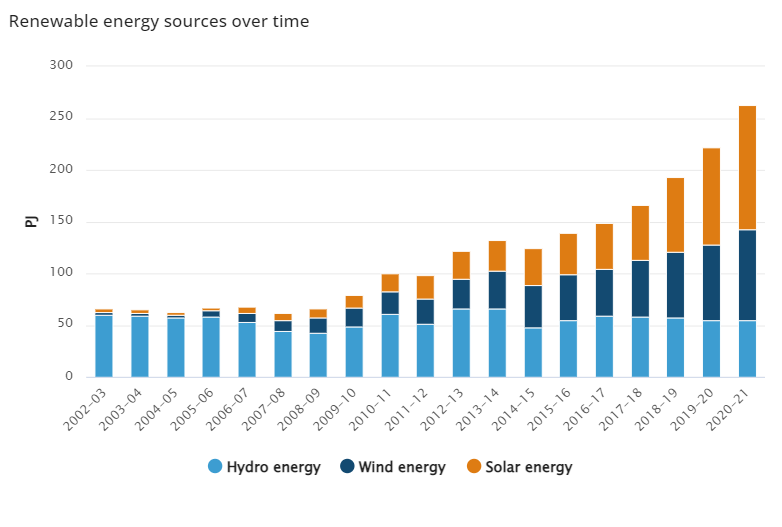

Renewable energy

The use of renewable energy by the electricity industry continued to increase in 2020-21 (up 18.5% to 263 PJ).

The main sources of renewable energy in 2020-21 were:

- Solar energy up 27.7% to 120 PJ

- Wind energy up 20.5% to 88 PJ

- Hydro energy steady at 55 PJ

Why do we care about foreign banks?

By Gareth Hutchens

What do the American Banks have to do with Australia isn't that a there problem?

- Chrisso

In a global financial system, everything's connected.

We still need to keep an eye on developments in financial markets overseas because they could impact Australia - and the fortunes of Australian banks, insurance companies, and super funds.

An example?

Every time the Reserve Bank board meets to discuss interest rates, they talk about domestic and international conditions.

The minutes from every board meeting show that they spend a lot of time talking about economic and financial conditions in other major economies.

Here are some snippets from this month's minutes:

"Members commenced their discussion of the global economy by noting that inflation remained high and well above central banks’ targets.

"Inflation in many economies had declined from earlier peaks but progress in returning inflation to target had slowed. Recent monthly core inflation data had been higher than expected in a range of advanced economies. Nevertheless, inflation in advanced economies was still expected to decline over coming quarters as economic activity slowed and input price pressures continued to dissipate.

"Indicators of domestic demand across advanced economies had been mixed. Retail sales had increased in early 2023 in a few economies, although volumes generally remained below their peaks.

"The housing sector remained subdued in many economies, reflecting the tightening of monetary policy over the prior year. Most of these indicators pre-dated the financial stability concerns and financial market volatility prompted by bank failures in the United States and Switzerland.

We don't have the luxury of ignoring events overseas, unfortunately.

Markets snapshot 1pm AEST

By Sue Lannin

ASX 200: -0.4% to 7,280 points

All Ordinaries: -0.4% to 7,476 points

Australian dollar: +0.1% to 66.06 US cents

Nikkei 225: -0.2% to 28,349

Shanghai Composite:+0.4%at 3,277

Hang Seng: +0.1% to 19,766

Dow Jones: -0.7% to 33,302 points

S&P 500: -0.4% to 4,056 points

Nasdaq: +0.5% to 11,854 points

FTSE: -0.5% to 7,853 points

EuroStoxx: -0.8% to 463 points

Spot gold: +0.5% to $US1,998/ounce

Brent crude: +0.3% to $US77.94/barrel

Iron ore: +2.4% to $US104.90/tonne

Bitcoin: +1.8% at $US28,926

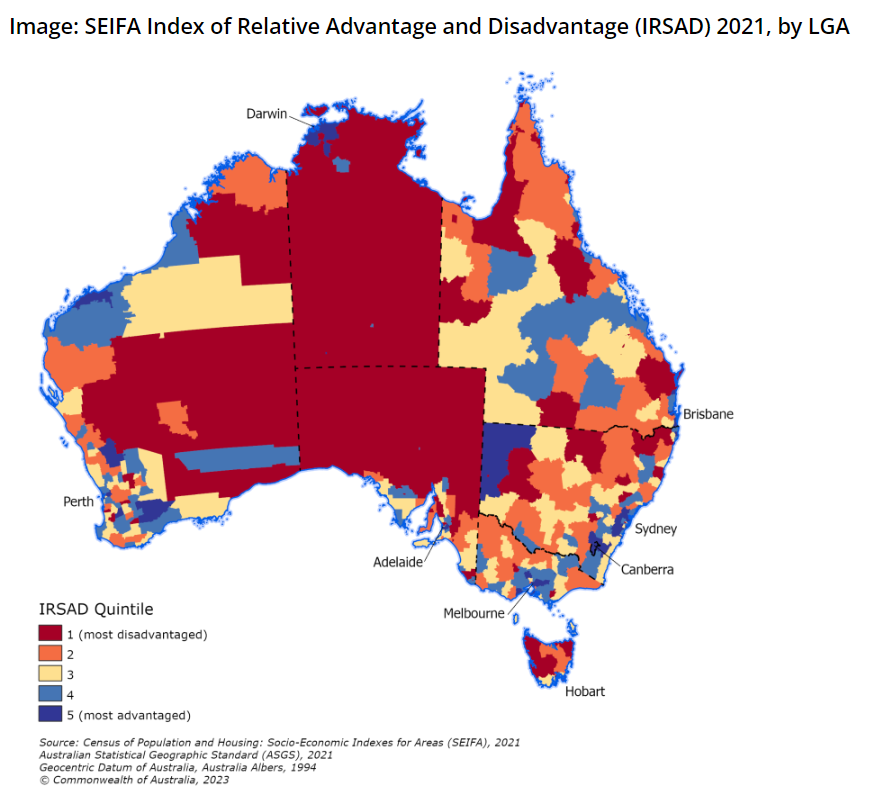

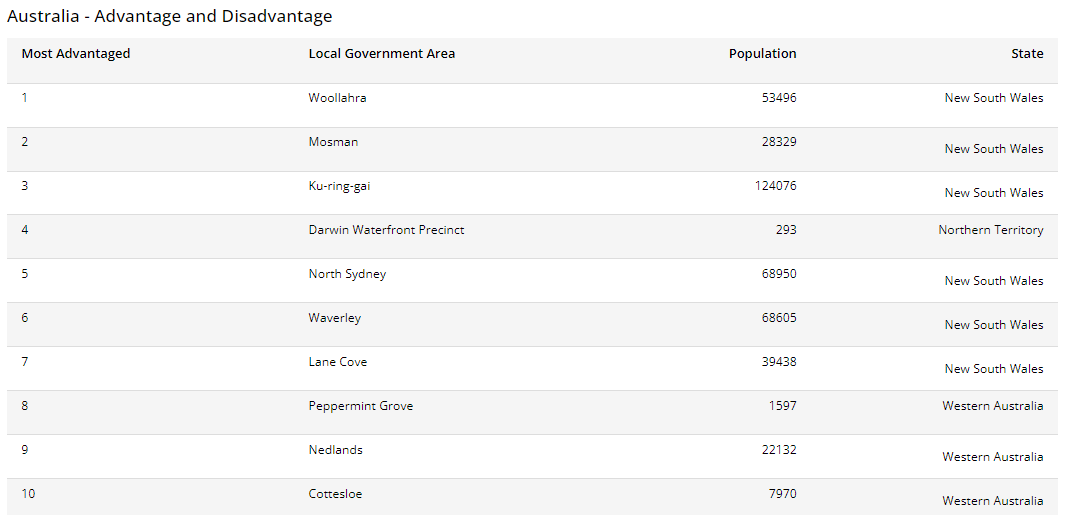

Woollahra is the richest place to live, while Woorabinda Aboriginal Shire is the poorest

By Sue Lannin

The Australian Bureau of Statistics has crunched the 2021 census data and given us a list of the richest and poorest places to live in Australia.

Unsurprisingly, a waterfront home in Sydney and Perth are hallmarks of Australia's richest postcodes.

The ABS says 9 out the 10 most advantaged local government areas are on waterfronts or close to the water.

Think Woollahra in Sydney's leafy inner east, which is the richest council region in the country, with waterfront areas in Darwin and Perth not far behind.

On the flipside, regional and remote Australia is a different world, with huge pockets of poverty and disadvantage, with Indigenous communities topping the list.

The poorest local government areas in the country are the rural Queensland towns of Woorabinda Aboriginal Shire and the Cherbourg Aboriginal Shire, followed by the Indigenous community of Belyuen in the Northern Territory, home to 149 people and 128 kilometres from Darwin.

Other remote communities such as East Arnhem in the NT, and Doomadgee Aboriginal Shire near the Gulf of Carpenteria in Queensland, are also in the top ten most disadvantaged local government areas, although rich in culture.

Doomadgee Council says the median weekly income for people living in the shire is $280 a week, compared to $587 per week for the rest of the state.

ASX 200 Movers and Shakers at 12:20pm AEST

By Sue Lannin

The local sharemarket is lower for the fifth trading session in a row as concerns re-emerge about the banking in the US.

Health products maker Blackmores has surged by one fifth after the board accepted a $1.9 billion takeover bid from Japanese beverage giant Kirin.

Here are the best and worst performers on the ASX 200 over lunchtime.

Markets snapshot 12pm AEST

By Sue Lannin

ASX 200: -0.5% to 7,281 points

All Ordinaries: -0.5% to 7,469 points

Australian dollar: +0.1% to 66.01 US cents

Nikkei 225: -0.3% to 28,322

Shanghai Composite: steady at 3,265

Hang Seng: -0.3% to 19,690

Dow Jones: -0.7% to 33,302 points

S&P 500: -0.4% to 4,056 points

Nasdaq: +0.5% to 11,854 points

FTSE: -0.5% to 7,853 points

EuroStoxx: -0.8% to 463 points

Spot gold: +0.25% to $US1,994/ounce

Brent crude: +0.5% to $US78.06/barrel

Iron ore: +2.4% to $US104.90/tonne

Bitcoin: +1.5% at $US28,826

Inflation bites as Australians pay more for bread and milk

By Sue Lannin

While the cost of living is declining overall because of steep interest rate rises by the Reserve Bank, you may not be feeling it at the supermarket.

Pantry staples like milk and bread continue to rise according to the Bureau of Statistics with grocery prices up 8 per cent from the same time last year.

Consumer inflation pulled back from 7.8 per cent over the year to December to 7 per cent over the year to March.

So which way will the Reserve Bank go next week when it decides whether or not to lift interest rates or leave them on hold on 3.6 per cent.

Cherelle Murphy, chief economist for Oceania for EY, told me on ABC News Channel that the crucial decision could go either way with economists split on the matter.

ASX movers and shakers at 10:30am AEST

By Sue Lannin

Here are the best and worst performing stocks on the ASX 200 in the first half hour of trade.

Markets snapshot at 10:15am AEST

By Sue Lannin

ASX 200: -0.3% to 7,295 points

All Ordinaries: -02% to 7,485 points

Australian dollar: +0.1% to 66.05 US cents

Dow Jones: -0.7% to 33,302 points

S&P 500: -0.4% to 4,056 points

Nasdaq: +0.5% to 11,854 points

FTSE: -0.5% to 7,853 points

EuroStoxx: -0.8% to 463 points

Spot gold: Flat at $US1,989/ounce

Brent crude: -3.7% to $US77.77/barrel

Iron ore: +2.4% to $US104.90/tonne

Bitcoin: -0.3% at $US28,335

ASX in the red and Japan's Kirin offers $2 billion for Blackmores

By Sue Lannin

The local sharemarket is lower again in early trade.

The ASX 200 index has lost 0.3 per cent to 7,315 with most sectors in the red.

Healthcare stocks are the biggest losers, while consumer firms and miners are the only bright spots.

Blackmores (+22 per cent) is the best performer after Japan's Kirin Holdings said it would buy the vitamins firm for nearly $2 billion.

The deal has the unanimous support of the Blackmores board, but needs the approval of investors and regulators.

Graphite miner Syrah Resources (-6 per cent) is doing the worst as it estimated it will spend $816 million expanding its production plant in Louisiana in the US.

1 in 5 super funds underperform

By Sue Lannin

The banking regulator has done its annual "heatmap" of Choice superannuation funds, which covers 163 products worth $292 billion.

It's found that 1 in 5 "significantly underperformed" over the 2022 financial year.

Of the 407 investment options that had been operating for eight years, 182 underperformed the benchmarks.

80 underperformed the benchmark by more than 0.5 per cent.

APRA said two thirds of investment options that were closed to new members had poor or significantly poor performance.

22 investment products (28 per cent) underperformed the benchmarks by up to 0.5 per cent, while 321 (39 per cent) significantly underperformed by 0.5 per cent or more.

And funds closed to members had higher average fees with the annual administration of $225 for a balance of $50,000 compared to an average $137 annual fee for lower cost My Super products.

While that is bad news for Australians, it's better than 2021 when 1 in 4 pension funds were judged to be underperformers

APRA defines Choice funds as superannuation funds chosen by members, rather than the default My Super products.

Market snapshot at 8:50am AEST

By Michael Janda

ASX SPI 200 futures: -0.2% to 7,311 points

Australian dollar: +0.1% to 66.05 US cents

Dow Jones: -0.7% to 33,302 points

S&P 500: -0.4% to 4,056 points

Nasdaq: +0.5% to 11,854 points

FTSE: -0.5% to 7,853 points

EuroStoxx: -0.8% to 463 points

Spot gold: Flat at $US1,989/ounce

Brent crude: -3.7% to $US77.77/barrel

Iron ore: +2.4% to $US104.90/tonne

Bitcoin: -0.3% at $US28,335

Banks drag Wall Street lower, ASX to follow

By Michael Janda

The benchmark S&P 500 index on Wall Street ended 0.4% lower as renewed banking worries offset positive earnings results for Alphabet, Microsoft and Meta.

Those strong tech results meant the Nasdaq closed 0.5% higher.

While Alphabet finished flat on its results, Microsoft jumped 7.2 per cent to $US295.37 a share on its profit numbers, released after the market closed yesterday.

Social media giant Meta released its numbers after today's market close, with its stock surging in after-hours trade.

"The US share market is split between tech majors, doing well on the back of strong earnings with Meta, the latest on that front, surging after the bell today following better than expected earnings as well as a strong Q2 outlook while Financials (and the rest) are hit by banking uncertainty and recession fears," notes NAB's Rodrigo Catril.

"Of some relief, and suggesting banking concerns are not yet a systemic risk, smaller regional bank PacWest Bancorp, which has also been on the watchlist, is up over 10%, after reporting stable deposits in late March and a rebound in April."

Wall Street's blue chip Dow Jones Industrial Average closed down 0.7%, while European markets were also generally lower.

The ASX looks set to follow that trend, with the futures off 0.2 per cent to 7,311 points.